Diversifying Your Crypto Portfolio: A Case Study

We can prove to you that some diversification strategy could be very profitable through back-testing.

The classic saying, “You should never put all your eggs in one basket”, rings true for all liquid asset investments, whether it’s a basket of stocks, bonds, or cryptocurrencies.

There are many guides on how to allocate your funds into various cryptocurrencies. However, most of these guides will simply tell you how many percent of your money should be allocated into each coin, without explaining why.

In this article, we’ll do something different. We won’t advise you on what percent of your funds should go into Bitcoin, altcoins, meme coins, or anything else. This is up for you to decide.

Instead, we will give you real data so that your decisions can be based on some hard facts. Isn’t that what smart investing is all about?

Portfolio diversification strategy

We can prove to you that some diversification strategy is more profitable (and risky) than others through back-testing.

This means taking historical data of various coins, applying a common strategy, and drawing conclusions about what our present condition would be (i.e. how much we would profit or lose).

Here is our crypto diversification case study setup:

We apply the dollar cost averaging (DCA) strategy where we invest a total of 500 US dollars per week starting 6 September 2020 and ending on 8 August 2021.

$500 weekly seems like a lot, but you will soon learn that investing monthly, as opposed to weekly, will still offer you a decent return. Read more about implementing this strategy below.

We apply this common strategy on three portfolios:

- 100% Bitcoin ($500 per week on BTC only), labeled BTC

- 50% Bitcoin and Ethereum ($250 each on BTC and ETH), labeled BTC:ETH

- 20% in 5 different altcoins, investing $100 per week in Solana (SOL), Chainlink (LINK), Litecoin (LTC), Polygon (MATIC) and Stellar (XLM), for a total of $500 per week. This portfolio is labeled ALTS.

The 5 altcoins were chosen because of their smaller market cap. In terms of market cap rank, they are in the top 20, but not in the top 10. Theoretically, their cheaper prices and lower market cap will cause them to experience a much higher level of volatility.

Bitcoin is chosen as the control in this experiment, because it has the lowest volatility among all the non-stablecoin cryptocurrencies. It’s also the “gateway cryptocurrency” for most crypto investors.

The 50:50 ETH and BTC mix is chosen because this is what a lot of newbie investors would opt for, as these are the top two market cap giants in the crypto space. Not to mention, both coins have a strong brand — Bitcoin being the first cryptocurrency, and Ethereum being the first smart contract cryptocurrency.

Price history data are all taken from the following Investing.com. Click on the links to visit the data source: Bitcoin, Ethereum, Solana, Chainlink, Litecoin, Polygon and Stellar.

Learn more about DCA: Read our guide on dollar-cost averaging investment strategy.

