Weekly Market Update: Cluster Fudge

In this week's market update, we observe the volatile markets that were driven by US recession fears and the Bank of Japan's rate rise, leading to a cascade of selling. Crypto faced extra pressure due to low weekend liquidity. Stay tuned for more updates.

Cluster Fudge. Only because the editor wouldn’t let me write what I was really thinking.

Let’s cut to the chase. Markets are weird. For the last year everyone’s been clamouring for the US job market to soften (read tank). Their job market tanks and oh no…the sky is falling, it’s going to be a recession, suddenly it’s a hard landing… panic…hit the sell button.

So the short version of what (we think) happened. Too much leveraged debt got unwound too fast due to some irrational moves. Same as it ever was.

Slightly longer version; The bad US jobs data sparked recession fears, this led to bigger Fed rate cut expectations and talk of a market recession. This, combined with the Bank of Japan’s surprise rate rise late last week meant the carry trade (see links below on that) was less profitable, so people started to unwind (ie sell) their leveraged positions.

This caused a cascade effect as prices dropped due to all the selling resulting in more people being forced to sell or get liquidated. Then all hell broke loose (read panic) and stuff got real, fast. Probably won’t read that in any economic textbook, but there you go.

Things were slightly worse in crypto because of the age old low liquidity over the weekend conundrum. Banks don’t send cash over the weekends.

In other crypto news Tether may be the most profitable company on the planet, Coinbase revenues have doubled year on year and Circle is likely to value itself at $5bn when it IPO’s.

In macro market news… well it was all about central bank rate differentials, leverage and the 30 year long gravy train that was the Yen carry trade unwinding.

In the US. The FOMC left rates unchanged due to a lack of compelling data. Then the non-farm payrolls report came out and totally spooked the market, and this had global ramifications.

In Europe, inflation and GDP crept up which were both a little surprising. Meanwhile, the Bank of England in a 5/4 decision decided on a rate cut. Over in Russia, inflation is rising at an unhealthy clip.

Regionally, the unintended consequences of Japan’s surprise rate cut played out in a massive way. India’s economy keeps booming while China’s manufacturing contraction continues.

Turning to Australia, they appear to be getting economically weaker. PMI is still in contraction and unemployment is trending up. Soft prices for minerals are affecting their terms of trade. The RBA, possibly benefiting from Monday’s meltdown, held rates steady.

In New Zealand house prices continue their fall, however bad loans appear to be plateauing. Unemployment rose in line with the RBNZ forecast making next week’s monetary policy decision a coin toss.

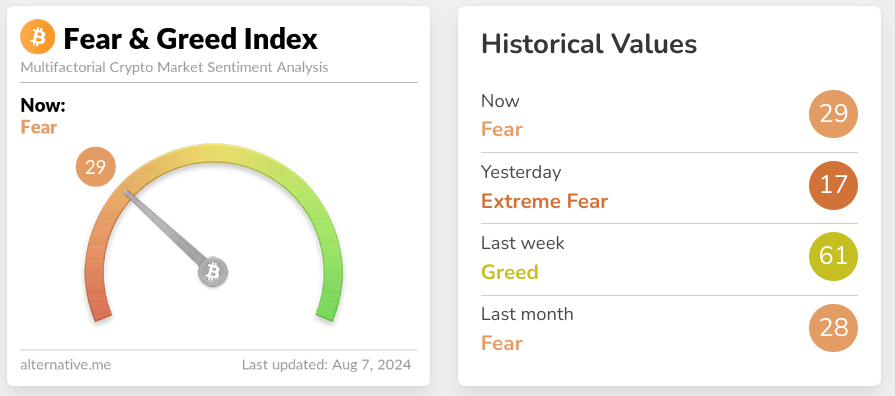

Meltdown Monday radically changed the market sentiment picture with us moving from Greed into extreme fear.

Highlights this week:

- It’s a sea of red in the top 100 assets. Everything lost ground on the 7 day chart.

- Remarkably, our buy/sell ratio on Monday shifted substantially to the buy side, even our data guy had to check the numbers. Then it got even more pronounced on Tuesday when the market stabilised. Talk about buying the dip!

- There was a noticeable shift to the majors with BTC, USDT, ETH and SOL all trading above trend.

- At the time of writing BTC and BNB were both down 14%, SOL and XRP were down 17% while ETH got a shellacking down 25% for the week.

- We didn’t have any gainers this week. It’s that bad.

- Maker (MKR) was our worst performer, down 33%.

View all top gainers: Visit the top gainers page to find out more.

