Weekly Market Update: Crypto Rebounds on Soft US Jobs Data

In this weekly crypto market update, we take a look at the post halving volatility and its impact on the the overall macro economy. Stay tuned for more updates in the crypto space and other developments from around the world.

The post halving volatility continues to rumble on. This time it was likely driven by last week’s FOMC announcement on US rates. The realisation of a delay to US rate cut seemed to give the market the jitters.

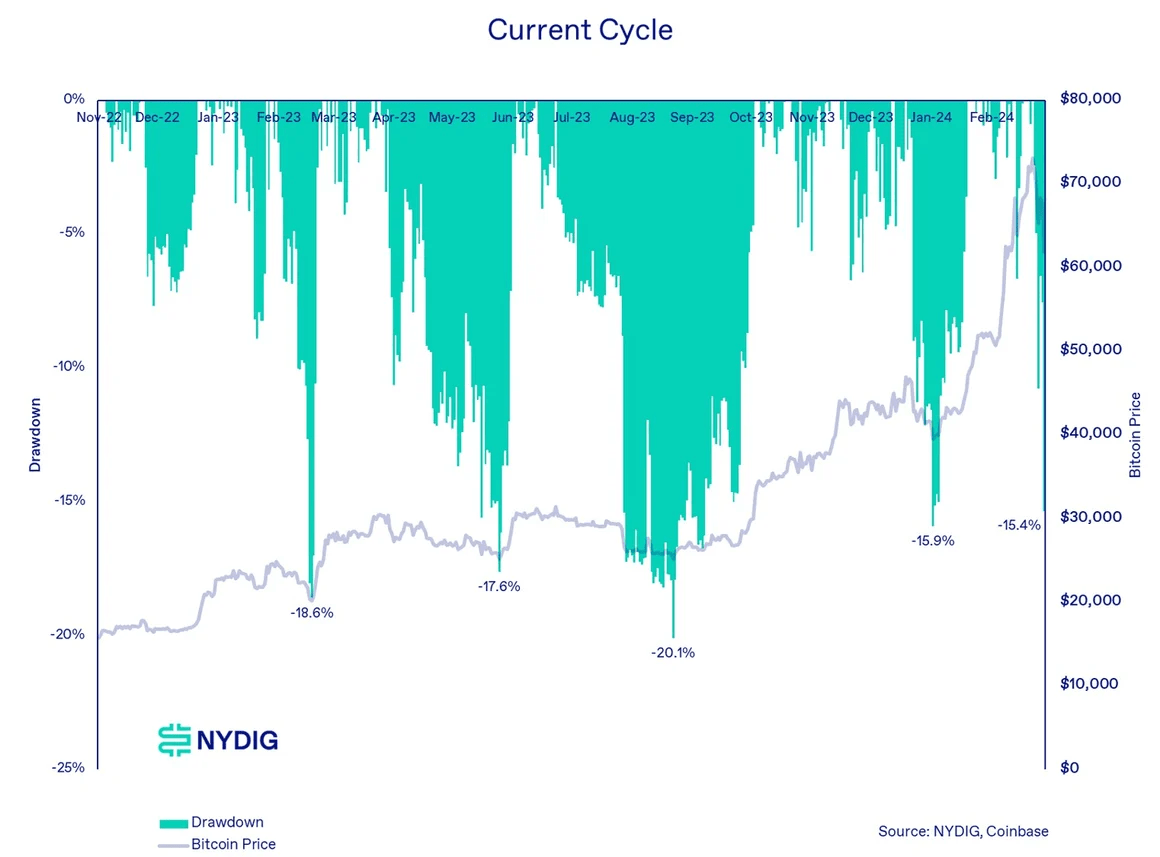

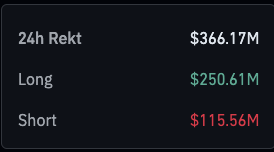

Prices fell with BTC hitting US$57k and the soft hands transferred their BTC to a willing market. We have seen this before with NYDIG pointing out that 20% pullbacks are the norm, not the exception. This caused quite a bit of chaos on the futures market and there were a bunch of liquidations.