Crypto portfolio diversification results

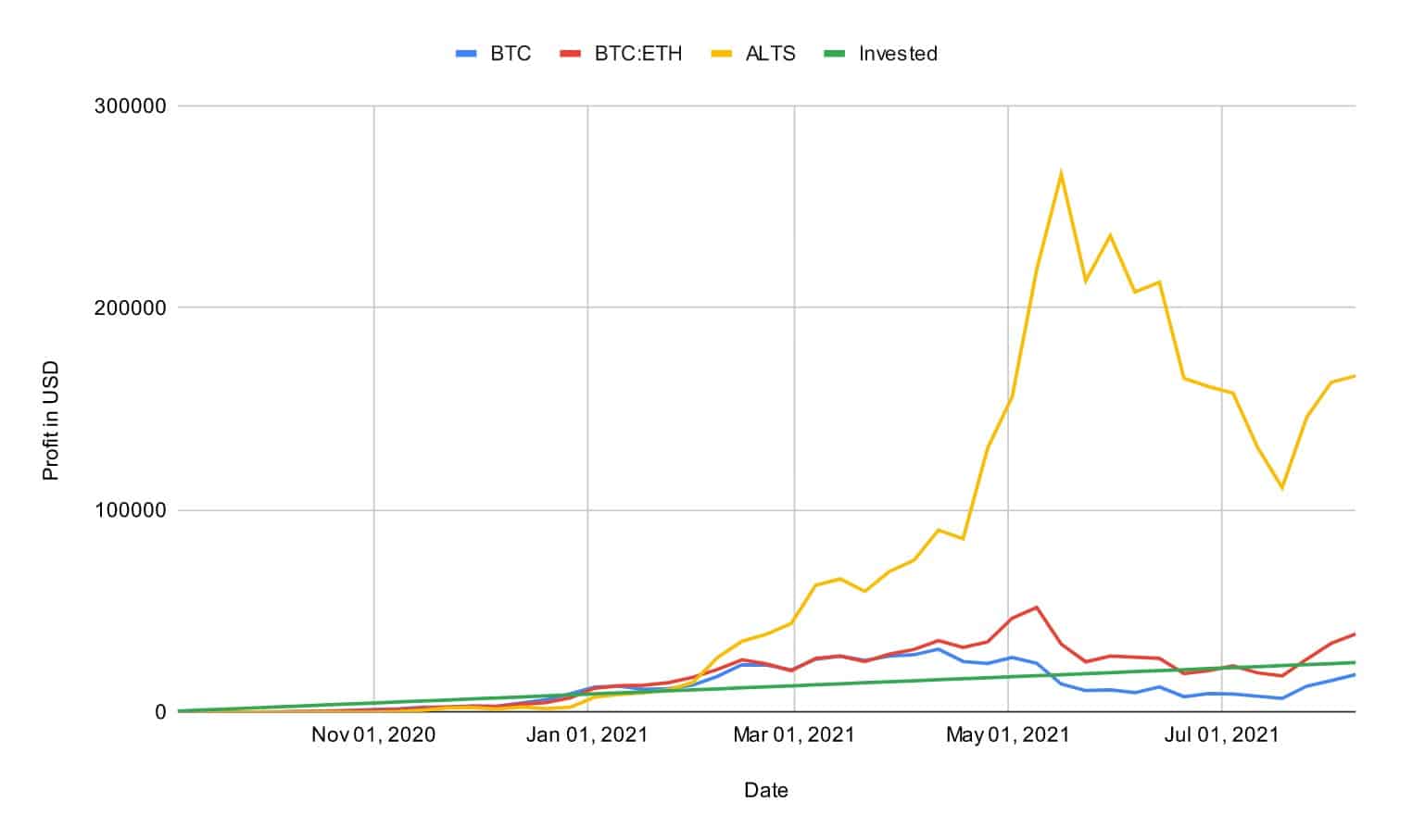

Looking at the result, you can see that there is a clear winner that outperforms all the other portfolios by far.

A diversified portfolio of five small-market cap altcoins would have been able to multiply the invested capital almost sevenfold (total invested = $24500; profit = $166,483.89; profit margin = 679.53%).

Now, you can easily make a conclusion that investing in Bitcoin or Ethereum is not going to be as rewarding as investing in a diversified basket of small-market cap altcoins.

However, there is a small catch. We first need to investigate why this is the case, and whether or not we can truly place our confidence in such an approach.

