Should I Invest in Bitcoin or Ethereum?

Should you invest in Bitcoin or Ethereum? This is one of the most frequently debated questions. Take a closer look at both BTC and ETH.

Most people who are considering buying crypto assets would have heard the advice to invest in Bitcoin or Ethereum. That is because Bitcoin and Ethereum are two cryptocurrencies with the largest market caps (i.e market values).

It’s no surprise that investors are interested in cryptocurrencies, given that more people are seeing cryptocurrencies as “the future of our entire medium of exchange systems”. Furthermore, both Bitcoin and Ethereum’s past performance have led some to believe that their future growths are promising, given how young the cryptocurrency market is.

Bitcoin first traded in 2009, where one coin was less than USD 0.01, and since then, prices have risen steadily; peaking above USD 20,000 in the 2017 bull market. Ethereum, on the other hand, debuted in 2015 at USD 2.83, and in less than 3 years, it was trading at USD 1,400.

Comparatively, Apple’s initial public offering price was USD 22 in 1980. And after almost three decades, it’s currently trading at USD 390. Both Bitcoin’s and Ethereum’s outstanding rate of returns on investments are undisputable.

Bitcoin and Ethereum are undoubtedly the most widely discussed cryptocurrencies. How similar are they? Or how different are they from one another? Is it better to invest in Bitcoin or Ethereum? These are some of the questions we receive from readers, family, friends, and those wanting to acquire their first crypto assets.

People want to know what they are investing in, and ultimately making an informed decision on cryptocurrency investments. However, it can be quite daunting trying to navigate yourself through the sea of information on both Bitcoin and Ethereum. And this is why our team at Easy Crypto did in-depth research on Bitcoin versus Ethereum to summarise this “cheat sheet” for you!

Bitcoin and Ethereum are similar in many ways. They are both digital currencies that are traded via online exchanges and stored in various types of cryptocurrency wallets.

Both Bitcoin and Ethereum are decentralised; meaning that they are not issued or regulated by a central authority or bank. Both cryptocurrencies make use of a distributed ledger technology known as a blockchain.

What is blockchain technology?

