Weekly Market Update: Central Banks Begin Easing

In this weekly crypto market update we take a closer look at movements made by Central Banks, along with other highlights and updates from the crypto space and macroeconomic developments from around the globe.

We saw another fairly volatile week in the broader global markets due to the US jobs market being a hot mess. The Non-Farm payroll headline numbers were up, like way up, and traders immediately threw their toys. More considered research indicates there is softness in the underlying trends so it’s not all bad.

This week institutional crypto news was quite big; Kraken is pre IPO and Robinhood acquired Bitstamp. However, the news item that really grabbed my attention was ETF issuer Van Eck’s research into the ETH price. By 2030 they are saying ETH could reach US$22k per coin. 🫨

Other standout news items centred around industry growth with Binance breaking 200 million users. Massive.

In macro news, shipping costs continue to rise and OPEC put out some confusing signals which caused quite the stir in Oil prices. But the biggest news was the first of the rate cuts from central banks. Canada, Denmark and the ECB all delivered this week. Arthur Haye’s called, “yahtzee!” and said it could be ‘game on’ for risk assets.

In the US, the employment market keeps putting out confusing signals, what the Fed makes of this is going to be interesting. Inflation expectations are down which will help.

Europe’s politics got more interesting with a low turnout election delivering a swift move to the right of the political spectrum. The ECB delivered on its June rate cut by moving rates to 3.75%. England’s ruling Conservative party is looking like it’s going to get an absolute pasting so more change in that region is incoming.

In Asia, PMI’s for China and Japan have rebounded nicely. China’s exports are surging as they front-run incoming tariffs. India re-elected the Modi government and India’s manufacturing sector continues to perform strongly.

In regional news, Australia Q1 GDP was underwhelming. Their balance of trade held up, driven however by a large fall in imports.

In New Zealand there were more data points indicating a weak economy. Business liquidations, insolvencies and home loans delinquencies are all up.

Some good news, grocers’ supply costs are down and crown finances are better than expected. And then the ANZ said the economy is in bad shape and brought forward its rate cut predictions to February 2025.

Easy Crypto recently conducted consumer research with Protocol Theory and found that crypto is becoming a new potential investment alternative for Kiwis during these challenging economic times.

The report also shed light on the challenges the industry faces in making investing more accessible for everyone.

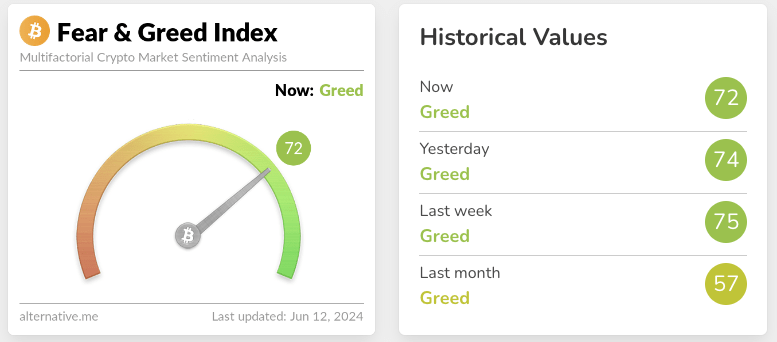

The absence of market moving news means that the crypto market sentiment has barely changed, we remain steady in greed territory.

Highlights this week:

- A late week fall in prices meant that almost all of the top 30 assets have lost ground this week, down 4-10%.

- Our buy – sell ratio showed an up-tick in buys over the last week, with a discernible increase in stablecoin purchases coming through in the data.

- At the time of writing BTC is down 4% , while ETH, BNB and XRP all fell 8%. SOL was down 12%

- Kyber (KNC) was our best performing asset up 12% on the week.

- Arweave (AR) gave up most of last week’s gains to be down 26%.

View all top gainers: Visit the top gainers page to find out more.