In other crypto news, Tether put out their quarterly attestation report. A thing of absolute beauty, some are saying they may be the most profitable company on the planet.

We saw some pretty interesting moves by Vodafone adding wallets to a SIM card, BlackRock’s BUIDL continues to rocket ahead and NEAR protocol is having a great ride at the moment.

In macro news, the risky end of the market was clearly spooked by the Fed rate decision, but got the wind back in its sails pretty quickly when the US jobs data was softer than expected. That market seems to be walking the tightrope of expectations and reality.

In the wider market, it has been a quiet news week. The possibility of a truce in the Middle East has brought some hope to the market, while European manufacturing has rebounded for the 2nd month and India continues to power ahead.

Locally, Australia’s cost of living index came in significantly above inflation. The RBA held rates steady, however it raises its inflation forecasts and was quite hawkish. Finally in NZ, the sluggish economy has meant a lower than expected tax take for the government.

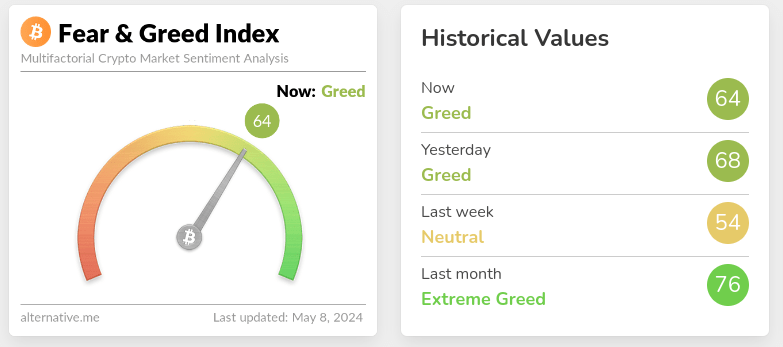

This week’s crypto market sentiment remains unchanged and holds steady in greed territory.

Highlights this week:

- Across the majors, there has been a small, broad based recovery in prices this week.

- Our buy – sell ratio was basically even this week, with Stablecoins being the most popular buy asset and BTC being the most sold coin.

- At the time of writing BTC and ETH were up 6% and 4% respectively. SOL’s rollercoasting continues, up 25% while NEAR had a great week up 21%.

- Render (RNDR) had a great week, up 45%.

- NEO was our worst performer of the week, down 3%.

View all top gainers: Visit the top gainers page to find out more.

Highlights from the crypto space

NYDIG analysis says that the recent BTC price drawdown is nothing out of the ordinary.

The Bitcoin network has processed its billionth transaction. 🎉

The Ethereum validator queue has halved over the last fortnight, down to 5 days to get live.

Staying with Ethereum and ETH, Senators are looking to censure SEC chair Gensler for making misrepresentations about ETH’s status last year while knowing the SEC was investigating it as a security.

Van Eck estimates there is $175bn in Bitcoin, or 15% of supply, held by institutions through ETFs.

Just after the FOMC announcement, crypto prices fell rapidly which resulted in $360m in liquidated positions.

BlackRock’s BUIDL fund grew $70 million last week. Apparently, that is 30% of the tokenised treasury market. BlackRock apparently liked how this went upping its investment in Securitize.

Other notable highlights from the crypto space:

- Tether released their quarterly attestation report. They made $4.52bn in profit….just in Q1.

- The Block will invest 10% of their Gross profit from Bitcoin into… Bitcoin.

- Roger Ver, an early Bitcoin evangelist, has been arrested in Spain for tax evasion and mail fraud.

- It wouldn’t be an update without a SEC story. This time they have served Robinhood with a Wells Notice.

- Rabby Wallet announced gas free signing.

- Near Protocol and its NEAR token are having quite a good run according to Messari Analysis.

- BTC’s founder pleaded guilty to $9bn in money laundering.

- Vodafone UK is adding Crypto wallet to its SIM cards.

- The Australian Tax Office is forcing exchanges to hand over user’s trade details.