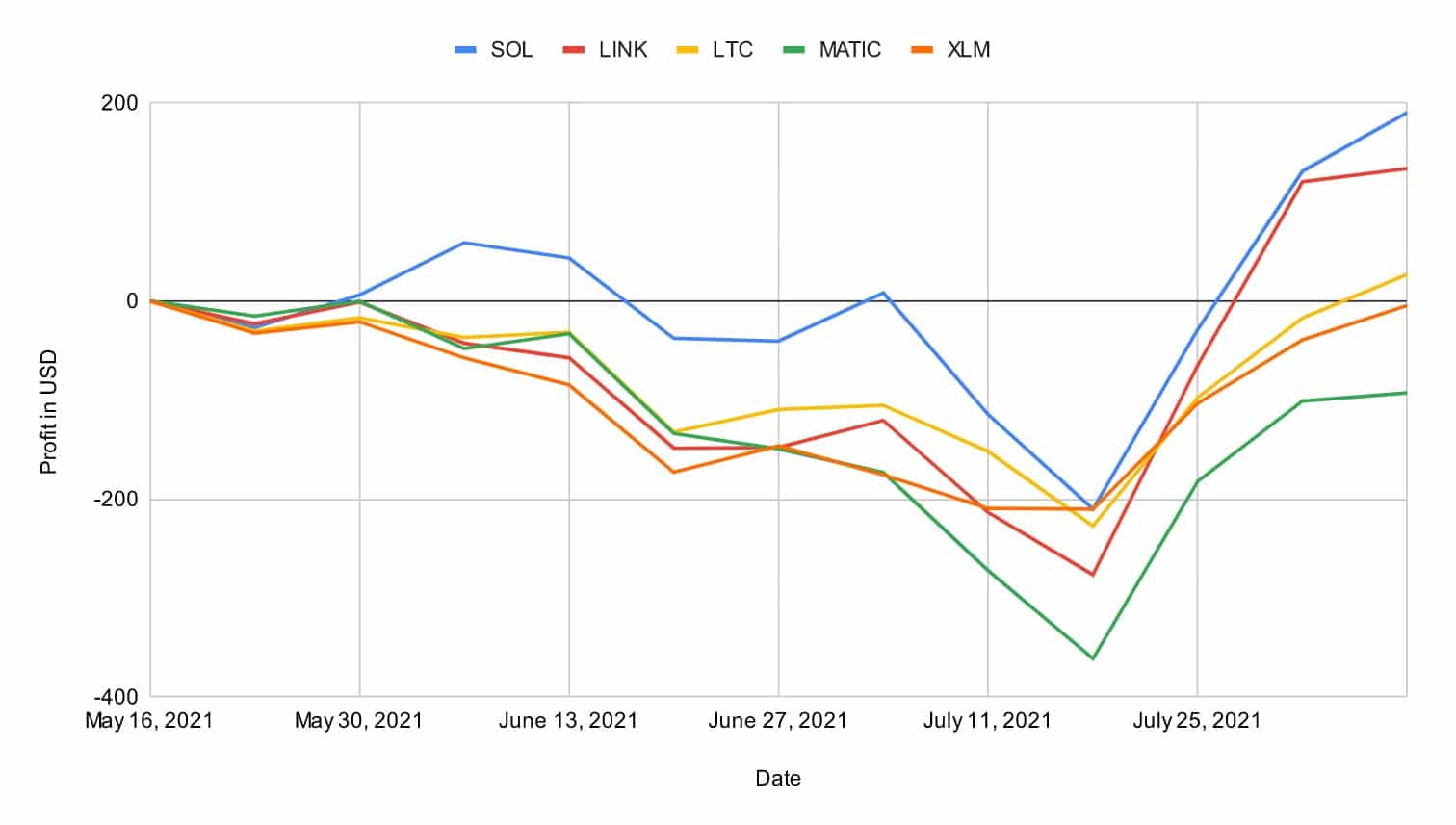

Breaking down the profit contribution from the altcoins

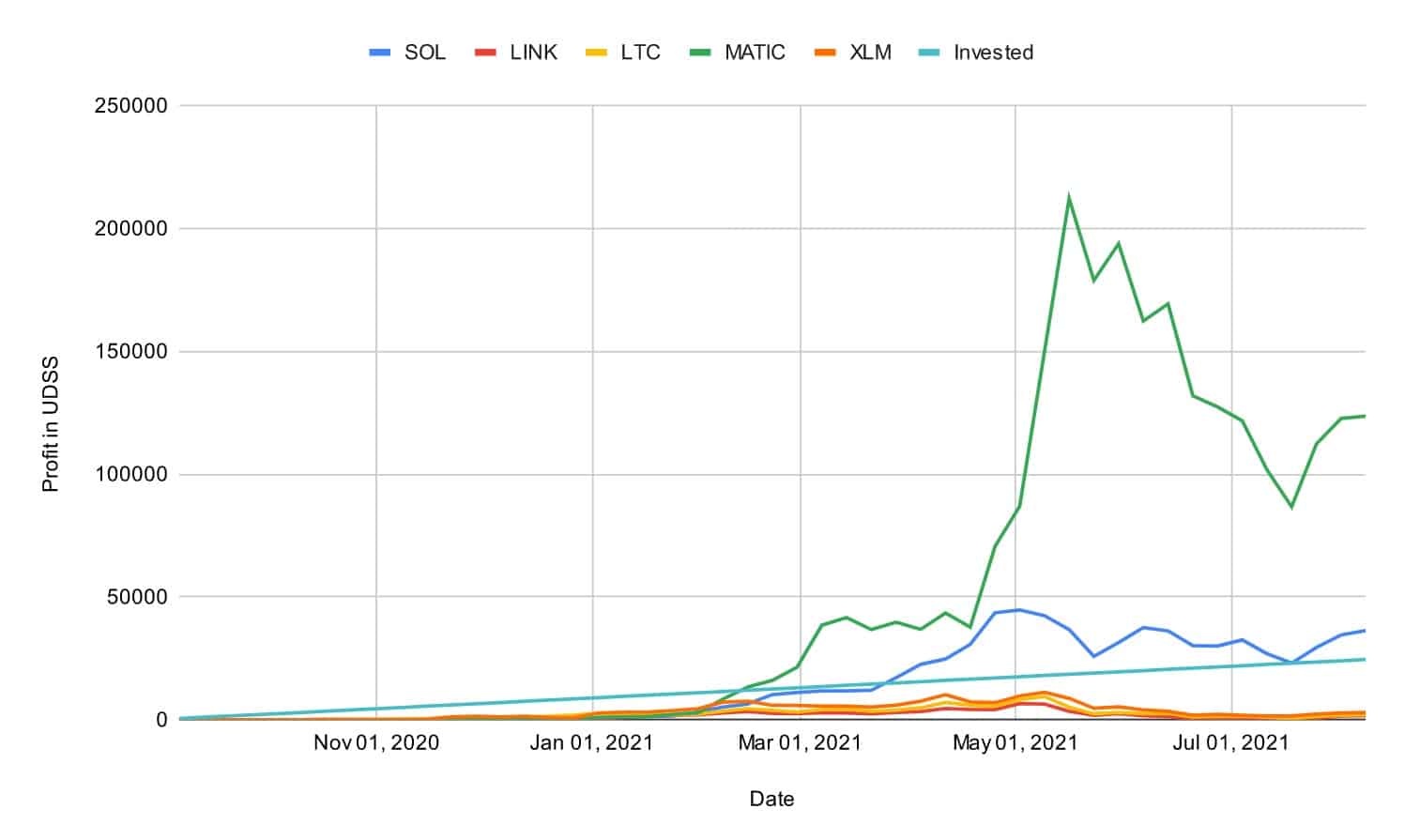

The altcoins that make up the portfolio we call ALTS are made up of equal parts of Solana, Chainlink, Litecoin, Matic, and XLM. Although each is given 20% of the invested capital, not all of them perform equally.

The chart below shows that MATIC has outperformed every other altcoin in the portfolio and has contributed $123,567.93 of the $166,483.89 in total profit, or 74% of it.

This is a disproportionate amount of contribution, which may get you wondering whether choosing MATIC as one of the five altcoins in ALTS was purely by chance or on purpose.

It’s a bit of both, actually. When setting up this case study, we wanted to pick the top altcoins by market cap that have three criteria:

- They’ve been in the market for at least a year ago from now.

- They are not in the top 10 most valuable coins by market cap.

- They are not stablecoins.

The first criterion ensures that the price equilibrium has been reached. Oftentimes, a coin price would skyrocket after an ICO, but only to fall back down after market equilibrium has been reached. The second criteria ensures that the coins aren’t in direct competition with some of the largest coins by market cap.

However, a year ago, the coins would have a much lower market cap value. The choice of these altcoins may be due to survivorship bias. The coins that were popular then may no longer be as popular presently.

Conversely, coins that were not well-known could become extremely popular. Some crypto investors refer to them as “sleeping giants”. The thing is, we can never know which coins will be sleeping giants that will “wake up” one day and soar in price.

Out of the five coins that make up our ALTS portfolio, SOL and MATIC had gained market traction in an unexpected way back in 2020. Meanwhile, LINK, LTC, and XLM, being some of the older tokens and coins, may have already settled on a more “stable” price range.

Related: Learn more about altcoins.

What if all the coins were given equal weight?

