Weekly Market Update: Global Tensions Drive Price Dip

In this weekly crypto market update, we take a look at the global rising tensions and how they've impacted the market prices. Stay tuned for more updates in the crypto space and other macro economic developments from around the world.

Well that happened. Crypto analysts have been saying that it’s not unusual to get big price dips leading into the halving due on the 19/20 April. What they weren’t anticipating was a major escalation in the middle eastern conflict. On a weekend. When US residents have to sell crypto to pay taxes due Monday.

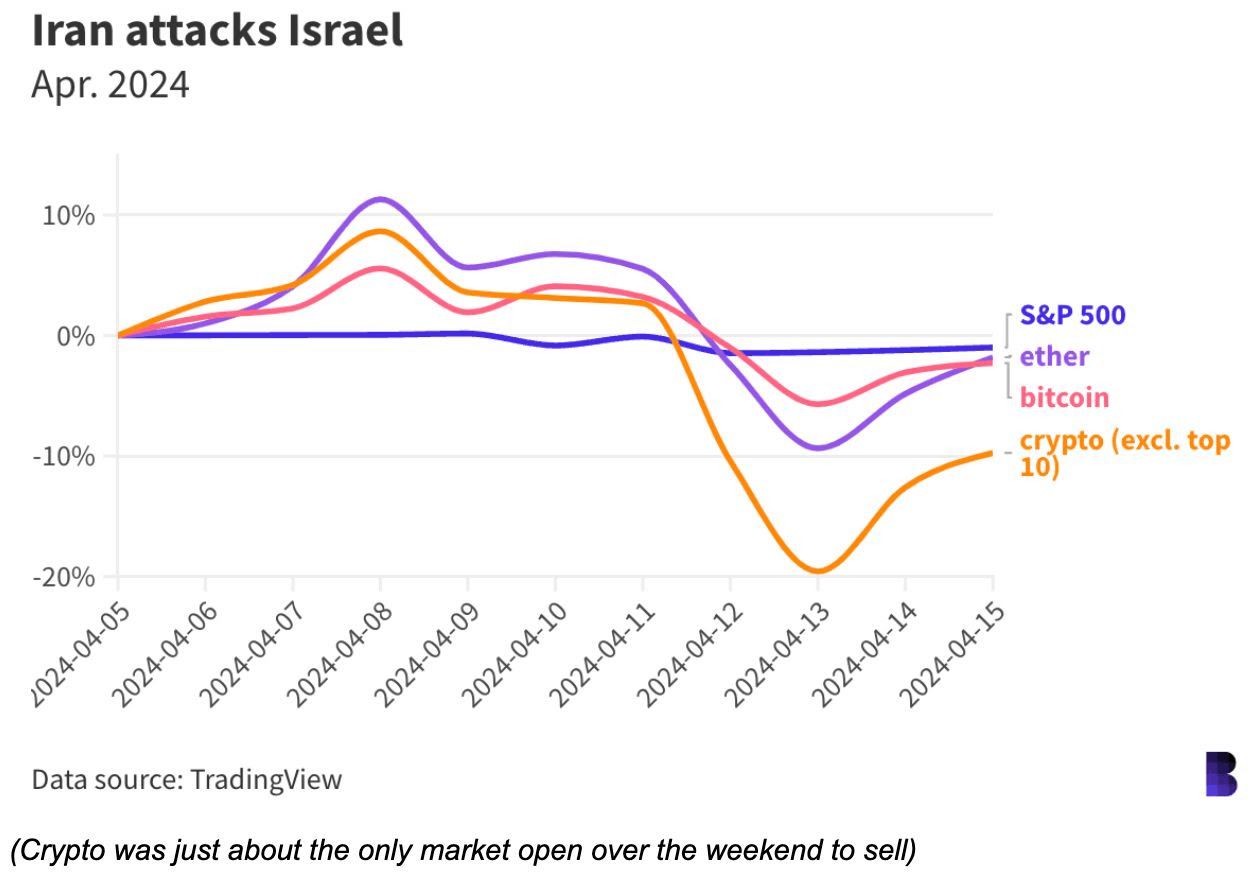

As a result of Iran’s actions, crypto, which trades 24×7 dipped, with Bitcoin falling circa 12% in 12 hours. Altcoins fell even further. Currency markets, conveniently (yes, that is sarcasm) closed for the weekend, struggled as the USD spiked and everything else fell. Traders and OTC desks ended up guessing where the markets would go and wide spreads were the result.

Asset prices have recovered somewhat, but it is clear that the market is jittery. Tradfi, when it eventually came back to work, experienced similar patterns with risk assets down and ‘safe havens’ like the USD and gold up.