Highlights from the crypto space

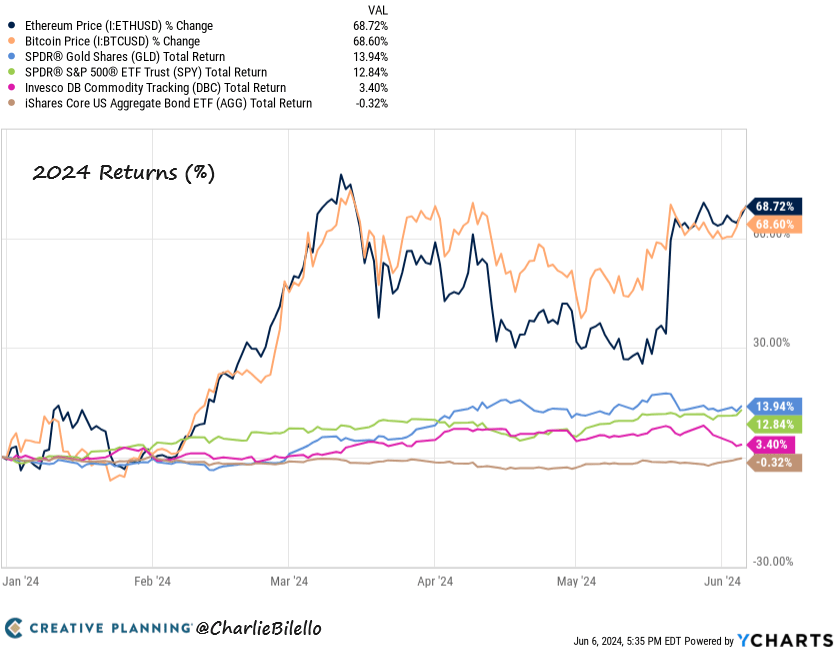

Charlie Billello reports the BTC and ETH returns are giving tradfi a pasting this year.

Great news! Kiwis can now pay bills with NZDD (New Zealand Digital Dollar) through Bill Pay.

Robinhood’s move into crypto became an absolute commitment as they bought OG crypto exchange Bitstamp for a reported US$200 million.

Kraken is reportedly raising $100m in pre-IPO funding.

VanEck, one of the ETF issuers, has raised its ETH price target to US$22k in 2030.

K33 says that an ETH EFT will create a supply shock in the market.

Fidelity is tokenising a Money Market Fund on the JP Morgan blockchain.

Following on from last week’s Binance European stablecoin announcement, Tether (USDT) looks like it might fall afoul of the EU MiCA legislation.

Binance has announced they have reached the 200 million user mark. 👊 Mobile wallet adoption has also reached ATH; 28 million according to recent research.

Someone kindly put together their key takeaways from last week’s Consensys event in Texas.

🌎 Macro news TLDR: US Jobs data cools markets.

Container prices are up another 12% on last week’s blip.

Oil prices drifted lower as OPEC+ signalled it will unwind its ‘voluntary’ production curbs. Brent dipped below US$80 per barrel. This was walked back by OPEC and prices have come back somewhat.

The Bank of Canada moved into easing territory with a 25bps cut to 4.75%, one of the first major Central Banks to do so. Following the ECB, Denmark’s central bank also cut rates 25bps.

U.S. economic news

Services PMI for May rebounded strongly, surging to 53.8, way up on April’s 49.4. Further evidence of a softening job market was evident with the ADP employment report showing only 152,000 jobs were added this month, vs the 175k expected. Wages were up 5%, which is ahead of inflation.

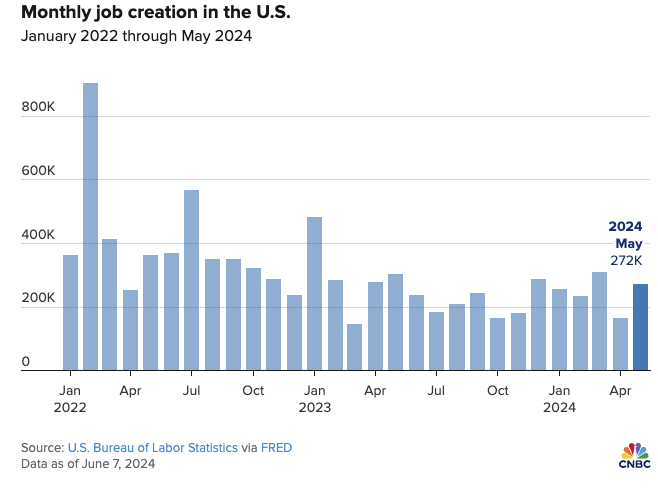

Non-Farm payrolls came in at 272k, way hotter than the 190k forecast. Wage inflation was up 4.1% for the year too.

However, this looks like an anomaly with a lot of data points indicating a softening employment market. Sadly traders didn’t see it that way.

Inflation expectations have come back slightly from April’s surprise increase, but still sits at 3.2%. CPI data is out later this week so watch out for volatility.

Stuff got real in Europe….

European parliament elections were held over the weekend. There was a major shift to the right in the political spectrum in France and Germany with the Greens looking like the losers. France has called a snap election and dissolved parliament.

As expected, the ECB delivered on the June rate cuts, delivering the 25bps cut in spite of some data pointing towards more lingering inflationary pressures.

Their core rate is now 3.75%. The ECB is saying it could be months until the next cut.

In Germany, new manufacturing orders continue to slide backwards. June’s figures are down on March’s result and down 1.6% YOY.

Unemployment is increasing in the UK, while weekly earnings are up.

And in Asia Pacific…

In China, the CAXIN services PMI result mirrored the US with a strong rebound to 54 for May. Japan recorded the same trend. China’s exports surged as they appear to be moving existing stock ahead of incoming tariffs.

India has reelected the Modi government, this time in coalition. India’s Manufacturing PMI for May dipped slightly to 57.5. The Central bank held interest rates at 6.5%.

