Will Bitcoin become a hedge against inflation in 2022?

This year in 2022, many Bitcoin investors hold the cryptocurrency dearly to protect their money.

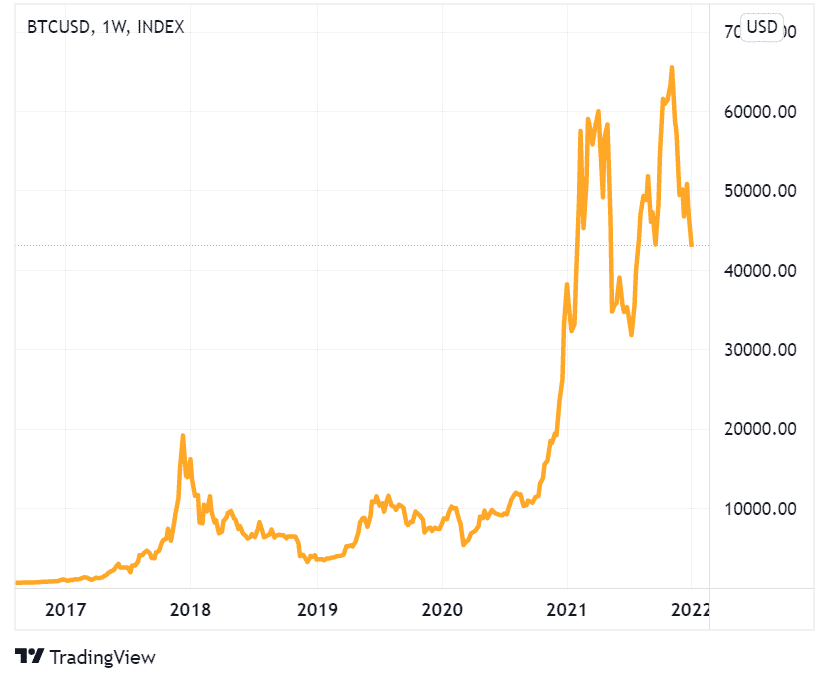

Bitcoin has surpassed its original purpose as a “peer-to-peer electronic cash” as envisioned by Satoshi Nakamoto. Arguably, the most modern use of the oldest cryptocurrency in the world is to hedge against inflation.

Now costing thousands of dollars per unit, Bitcoin’s payment currency proposition evolved into something more similar to gold. Bitcoin is scarce, incorruptible, indestructible, and for some, mysterious and attractive to have.

This year, many Bitcoin investors hold the cryptocurrency dearly to protect their money. Many more still are considering Bitcoin to hedge against inflation. So, is 2022 the year for Bitcoin, and will it truly help millions of people from the unrealised effect of high inflation?

Learn more: What is Bitcoin? A Complete Guide in 2021

Higher inflation is being felt worldwide

With the world economy still trudging under the weight of COVID-19, some central banks have been enacting an expansionary monetary policy. This has inadvertently increased the money supply of fiat currencies, leading to higher-than-average levels of inflation around the world