However, let’s take a breath and look at this in historical context. This is far from the largest dip in price we have ever had and lower than previous halving dips which were around 30%. Give it time, says the pessimists.

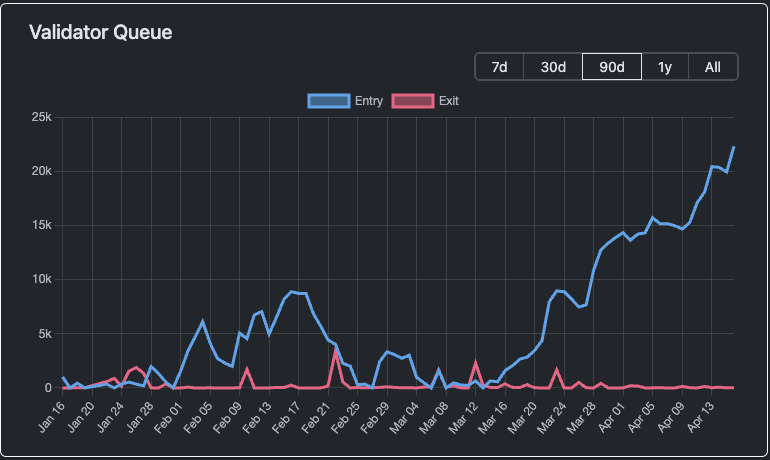

In other big crypto news, there are reports that Hong Kong’s regulator has approved both the Bitcoin and ETH spot ETFs. Which is helpful because the chances of an ETH ETF in the US is sliding out. US regulators took an unwelcome centre stage as Uniswap got served by the SEC and the US congress is debating crypto bills. The entry queue for new Ethereum validators is rocketing up with over 20 000 now lined up.