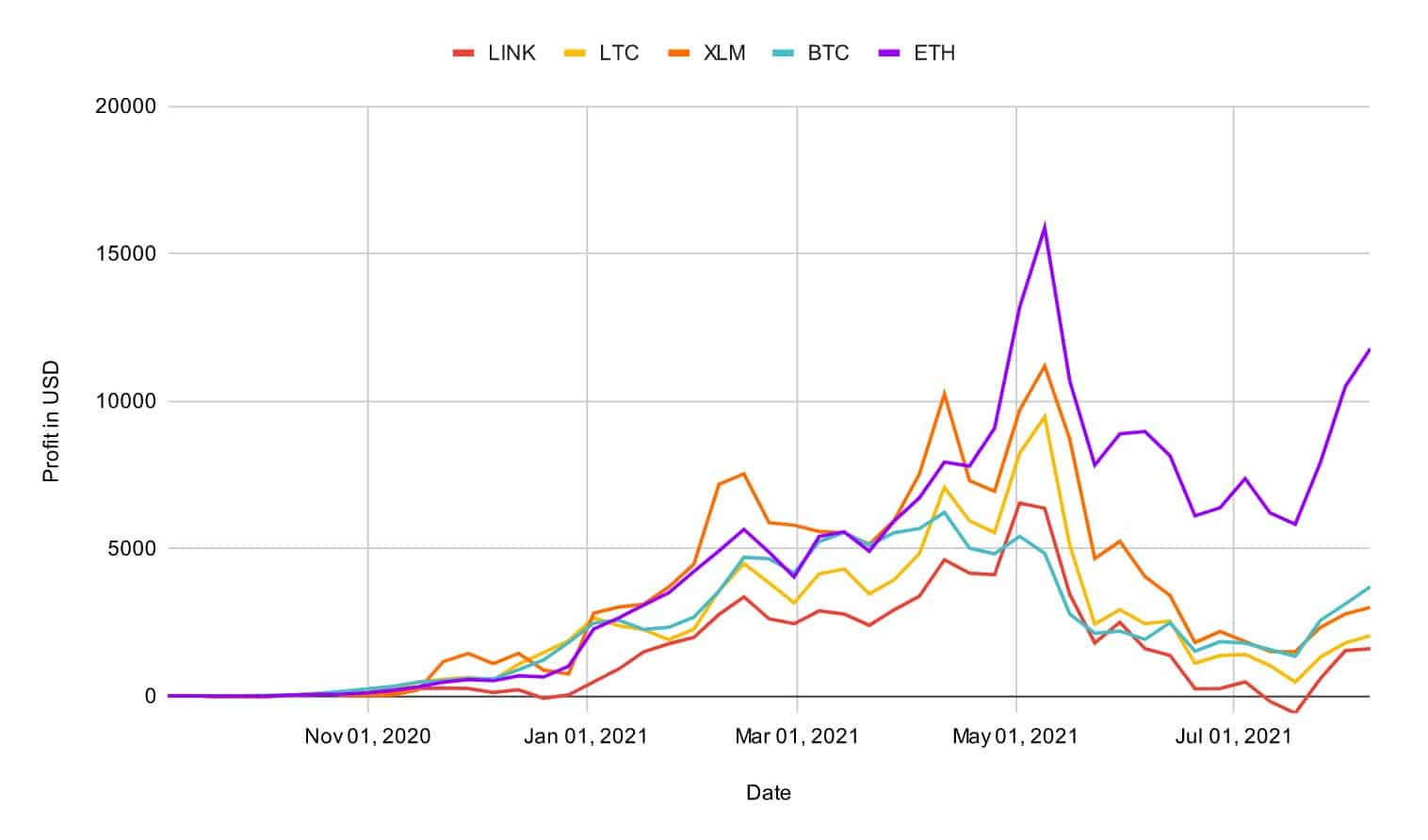

Now, we’re going to compare the profitability of some of these coins, if we had invested $100 in each of them every week. We’ve excluded SOL and MATIC to make the graph look more coherent.

Both SOL and MATIC are able to return $36272.68 and $123,567.93 in profit, respectively. These numbers would have been quite literally off the charts.

Given equal weight, ETH appears to be the top gainer, consistently outperforming the market sample as well as BTC, which is the control in our case study.

LINK had its moment of reaching negative in terms of profit during the temporary market downturn between May and July 2021.

The downside of the portfolio ALTS

As prefaced above, ALTS is made up of five smaller market-cap coins. We’ve also discovered that MATIC and SOL are responsible for the majority of the profits returned by ALTS.

However, notice that while both coins contributed to a large sum of profit, at least MATIC experienced one of the worst drops in value since early May during the market downturn.