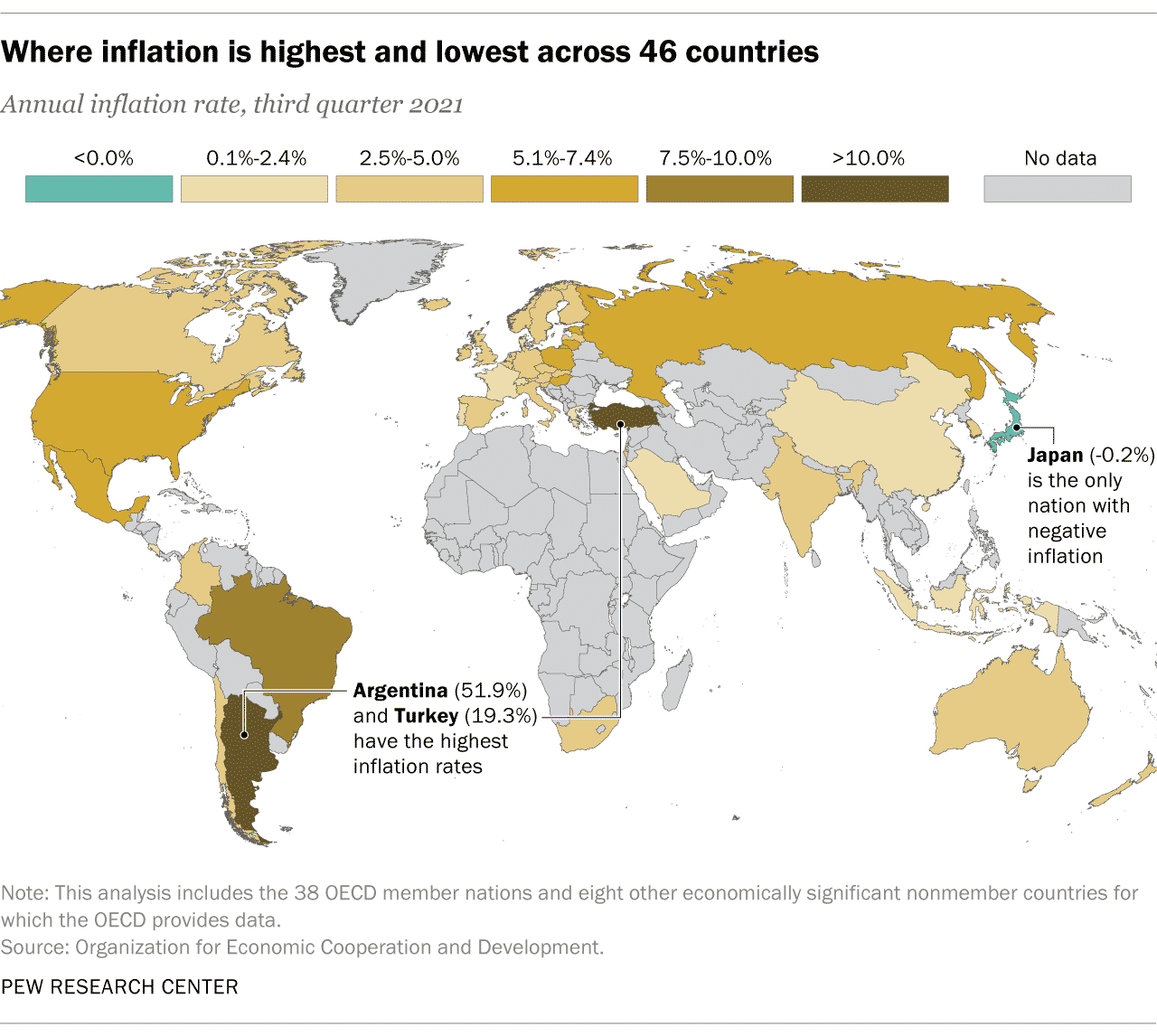

While regulated levels of inflation are healthy for the economy, hyperinflation has taken a toll on the population’s savings and purchasing power. On the extreme end, rampant inflation caused a devaluation of the Turkish lira. In most countries, however, things are not so severe.