Highlights from the crypto space

Adding to the wider market mayhem, leading market maker Jump trading began dumping crypto like it was carrying the plague. At this point we don’t know why.

Monday’s flash crash caused over $1bn in liquidations.

Milkroad is reporting that global liquidity is on the rise. That’s been a good thing for BTC prices.

Over 70% of the Mt Gox distribution has been paid out, just $2bn left. The Market was shrugging it off like a champ. Then, you know…

USDC issuer Circle is planning its IPO and will likely list at a $5bn valuation. USDT issuer Tether made $5.2bn in profit in Q2… they make our banks look poor.

Coinbase is also having a good ole time, revenues are double what they were last year.

Rumours are swirling that the SEC is looking to shelve allegations that Solana is a security in its Binance case. That could be a big deal.

Which assets have outperformed ETH and SOL this year…and if you read to the end, how much has SOL outperformed the S&P. Interesting reading.

Here’s a report into which blockchains are profitable. There’s an interesting question!

Empire back tested different investment strategies to 1 Jan 23. Some interesting findings. The 60/40/20 BTC ETH SOL portfolio smoked it.

🌎 Macro news TLDR: The carry trade blows up

There’s been some big moves in the currency market since the US jobs data. The massive Yen carry trade is unwinding at a rapid pace.

Things got so bad that circuit breakers that halt trading were activated on the Nikkei and South Korean stock exchanges.

Here is a great video on how the carry trade blew up.

The Magnificent 7 – the largest tech companies in the world – lost $1 trillion in market cap ….Monday.

In the Middle East tensions are higher, although Iran has said it wants to avoid all out war.

U.S. economic news

As widely expected the FOMC left the US rates unchanged, but definitely talked up a September rate cut. They managed expectations saying it would NOT be 50bps. (update… that could well change now).

The ADP jobs report came out softer than expected, a finding supported by the widely watched Non-Farm Payrolls report which was surprisingly weak, coming in at 114k vs an expected 175k.

Unemployment moved from 4.1% to 4.3%. These are big moves and paint a much weaker job market than just last month. The ISM PMI for July reassured markets, coming in at 51.4 vs June’s 48.8.

Over in Europe….

Eurozone inflation for July came in above expectations at 2.6%, the expectation was 2.4%. Core inflation was also elevated. Flash GDP readings for Q2 were also above expectation at 0.3%. Things are picking up! Manufacturing PMI was unchanged in July at 45.8.

The BoE decision on rates was a coin toss, they eventually landed on a 5-4 decision to cut by 25bps to 5%. They are going to be careful going forward. Well that is reassuring.

Russian inflation hit 8.6%, it might be the “special military operation” in Ukraine.

And in Asia Pacific…

The BoJ surprised the market and went for a 15bps rise to its interest rates to get to a policy rate of 0.25%. This is only the 2nd raise in 20 years so it’s a big deal (as we found out).

They also signalled a halving in the bond buying activity. Manufacturing PMI pulled back to 49.1 for July. Following the recession fears in the US, all hell broke loose on the Asian share markets.

China’s official PMI showed a continued contraction in manufacturing and only a slight expansion in services. Conversely India’s manufacturing PMI is holding at 58.1, the cost seems to be inflation.

In Australia, their Manufacturing PMI increased slightly to 47.5. Services also softened but remains in expansion, just. Employment and new orders are all pulling back. The commodity price collapse is affecting their terms of trade too.

On Tuesday the RBA decided to keep interest rates at 4.35% in what was described as a hawkish hold. Monday’s meltdown may have meant they dodged a bullet.

In New Zealand, median house prices continue to fall and are now down16% from the ATH of January 22. Non performing house loans have flattened off.

Lastly, the NZ unemployment rate lifted 0.2 % in the quarter to 4.6% which was inline with the RBNZ forecasts. Wage growth was 4.6% annualised, but stripping out public sector increases was 3.6% which is inline with CPI.

That’s a wrap for this week.

Stay tuned for the next update.

Did you miss the last weekly update?

Share to

Stay curious and informed

Your info will be handled according to our Privacy Policy.

Make sure to follow our Twitter, Instagram, and YouTube channel to stay up-to-date with Easy Crypto!

Also, don’t forget to subscribe to our monthly newsletter to have the latest crypto insights, news, and updates delivered to our inbox.

Disclaimer: Information is current as at the date of publication. This is general information only and is not intended to be advice. Crypto is volatile, carries risk and the value can go up and down. Past performance is not an indicator of future returns. Please do your own research.

Last updated August 7, 2024