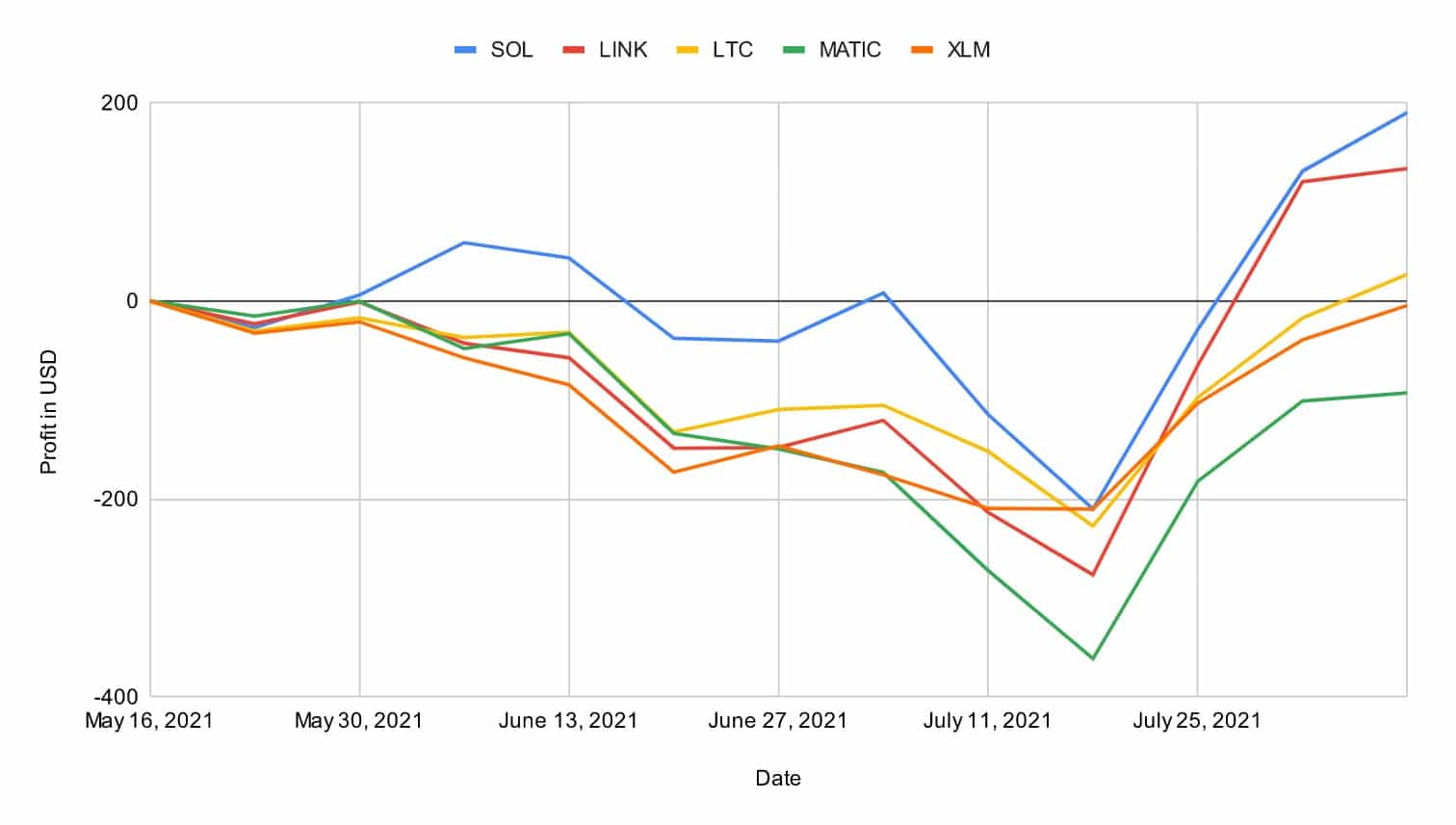

To return to our case study set up, if we invest $500 per week during the market downturn, we would continue to experience a floating loss for two months, before a market breakout (or rebound) returns us back to profit.

In our case, the chosen altcoins that makeup ALTS have sunk lower in price than Bitcoin and Ethereum.

This makes them slower to climb out of the negative profit, but this is nevertheless achievable if the market continues to climb higher.

Reasons why diversifying your portfolio is a good idea

The crypto space is still young, and there are so many questions that were left unanswered, such as:

- How will most businesses adopt cryptocurrencies?

- When will cryptocurrencies become less of a speculative asset, and more utilised as they are originally designed to do?

- Which feature of decentralised network technology will become more important in the future?

The answer to these questions will always be surprising, and it will also become reflected in the market activity. Some cryptocurrencies may turn out to be “sleeping giants”, as with the case for Solana’s and Polygon’s cryptocurrency.

How can we know which cryptocurrencies will “wake up” if we don’t hold them in our portfolio?

During a coin’s initial market circulation, prices tend to be cheap and the movement volatile.

Why is it important to diversify your crypto portfolio?

Diversifying your crypto portfolio distributes the potential risk of market volatility that is often associated with cryptocurrencies. This doubles as a hedge from incurring large losses when a coin enters a bear market. Another advantage of diversification is the increased exposure to other potentially profitable assets that you may have otherwise missed out on.