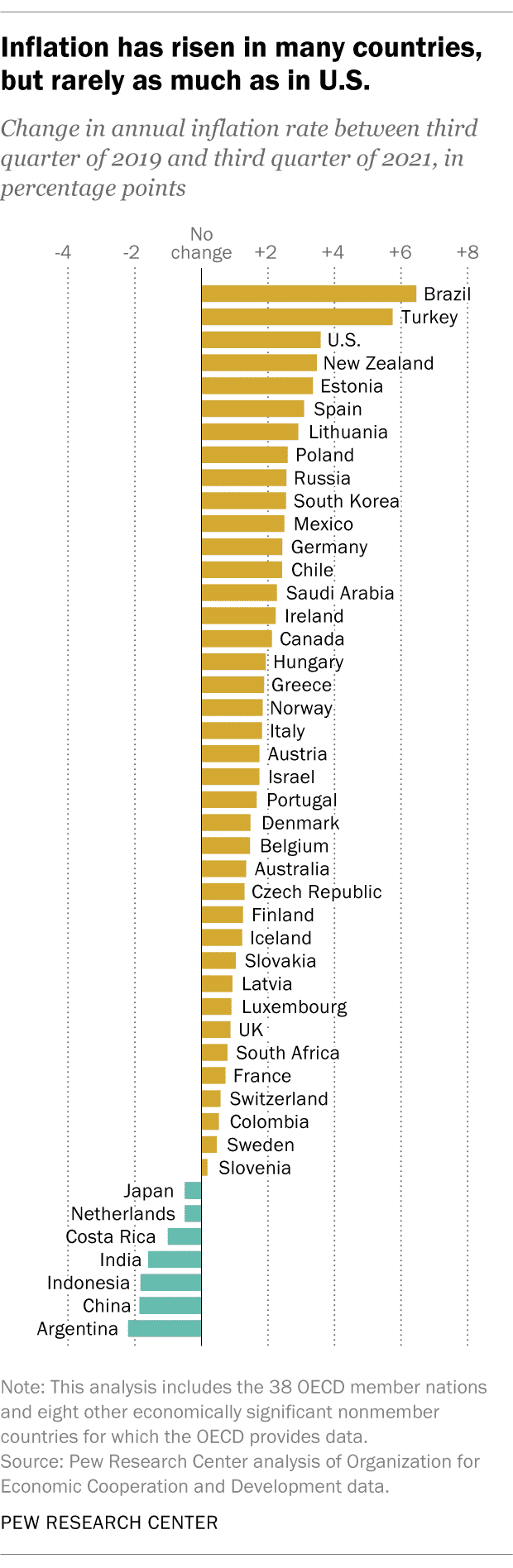

Here is a report by Pew Research Center showing the change in annual inflation rate between Q3 of 2019 and Q3 of 2020.

Please take note that this does not mean that Brazil’s inflation rate is much higher than Turkey. On the contrary, as shown in the diagram below, both Turkey and Argentina have been experiencing some of the highest inflation rates in the world.

Now, pay attention to where the United States is. The United States dollar (USD) is our focus because of its role acting as the world’s reserve currency. Somehow, historically and/or politically, many countries hold the USD in high regard (even if the Euro has a higher exchange rate against the USD).

Now, the USD is experiencing the same level of inflation as the Russian rouble, among others. Some have already anticipated this, including Wharton School Professor Jeremy Siegel. On multiple occasions, he had warned the US government of the threat of high levels of inflation.

“I’ve been saying this for a long time. I’ve been warning about inflation for a year and a half,” he said in an interview. “The [US Federal Reserve (Fed)] and the fiscal authorities so way overdid it, particularly the Fed on liquidity.” He also remarked that the Fed is “so far behind the curve”.

Prof. Jeremy Siegel is a Russell E. Palmer Professor Emeritus of Finance at Wharton School, University of Pennsylvania. He focuses on demographics, financial markets, long-run asset returns, and macroeconomics in his research.

“Gold has been disappointing”