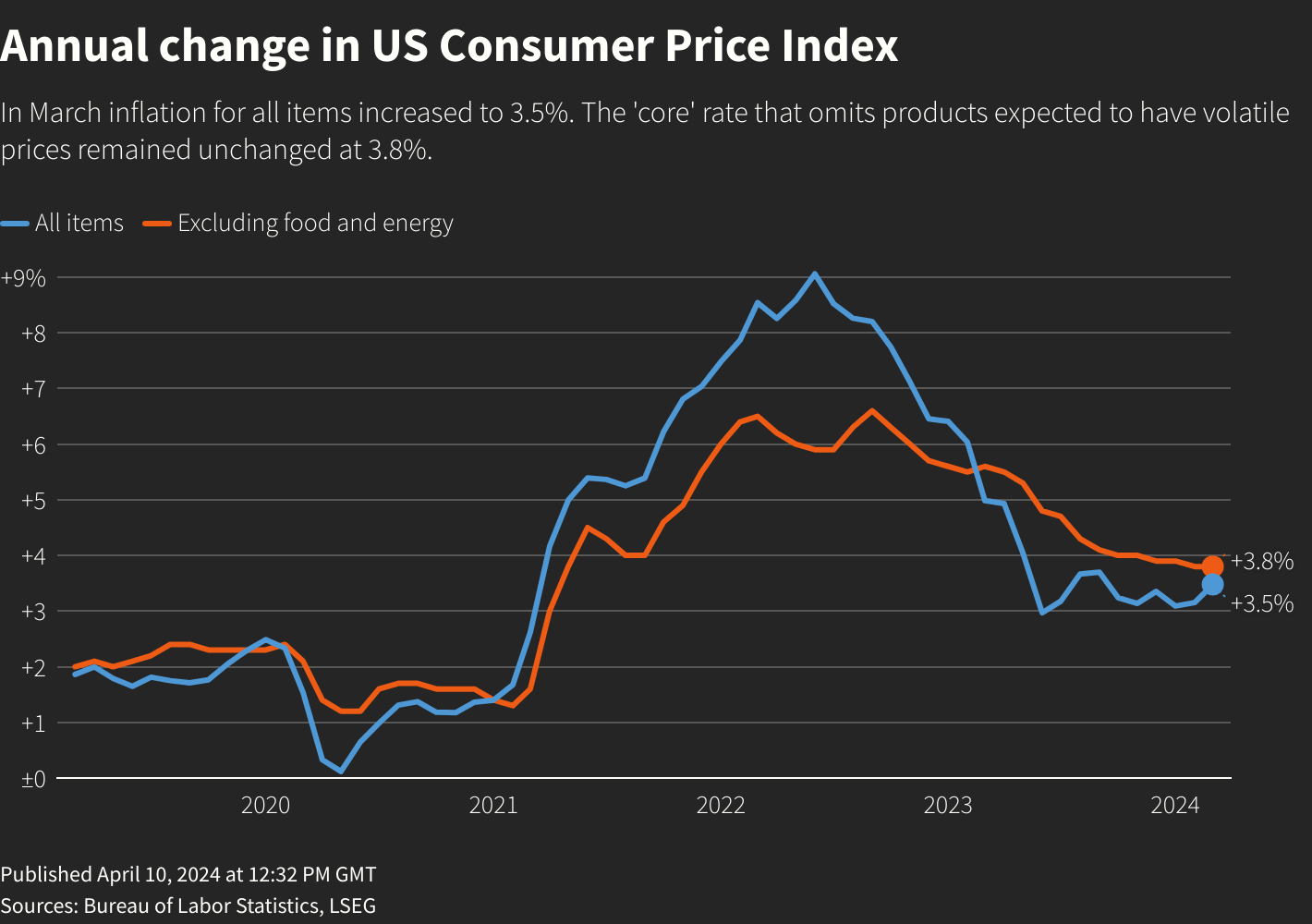

In wider economic news, well there is a lot. Flooding in Russia, plus the actions of Iran have led to higher oil prices. The US CPI news from last week was not great reading, inflation is up and the expectations of rate cuts soon are dwindling. It was no surprise then that Chairman Powell said they aren’t making the progress they want to see this year.

Europe looks like it is finally heading in the right direction with inflation down and industrial production recovering. The ECB appears on a different path now and rate cuts are coming soon. Britain is following suit and may have exited its recession. The Ukraine war appears to be seeing an increase in hostilities. Never let a good crisis go to waste seems to be Russia’s mantra.