In summary, diversification gives us two distinct advantages:

- An increased exposure to various coins that could potentially increase in price due to unexpected demand. As evident during our case study, it takes at least one coin to surge upwards in order to outperform Bitcoin.

- A hedge to protect us from incurring greater losses if a coin’s price falls deep. From our case study, at one point MATIC is $272.37 unprofitable, but overall, the portfolio’s value drops only as far as -$1285.61. If we invest exclusively in MATIC at this time, the portfolio’s value will continue to go down to -$1383.57.

Adding Bitcoin and Ethereum as volatility hedge

As two of the world’s most popular cryptocurrencies, Bitcoin and Ethereum can act as volatility hedge if you want to diversify into other altcoins.

Fundamentally, Bitcoin and Ethereum are two coins that are unlikely to become worthless due to their brand. Bitcoin seems to be the preferred store of value, like digital gold, due to its already extensive network.

Ethereum may one day overtake Bitcoin in terms of market cap, but its function as a smart contract network won’t just vanish simply because other networks are competing against it. With Ethereum 2.0 approaching fast, it may already have a firm grip on its future as a decentralised Internet platform.

Further reading: Read our guide on Bitcoin (BTC) and Ethereum (ETH).

Apply the strategy with Easy Crypto

From the result of this case study, you can see that investing $100 in various cryptocurrencies every week starting last year has resulted in about 700% increase in the portfolio value.

Of course, not everyone has the luxury of spending more than $2000 per month on cryptocurrencies. However, even if you’re planning to spend, say $1000 per month, you will still enjoy the benefits of this strategy.

With $1000 per month, you can gain exposure to 10 altcoins worth $100. This means if one of them turns out to be a “sleeping giant”, this $100 might just multiply many times over, drastically increasing your portfolio’s value at the same time.

Check our rates: Have a bird’s eye view of all our cryptocurrencies and their rates.