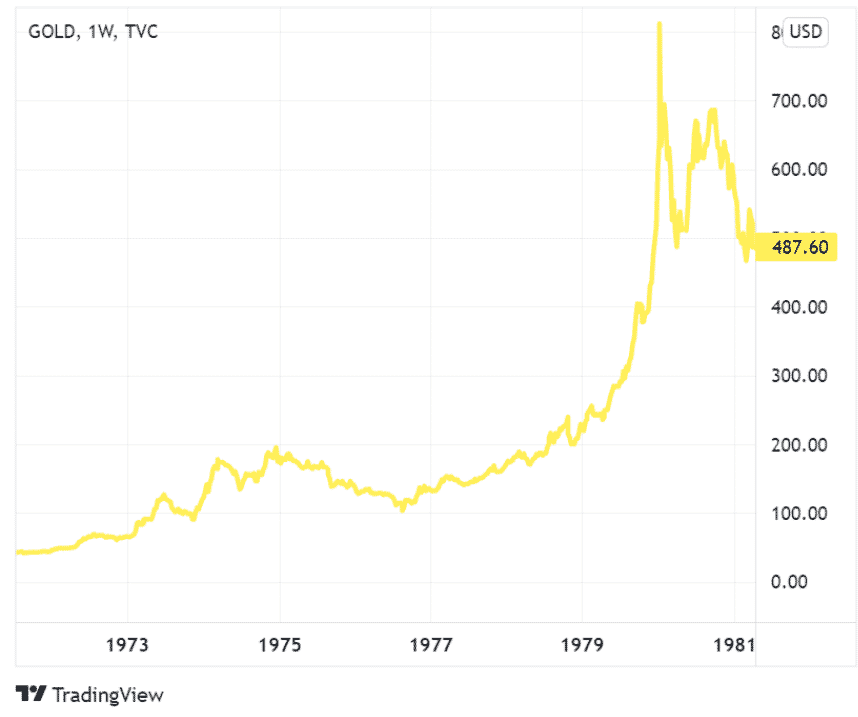

Traditionally, gold has been the go-to asset to hedge against inflation. Indeed, since the Fed decoupled the USD from gold in the 1970s, gold prices have skyrocketed in nearly similar fashion to Bitcoin.

However, Prof. Siegel noted that gold “has been disappointing”. For the last decade, gold’s market value has only risen by 12%. After January 2012, gold has spent most of its time underperforming, before investors called for its demand in March 2020.

Still, throughout 2020 and 2021, gold prices kept falling, to many people’s surprise. The reason behind this is quite complex, but one thing is certain. Bitcoin is stealing gold’s spotlight, and the younger generation much prefers Bitcoin as an inflation hedge.

“Let’s face the fact, I think bitcoin as an inflation hedge in the minds of many of the younger investors has replaced gold … Digital coins are the new gold for the millennials,” Prof. Siegel noted.

Billionaires are also taking on Bitcoin

It’s not just the millennials and the Gen Z fresh graduates that are seeing Bitcoin as legitimate investments. At least three billionaires are putting their cash reserves into Bitcoin, according to Cointelegraph:

Thomas Peterffy

Thomas Peterffy said in a Bloomberg report that investors should have at least 2-3% of their portfolio in crypto assets. The same man said that Bitcoin could “destabilise the real economy” in 2017. Now softening his stance, his firm Greenwich Exchange enables his clients to trade four of the oldest cryptocurrencies.

Petterfy claimed that while some of the crypto assets could go to zero, he thinks that others could potentially reap “extraordinary returns”. Perhaps it was his way of saying that diversification is key to managing risks while investing in crypto assets.

Ray Dalio

Hedge fund manager Ray Dalio has also become friendlier to crypto assets. He revealed that his portfolio contained some Bitcoin and Ethereum. He commented in late December 2021 that Bitcoin held up for more than a decade, despite the fact that it’s essentially a computer programme that is not backed by any government.

“I think it’s impressive that for the last 10–11 years, that programming has held up. It hasn’t been hacked, and it has an adoption rate,” said Ray Dalio.

Dalio also mused that “cash, which most investors think is the safest investment is… the worst investment.”

Paul Tudor Jones

Another hedge fund manager Paul Tudor Jones, unlike the previously mentioned, is a “bitcoin bull” — although not as much as Twitter’s ex-CEO Jack Dorsey. Jones said he owned single digit percentages in crypto out of his portfolio, and said that at the moment, he prefers cryptocurrency over gold.

“Clearly, there’s a place for crypto. Clearly, it’s winning the race against gold at the moment,” he said in a CNBC interview. His reason to hold Bitcoin is the same as what many of its investors believe the cryptocurrency can potentially do — to hedge against inflation.

The takeaway

One thing to learn from these billionaires is to not dismiss digital assets easily as they have some of the highest yearly returns. However, good risk management is also recommended. Diversification across more “traditional” asset classes could prevent large losses due to crypto’s volatility.

It’s also not hard to believe that Bitcoin will become an inflation hedge, given its availability and low barrier to entry. On the other hand, self-custodial gold is difficult to store securely. Buying gold-derived certificates will also be costly for some people, due to things like storage and maintenance fees.

Share to

Stay curious and informed

Your info will be handled according to our Privacy Policy.

Make sure to follow our Twitter, Instagram, and YouTube channel to stay up-to-date with Easy Crypto!

Also, don’t forget to subscribe to our monthly newsletter to have the latest crypto insights, news, and updates delivered to our inbox.

Disclaimer: Information is current as at the date of publication. This is general information only and is not intended to be advice. Crypto is volatile, carries risk and the value can go up and down. Past performance is not an indicator of future returns. Please do your own research.

Last updated October 18, 2022