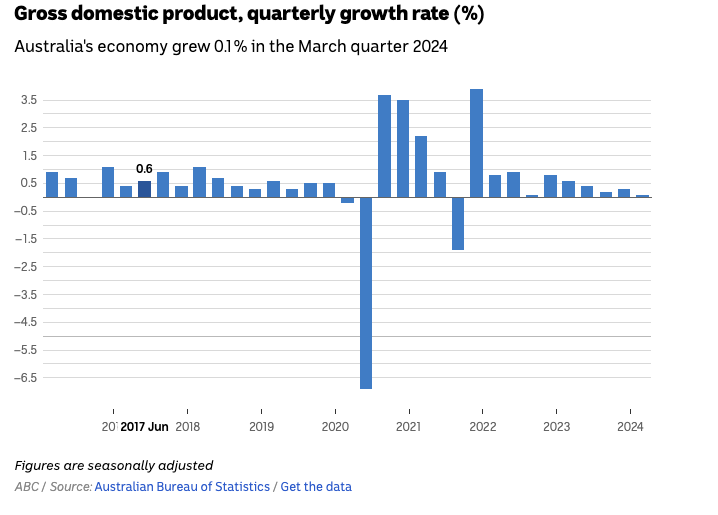

Australian GDP was a disappointment, recording 0.1% growth in the March Quarter and their 5th consecutive GDP per capita decline. Some are whispering recession. Australia’s balance of trade data shows April exports declining, but imports were down even more, helping their position. May’s Business Confidence survey fell into negative territory, indicating the economic funk is spreading into Q2.

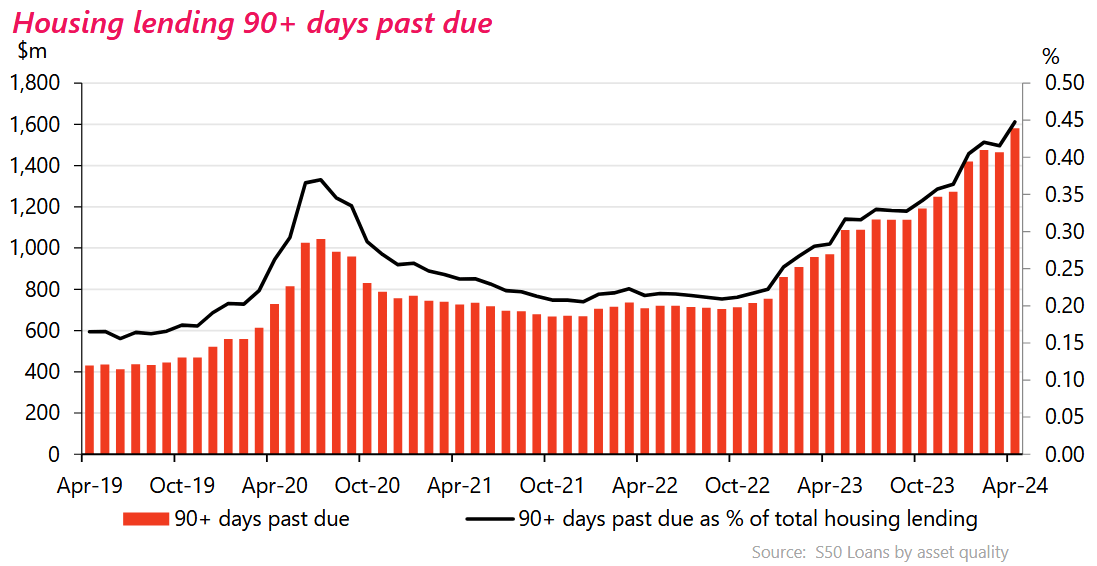

In NZ, Centrix reports that business insolvencies are up 30% and liquidations are up 19% on a year ago. The manufacturing sector was particularly hard hit. Non-performing housing loans are also way up.

The Crown’s finances are doing better than forecast with the deficit being $1.7bn better than last week’s budget. Tax take was up as PIE’s are having better than expected returns.

ANZ thinks the “real economy is very weak” and has brought forward its call on when rate cuts will happen from May to February. The New Zealand Grocery Supplier Cost Index, a measure of wholesale supplier costs, was up 2.9% in the year to May.

That’s a wrap for this week.

Stay tuned for the next update.

Did you miss the last weekly update?

Share to

Stay curious and informed

Your info will be handled according to our Privacy Policy.

Make sure to follow our Twitter, Instagram, and YouTube channel to stay up-to-date with Easy Crypto!

Also, don’t forget to subscribe to our monthly newsletter to have the latest crypto insights, news, and updates delivered to our inbox.

Disclaimer: Information is current as at the date of publication. This is general information only and is not intended to be advice. Crypto is volatile, carries risk and the value can go up and down. Past performance is not an indicator of future returns. Please do your own research.

Last updated June 12, 2024