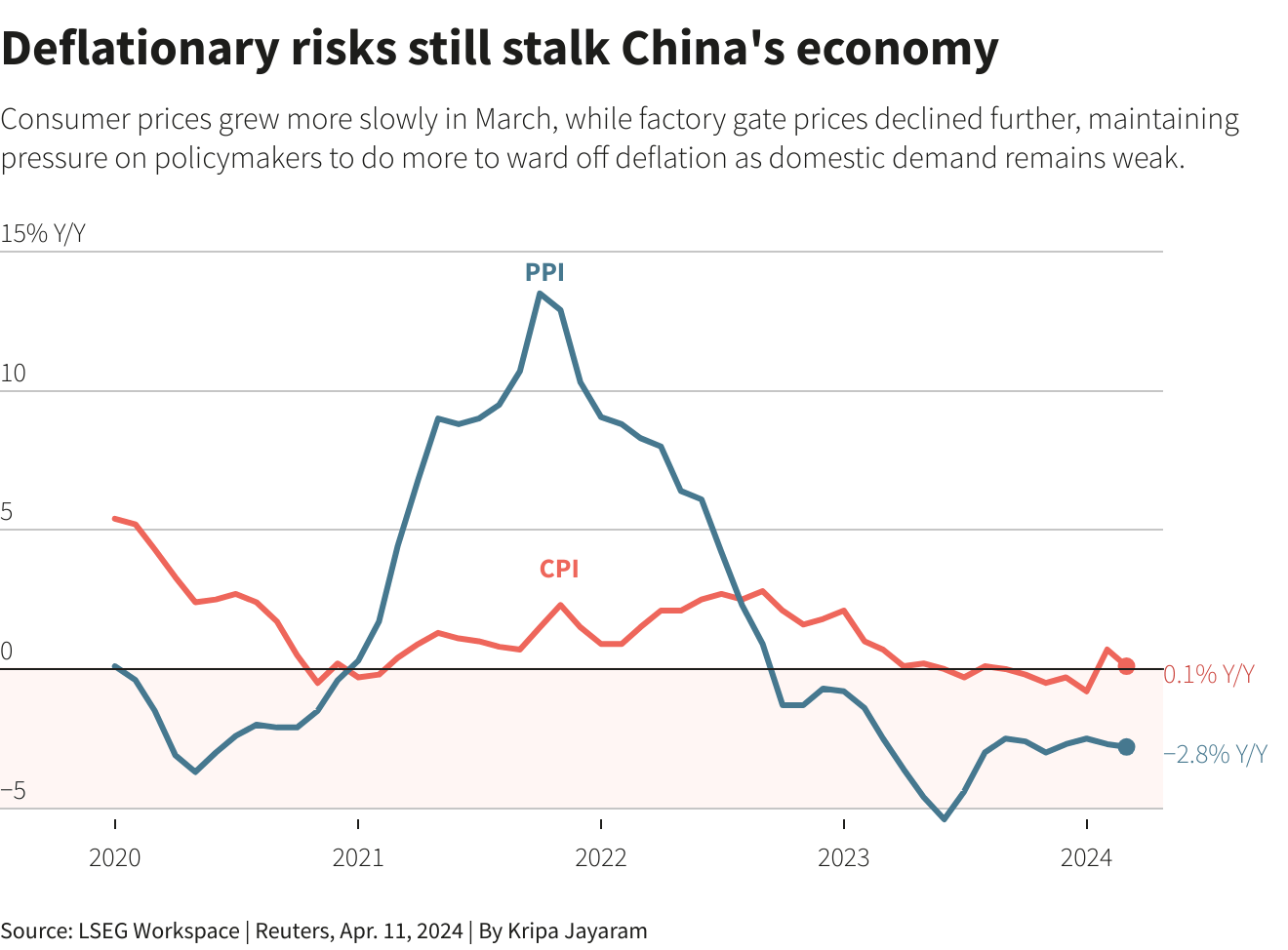

In APAC, China continues to flirt with deflation and suffered a ratings downgrade. Despite that they posted strong YoY GDP numbers. Japan and Taiwan reported strong export growth and India posted a small decrease in its inflation.

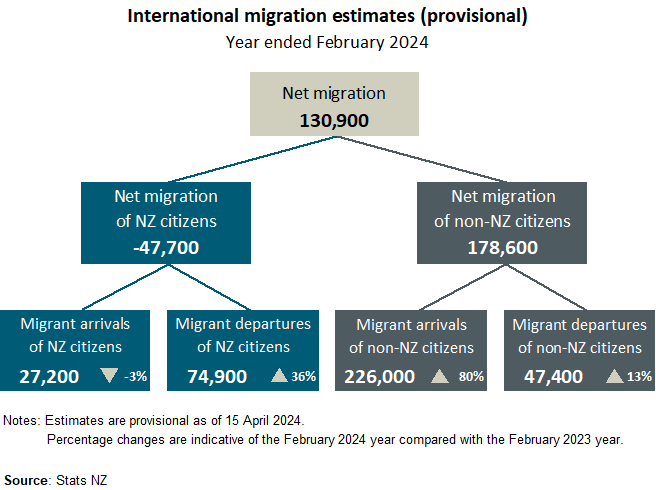

Finally, in New Zealand immigration continues to run hot. Retail spending and services measures were pretty depressed. On the good news front, food inflation was way down and CPI, which was 4.7 in the December quarter, has declined to 4%, although non-tradable domestic inflation remains stubbornly high.

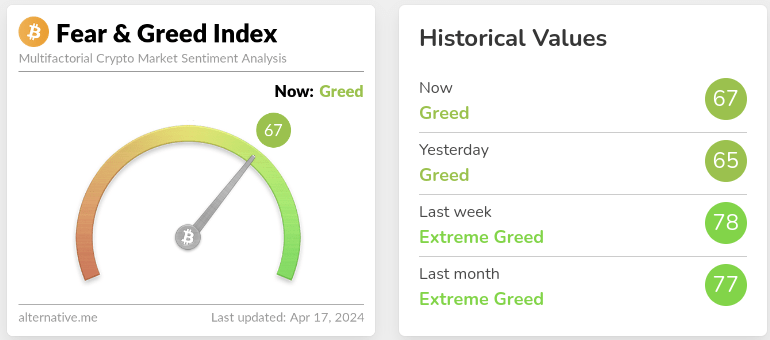

Volatility has marked this week’s price action which can politely be described as a pull back. As such there has been a significant retracement in market sentiment and we are now sitting in lower greed territory.

Highlights this week:

- Across the majors, the trend has been down for everything but stablecoins, the question being how far back has the asset fallen?

- You all appear to have treated the pull back as a buy opportunity, perhaps you were waiting for it? Anyway our buy – sell ratio has heavily skewed to a buy side bias this week with the most bought coins being the top 5 by market cap.

- At the time of writing BTC is down 9%, ETH 13% and SOL 24% respectively.

- Ontology Gas (ONG) bucked the trend and is up 33%.

- On the back of the SEC Wells notice UNI was our worst performing asset this week, down 38%. Other DEX coins like AAVE and dydx are similarly down ~30%.

View all top gainers: Visit the top gainers page to find out more.

Highlights from the crypto space

Blockworks put out a post Monday highlighting the impact of the weekend’s attack by Iran. As crypto trades 24×7, we are often the lead indicator for what will happen in the markets on the US Monday open (hint, they dropped).

Lost in the noise was a quite large move in the currency markets. Unfortunately banks don’t work weekends, so spreads spiked to very large levels while markets guessed where they would land again when markets opened.