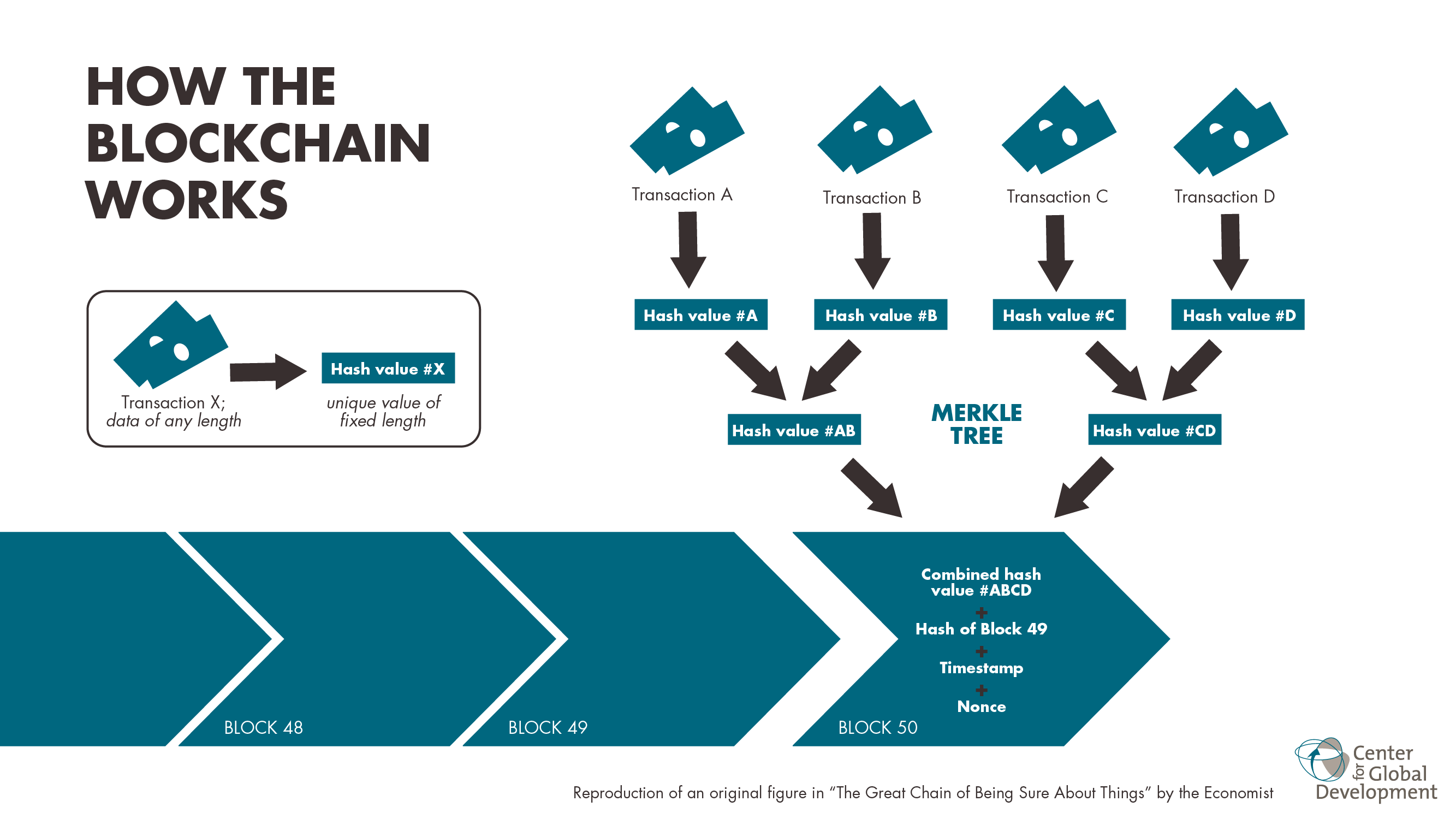

To understand the ‘worth’ (or some might say intrinsic value) of Bitcoin and Ethereum, it is imperative to understand the technology which powers them — the blockchain. A blockchain is a huge peer-to-peer network that stores information.

Although it is public (which offers transparency), it is secure (such that information is anonymised), and that is because many people (and their computers) participate in running this network.

So how does blockchain allow the modelling of digital currency? In simple terms, on this network, there are a whole bunch of computers.

Each one of these computers is known as a ‘node’. And each node holds a copy of all the data on the network, with the data containing all of the transaction information on the network. The transaction information then allows you to calculate the balance on the network. To make this easier to digest, we have broken this bit of information down into point forms for you:

- A blockchain is a database that is shared across a network of computers

- Once a record has been added to a chain, it is very difficult to change.

- To ensure all the copies of the database are the same, the network makes constant checks.

Key terms:

A database: Records that are bundled together into blocks and added to a chain one after another, and the basic parts are:

- The record – this can be any information

- The block – a bundle of these records

- The chain – all the blocks linked together.

So, to sum things up, blockchain technology allows one to know how much currency you have in your wallet. And the public nature of a blockchain allows pretty much anyone to participate in the running of the network.

Read more: What is blockchain technology?

Now that one understands how Bitcoin and Ethereum are similar, how then, are they different? What are the advantages to invest in Bitcoin? What are the benefits to invest in Ethereum? We’ll first need to take a closer look to understand the characteristics of Bitcoin and Ethereum.

What is Bitcoin?

Bitcoin was first launched in January 2009. Its mysterious founder, Satoshi Nakamoto (no one knows if this was one person or a group. It’s a pseudonym), introduced a novel idea set up in a white paper.

Bitcoin was revolutionary as it offered the promise of an online currency that was secured without the involvement of any central authority, unlike our government-issued fiat money (e.g NZD, AUD, USD). There are no physical

Bitcoins, only balances associated with a cryptographically secured public ledger. This means that its blockchain network documents each and every transaction on a Bitcoin wallet address. Bitcoin was not the first attempt at an online currency.