Diversify and track your portfolio easily with Easy Crypto

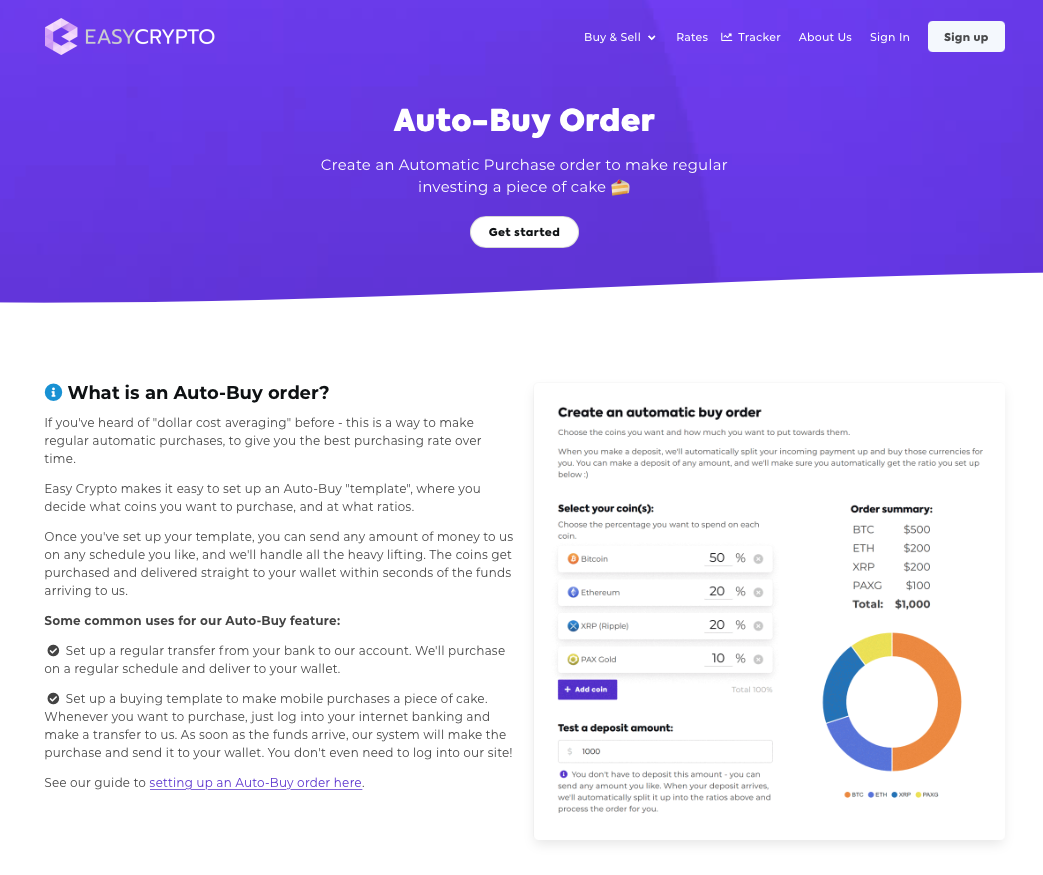

Diversifying your portfolio is easy to do with Easy Crypto. All you have to do is go to Buy & Sell on the main menu and click on Auto-Buy. With Auto-Buy, you can automate your investment with a few clicks.

Choose the percentage of funds allocated to the coins of your choice. Then enter the total amount of money you wish to invest in cryptocurrencies every month.

Afterwards, leave the system running as you go about your busy life. From time to time, however, you can come back to Easy Crypto to see how your investment is doing.

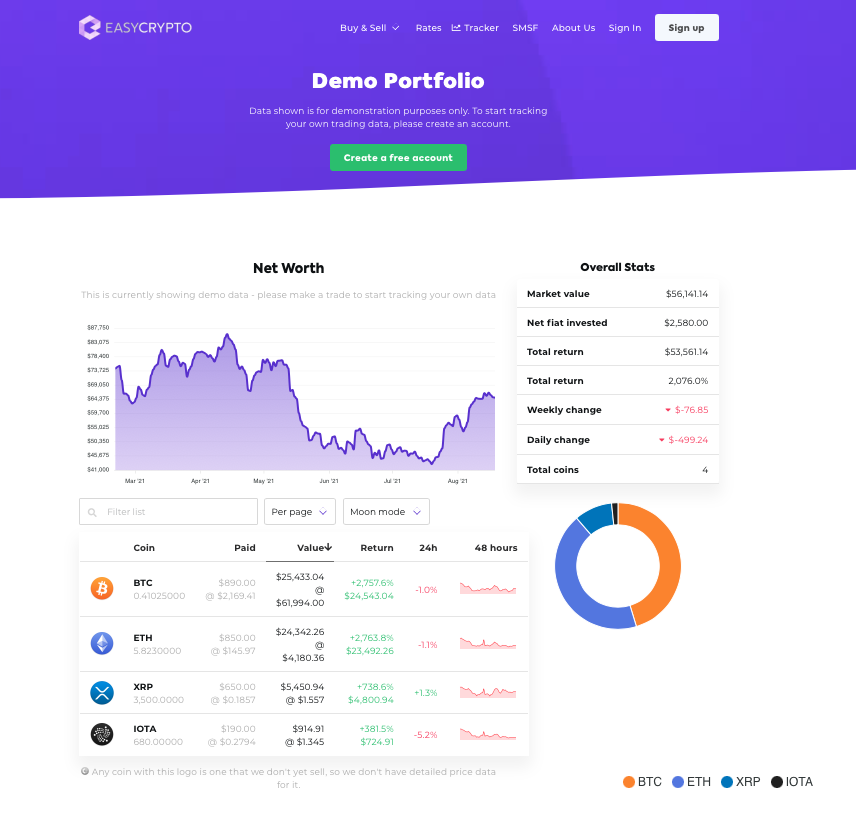

You can make use of the Portfolio Tracker tool, which is automatically set up if you transact through Easy Crypto.

Use these tools and become a super crypto investor. To learn more about cryptocurrencies and investing strategies, check out our other articles. We hope this guide has been useful to you.

Stay updated in the crypto space!

Part of making strategic investment decisions is knowing what developments are unfolding in the crypto space.

Subscribe to our monthly newsletter to get the latest curated insights, market updates, and newest developments on all things crypto delivered to your inbox!

Share to

Stay curious and informed

Your info will be handled according to our Privacy Policy.

Make sure to follow our Facebook, Twitter, Instagram, and YouTube channel to stay up-to-date with Easy Crypto!

Also, don’t forget to subscribe to our monthly newsletter to have the latest crypto insights, news, and updates delivered to our inbox.

Disclaimer: Information is current as at the date of publication. This is general information only and is not intended to be advice. Crypto is volatile, carries risk and the value can go up and down. Past performance is not an indicator of future returns. Please do your own research.

Last updated July 29, 2024