And that wraps up our highlights from around the crypto space. Stay tuned below for other macroeconomic updates from around the world.

What is going on in the world of Finance …

🌎 Macro news TLDR: …More conflicting US data

U.S. economic news

A lot of big announcements from the US hit the market late last week. ISM PMI data confirmed last week’s alternate ISM measure; manufacturing is in contraction at 49.2%.

The JOLTS report came out, showing job openings are at their lowest level in 3 years, falling 325k in March. It’s not huge but it’s finally a signal of a softening job market.

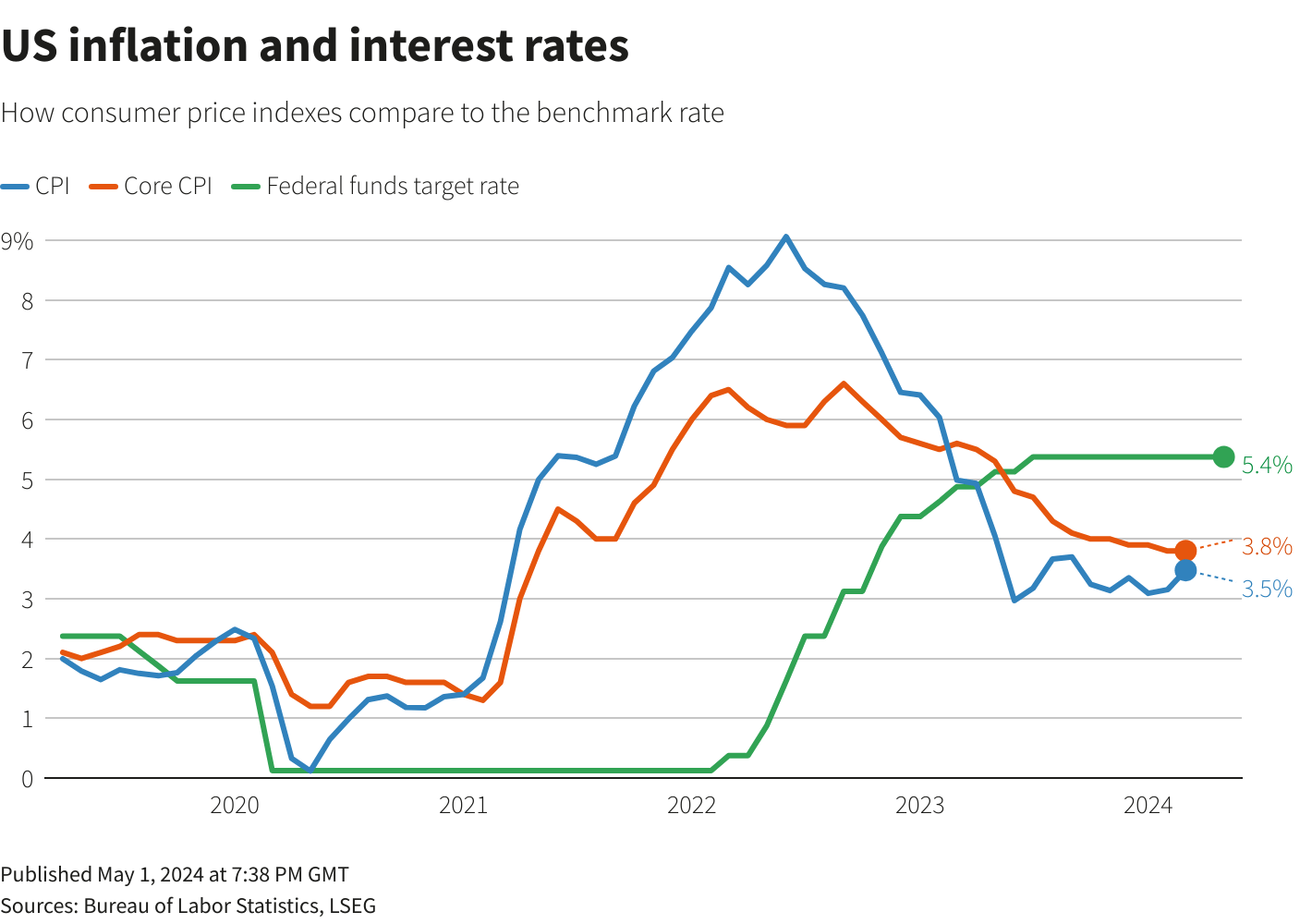

The FOMC spoke and gave the market some insight into the Fed’s thinking on interest rates. They decided to hold rates at 5.25%-5.5%.