However, it was the most successful in its early efforts, and some regard Bitcoin as a predecessor to the other cryptocurrencies that have been developed in the recent decade.

Fun fact: At the start of the 2017 cryptocurrency boom, Bitcoin’s market value accounted for 87% of the total cryptocurrency market.

More on Bitcoin: Click here to read our complete guide on Bitcoin.

What is Ethereum?

Launched in July 205, Ethereum is the largest, most well-established, open-ended decentralised software platform. It proved that blockchain technology can be used to create applications that go beyond just enabling digital currency.

Ethereum enables the deployment of smart contracts and decentralised applications to be built and run without any downtime, fraud, control, or interference from another party. Smart contracts are unlike traditional contracts that rely on human intermediaries. While these transactions are trackable, they are irreversible.

Apart from Vitalik Buterin, a programmer from Toronto, Canada. Other co-founders were included in the development of Ethereum; Mihai Alisie, Charles Hoskinson, Anthony Di Lorio, Dr. Gavin Wood, and Joseph Lubin.

Technically, Ethereum is not a currency, but a platform. Its native cryptographic token is known as Ether. Ether is like the fuel for running commands on the Ethereum platform and is used by developers to build and run applications on their platform.

Related: Read our complete guide on Ethereum.

Having considered the strength and weaknesses of Bitcoin and Ethereum, let’s now discuss the key differences.

Should I invest in Bitcoin or Ethereum?

There are many crucial distinctions between the two most popular cryptocurrencies. The Ethereum network, for example, can contain executable code, while Bitcoin network transactions are typically only for keeping notes.

Other differences include block time (an ether transaction is validated in seconds, as opposed to minutes for bitcoin), and algorithms that they run on (Ethereum uses Ethash while Bitcoin uses SHA-256).

To make things simpler, we have created a side-by-side comparison table to help you visualise the key differences between Bitcoin and Ethereum — yes, we’ve considered the needs of those who you who are ‘minimalist readers’.

Hope this table can help you decide to invest in Bitcoin or Ethereum.

| Bitcoin | Ethereum | |

| Founders | Satoshi Nakamoto (pseudonym) | Vitalik Buterin |

| Launch Date | 03 Jan 2009 | 30 July 2015 |

| Hashing Algorithm | SHA-256 | Ethash |

| Block Confirmation Time | 10 minutes approximately | 15 seconds |

| Block Size Limit | 2MB | 1MB |

| Block Reward | 12.5 BTC (halves every 210,000; approximately 4 years) | 5 ETH per block |

| Programming Language Used | Stacked-based language | Turing Complete |

| Circulating Supply | 18,724,537 BTC (June 2021) | 116,124,199 ETH (June 2021) |

| Maximum Supply | 21,000,000 BTC | ∞ |

| All time High | USD $64,804.72 | USD $4,356.99 |

The table above provides a skeletal frame of the main differences between Bitcoin and Ethereum, however, this information alone is insufficient. While both Bitcoin and Ethereum networks are guided by the distributed ledger and cryptographic concepts, the two vary in many respects technologically.

Most critically, the Bitcoin and Ethereum networks are different concerning their overall objectives. Bitcoin was created as an alternative to fiat money, and thus aspires to be a medium of exchange and a store of value.

Security is Bitcoin’s priority; Bitcoin uses C++ programming and has less than 70 specific commands that can be used — this limitation provides more security because it is much more difficult to hack the blockchain within those set commands.

Since everything is shown on the public ledger (the blockchain), one can be confident that the transaction is legitimate and the need to trust a third party is negated.

Bitcoin operates on a proof-of-work basis. Proof-of-work means that to create blocks and add them to the blockchain, one must solve complex mathematical problems (sometimes called ‘mining’). Due to this process, information becomes difficult and can be costly to make, which helps to prevent fraud and malicious activity.

Although the proof-of-work model helps to increase security and validity, it has its shortcomings.