Another Blockworks piece is out saying that this BTC halving will be different due to the institutional flows.

Monday was also US tax season, which drives a lot of selling in days prior to cover that obligation.

The weekend’s volatility was just another day in crypto according to old hands.

Something is going on in Ethereum, the validator queue is way up in the last 30 days with 22000 queuing for entry as of today. That is a two week wait list.

Other notable highlights from around the crypto space:

- Solana released a network update to address the congestion problem on the chain.

- Hong Kong approved both Spot BTC and ETH ETFs on Monday. They have not been launched yet.

- The chances of the spot ETH ETF in the US are sliding out as the SEC looks to delay its decision.

- Senator Warren is at it again, asking for more congressional powers over crypto without really understanding it. The US is also looking for congressional oversight of stablecoins.

- Uniswap received a Wells notice from the SEC saying to expect legal action against them for selling unregistered securities.

- Bitcoin ordinals has a potential challenger, Runes is a new fungible token standard.

- Paypal’s PYUSD stablecoin supply has dropped 38% in the last month despite the crypto rally.

And that wraps up our highlights from around the crypto space. Stay tuned below for other macroeconomic updates from around the world.

What is going on in the world of Finance …

Markets have digested the Iranian Israel events of the weekend. Oil prices initially spiked, but have retraced back to $90 a barrel.

The retracement seems to have been led by the news that Iran let the world know it was coming and that the US wouldn’t engage.

The IMF upgraded global growth forecasts stating the global economy was surprisingly resilient.

🌎 Macro news TLDR: …US CPI is increasing.

U.S. economic news

The big news this week was the US CPI coming in hotter than expected. CPI in March rose to 3.5%, above the 3.4% expected and well above February’s 3.2%.

Core CPI was flat at 3.8%, but a dip was expected. All in all not a great picture. Stocks fell immediately on the news, crypto remained resilient. March retail sales were also stronger than expected at 0.7%.

Federal Reserve Chairman Powell spoke today and said they aren’t seeing progress on inflation this year.

Meanwhile in Europe….

EU industrial production is up again in February. The ECB held rates for the 5th straight policy review. It also said they are cutting their own path and not to tie them to the US trends.

Economists are sticking to their views that Eurozone inflation is going to meet the 2% target. ECB Chair Legarde said they are on track for rate cuts soon.

GDP readings for January and February indicate that Britain might be exiting its recession. Wage growth is slowing and unemployment creeping up too. Both good signs for the BoE.

Severe flooding in parts of Russia has meant one of their major oil refineries has had to shut down. Russia has also ramped up hostilities with Ukraine this week.

And in Asia Pacific…

Ratings agency Fitch downgraded China’s ratings and growth chances due to the prolonged property downturn and local government debt challenges.

China continues to flirt with deflation as March CPI fell significantly, PPI is in deflation territory. Annualised CPI is 0.1% currently leading to the calls for more stimulus, the PBOC was unmoved though and held rates.

Chinese exports for March slumped 7.5% on an annualised basis. In something of a surprise, China’s Q1 GDP blew through expectations coming in at 5.3% year on year.

Japan’s producer prices posted a nice 0.2% increase, while Taiwan had a massive surge in exports, which is welcome news. India’s inflation eased to 4.85% in March.

In New Zealand, annual food price inflation continues to fall, coming in at just 0.7% for the year to March. Services PMI fell sharply in March to 47.5, down from 52 in February. Retail spending is up 0.1% for the quarter, which would be well below inflation (estimated at 1%), March’s numbers were well down on February’s numbers. Stats NZ report that net immigration is still running hot.

CPI for the March quarter came in slightly above the recent RBNZ forecasts, but below economist estimates at 0.6% for the quarter and 4% annualised.

Domestic (non-tradable) inflation has stayed persistently high at 1.6% for the quarter or 5.8% annualised driven by housing, utilities, recreation, tobacco and alcohol . Tradable inflation fell from 3% to 1.6% over the same period.

That’s a wrap for this week.

Stay tuned for the next update.

Did you miss the last weekly update?

Share to

Stay curious and informed

Your info will be handled according to our Privacy Policy.

Make sure to follow our Twitter, Instagram, and YouTube channel to stay up-to-date with Easy Crypto!

Also, don’t forget to subscribe to our monthly newsletter to have the latest crypto insights, news, and updates delivered to our inbox.

Disclaimer: Information is current as at the date of publication. This is general information only and is not intended to be advice. Crypto is volatile, carries risk and the value can go up and down. Past performance is not an indicator of future returns. Please do your own research.

Last updated April 17, 2024