They highlighted that the inflation fight had stalled and they will hold the line until they see progress (bad news), but also said that the next move is unlikely to be a rate hike (good news).

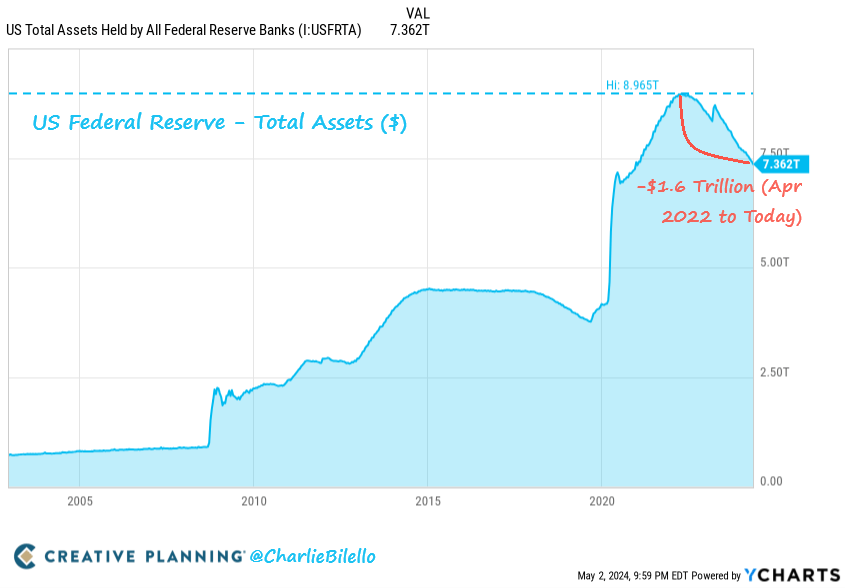

The Fed also signalled an easing of Quantitative Tightening (QT) from $95bn per month to just $60bn.

Meanwhile in Europe….

European manufacturing has returned to expansion hitting 51.7 as their recovery takes hold. Retail sales were up 2% year on year which was a surprise.

And in Asia Pacific…

India’s manufacturing PMI has declined slightly but is still a great 60.7. While Japan’s services PMI surged to 54.3.