First, it does not give miners (i.e. those who participate in creating transaction blocks) an incentive to collaborate and there is no consequence for a person who carries out malicious activity. Proof-of-work also consumes a high amount of energy to validate transactions, which can have negative impacts on the environment.

Related: What is proof of work?

Ethereum, on the other hand, was meant to provide an immutable platform for programmatic contracts and applications through its own currency. Ethereum, like Bitcoin, operates on a proof-of-work basis but is working towards changing to a proof-of-stake model (the upcoming ETH 2.0), which will change their reward system.

In a proof-of-stake model, there are no miners but validators. Validators will be required to use their own ether. And in order to validate a block of transactions, they will be required to put their own ether on the line to certify that a block is valid. This way, if a validator does something invalid, they will lose their stake (i.e. their own ether).

Related: What is proof of stake?

Bitcoin and Ethereum are both digital currencies, but Ethereum’s primary aim is not to set up an external monetary structure as an alternative.

Instead, its objective was to promote and monetise the operation of the Ethereum Smart Contract and the decentralised application platform. In some sense, Ethereum is another use-case for a blockchain that supports the Bitcoin network.

Technically, Ethereum should not conflict with Bitcoin. However, the popularity of Ethereum has made it competitive, particularly from the perspectives of traders and speculators. For the most part, Ethereum has been near behind Bitcoin in terms of market rankings and market cap.

Do people choose to invest in Bitcoin or Ethereum?

As a non-tech person, I found navigating through the technical differences rather dense. So, I sought help from two of our tech and blockchain gurus at Easy Crypto, Alan and Sean. Both of them have spared me the agony of reading through articles and articles, and have kindly broken down the pros and cons of choosing to invest in Bitcoin or Ethereum.

Here are Alan’s key takeaways for readers:

| Bitcoin | Ethereum |

| Currency only | Serves as a platform |

| Not widely adopted as a payment currency (due to the associated costs involved to process transactions) | Many more functions than Bitcoin (e.g. smart contracts and decentralised apps) |

| Store of value | ETH 2.0 coming soon (adopting proof of stake model) |

| Reputation (i.e. Digital Gold) | The Ethereum Enterprise Alliance – a growing Decentralised Finance Industry building on top of Ethereum. |

| Large Institutional Investments (Yes, Wall Street is bullish) | Black Thursday – when the Ethereum network completely failed to function |

Sean’s key takeaways for readers:

“It’s like comparing apples and oranges. Bitcoin is designed as a currency or ‘money’ whereas Ethereum’s tag line in the early days was a world computer. You write code (aka smart contracts) in Solidity say and then deploy it on the Ethereum network work and it will execute. Ether is how you pay for the cost of the smart contract to run because someone has to pay for computer time.”

It pays for one to understand the crypto asset they’re investing in, so do consider those key differences we’ve summarised for you. Before researching these differences between Bitcoin and Ethereum, I confess that I was mostly oblivious to their fundamentals — I hope this summary helped you as much as it had helped me.

There are so, so many more cryptocurrencies out there (and the numbers are still growing). Each one of them has its own unique specification and functionality. It is therefore important doing thorough and in-depth research to make an informed decision in your crypto-asset investments.

With that said, do you have a favourite and what’s your price predictions for these coins?

Would you rather invest in Bitcoin (BTC)?

Or are you more of an Ethereum (ETH) Investor?

Contact Easy Crypto for more information about buying Bitcoin and other cryptocurrencies!

We’re always ready to help 🙂

Share to

Stay curious and informed

Your info will be handled according to our Privacy Policy.

Make sure to follow our Facebook, Twitter, Instagram, and YouTube channel to stay up-to-date with Easy Crypto!

Also, don’t forget to subscribe to our monthly newsletter to have the latest crypto insights, news, and updates delivered to our inbox.

Disclaimer: Information is current as at the date of publication. This is general information only and is not intended to be advice. Crypto is volatile, carries risk and the value can go up and down. Past performance is not an indicator of future returns. Please do your own research.

Last updated February 18, 2025