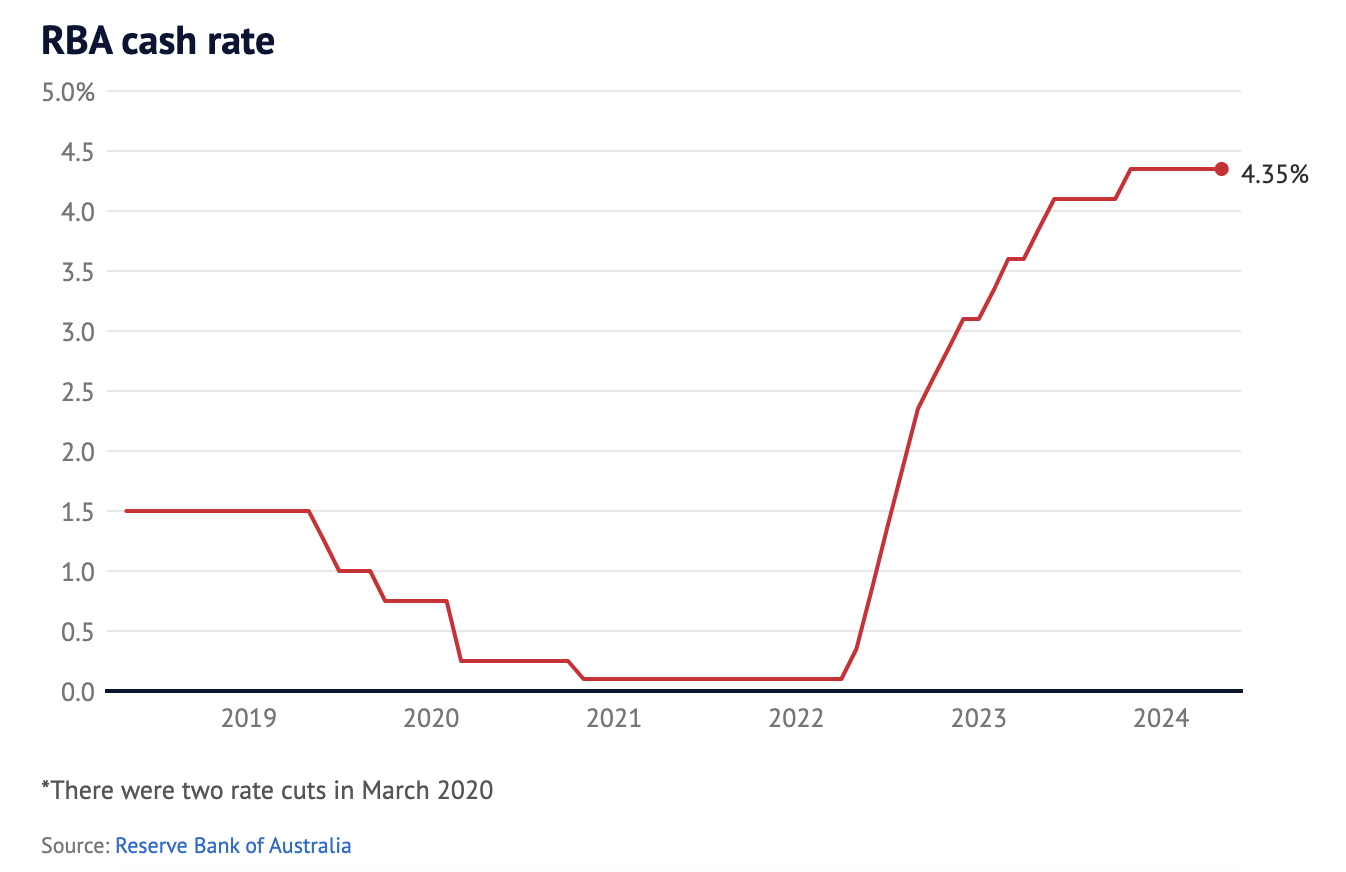

Stats Australia released their version of a living cost index, it came out at 6.5%, way above the CPI of 4.5%. Like NZ it seems mortgage fees are a key driver. Retail sales continue to fall, while job adverts unexpectedly rose indicating a slightly more buoyant market.

The RBA held its OCR steady at 4.35%, however it lifted its forecast inflation rate from 3.8% to 4.1% and struck a clearly hawkish tone. Not good!

In New Zealand, Crown tax revenue for the 9 months to March was down 1.3% or $1.6bn. The tough economic conditions appear to be hitting the corporate tax take.

Meat exports were down 5% due to a big fall in demand from our larger Asian markets. However, the Global Dairy Trade posted a small price increase which was welcome news.

That’s a wrap for this week.

Stay tuned for the next update.

Did you miss the last weekly update?

Share to

Stay curious and informed

Your info will be handled according to our Privacy Policy.

Make sure to follow our Twitter, Instagram, and YouTube channel to stay up-to-date with Easy Crypto!

Also, don’t forget to subscribe to our monthly newsletter to have the latest crypto insights, news, and updates delivered to our inbox.

Disclaimer: Information is current as at the date of publication. This is general information only and is not intended to be advice. Crypto is volatile, carries risk and the value can go up and down. Past performance is not an indicator of future returns. Please do your own research.

Last updated May 8, 2024