Weekly Market Update: The 4th Bitcoin Epoch Commences

In this weekly crypto market update, we take a look at market activities post Bitcoin halving. Stay tuned for more updates in the crypto space and other macro economic developments from around the world.

On Saturday, Bitcoin had its 4th halving event. Like New Year’s Eve, there was a bit of excitement heading in and some people got a bit exuberant about it. And then the next day was a bit flat. This is the pattern of all halvings. This time looks similar although like most things this cycle, we appear to be ahead of the curve so to speak.

In wider crypto news, we got some insight into who has been buying the BTC ETFs and it’s not the big guys…yet. We also got a surprise from the IMF who looked at BTC’s impact on high inflation countries and concluded it was positive. Wow! We have another date for the Mt Gox payout and Ripple returned to serve the SEC by forcibly rebuffing its claims.

In macro news, a cool off in the Middle East means markets are feeling more positive. Oil and cargo prices are declining and there is a slight rebound in the share market going on as risk becomes more tolerable to the markets.

The US story is an inflation one at the minute. The Fed is clearly signalling that inflation is not beaten, and markets are starting to expect higher for longer.

In Europe, June rate cuts are now widely expected and anything else would be a shock which central banks try to avoid. The UK inflation picture is improving, but slower than expected. We have heard that before.

In APAC, Japan’s export economy continues to show solid results, in response the BoJ appears to be flirting with rate rises. Again, we have heard this before. Meanwhile, China’s central bank held its benchmark rates steady.

In Australia, their job market is getting softer as is New Zealand. Both central banks will like this news.

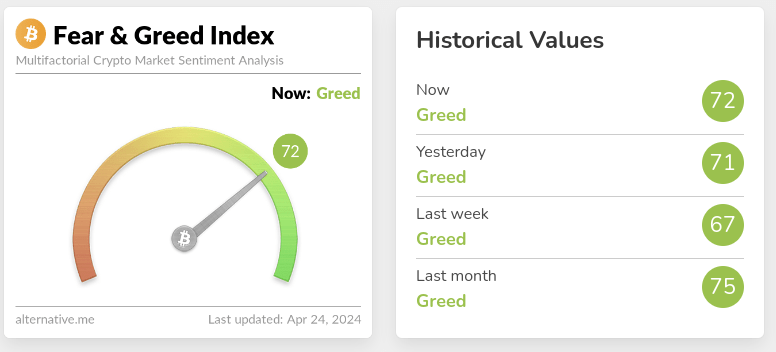

Markets staged a mild recovery after last week’s downwards move. As the movements are relatively subdued, market sentiment has held steady in greed territory.

Highlights this week:

- Across the majors, there has been a broad based recovery in asset prices. As we are now past the BTC halving and things in the Middle East have settled for now, markets seem to be settling back into BAU.

- It appears that you are treating the current price levels as a buyer’s market and we continue to see more of a skew toward the buy side. SOL has been particularly popular this week.

- At the time of writing BTC and ETH are both up 5%, XRP and BNB were up 13% and SOL an impressive 19%.

- Hedera (HBAR) led the pack, up a whopping 58%.

- Maker (MKR) was our biggest decliner this week, down 7%.

View all top gainers: Visit the top gainers page to find out more.

Highlights from the crypto space

Kaiko analysis of the 4th halving illustrates that this time around we have slightly outperformed other halvings. PSA, most of the action happens some time post halving.

The Mt Gox creditors provided an update stating that they intend to payout 142k BTC and 143k BCH this October.

Bitcoin transaction fees briefly soared to $128 following the launch of the Rune protocol, as users hurried to mint digital tokens. That’s more than seven times the average fee rate from the day before and double the previous record set three years ago, bringing miners more profits. However, they have since returned to lower levels now.

The DeFi report breaks down Ethereum’s Q1 performance. Active wallets, a proxy for users , are up 22% in Q1 to 118m, and the token supply is deflating at .38% per year. No surprise DeFi is the major driver of network fees.

The IMF put out a primer on Bitcoin cross border flows. Here is a doozy of a quote .“Bitcoin transactions provide a way for individuals in high-inflation countries to stabilize their savings and participate in global commerce on terms that aren’t possible through their local currencies.”

CoinGecko put out their Q1 2024 report. There are some absolute gems in there, but the narratives piece stood out to this writer.

Tradfi, with its many many rules, has some upsides like the 13f filings which detail who is actually buying the US spot BTC ETFs. TLDR; it’s not the big guys, yet. In other ETF news, Greyscale is launching a new ETF product called the mini BTC ETF with very competitive fees.

Following on from last week’s post about US regulators targeting stablecoins, a new bill has been put forward to ban Algorithmic stablecoins like UST, force them to have cash or cash equivalents and implement AML laws. The UK will issue new Stablecoin and crypto regulation by July.

Ripple rebuffed the SEC claim for $2bn but saying that no case has been proven and requesting a $10m settlement. Staying with the SEC, two lawyers appear to have been forced out over the SEC’s DEBT rebuke for the SECs gross abuse of power.

Other notable updates from around the crypto space:

- Kraken has launched its own Self Custodial wallet.

- One potential reason for the soft BTC price in the last week could be Binance selling $1bn in BTC from its SNAFU fund.

- Circle has built a smart contract that will allow Blackrock BUIDL tokenised fund holders to automatically liquidate to USDC. The big news part of this is that institutions are using smart contracts.

- Optimism (OP) has a big token unlock this week. About 2.5% of supply or $62m will become available.

And that wraps up our highlights from around the crypto space. Stay tuned below for other macroeconomic updates from around the world.

What is going on in the world of Finance …

Container shipping rates continue to slide, but are still up over 50% on last year. Bulk cargo prices are starting to trend upwards again.

Crude oil prices continue to slide as the Middle East looks like it is settling somewhat.

🌎 Macro news TLDR: …Chances of US rate cuts are declining

U.S. economic news

US regional banks are taking on more loss provisions for commercial real estate as non performing loans are increasing.

Fed members are all sticking to the company line, rates are higher for longer and they are waiting on the data.

Later this week we will see the release of the PCE data which will give us another view of US inflation. The outlook for rate cuts has shifted with the chances of no cuts now higher than the chances of 3 cuts.

Meanwhile in Europe….

In Europe, 91 of 97 economists are calling for a June rate cut.

UK CPI fell from 3.4% to 3.2% annualised in March. This was above the 3.1% expected by the BoE. Closely watched elements like Services and Core inflation both fell less than expected too leading to speculation that June rate cuts are less likely to happen.

And in Asia Pacific…

More good news for Japan, they had a 7.3% increase in exports this year. The significant decline in the Yen could force the BoJ to finally raise rates. China’s PBoC held their benchmark rates at 3.45% as expected. Taiwan’s good run continues with exports up 1.2%.

Australia’s job market continues to slowly soften, unemployment ticked up to 3.8%, which was below the 3.9% expected.

Workforce participation also drifted down to 66.6%. A similar pattern is emerging in New Zealand with job ads down 27% year on year.

That’s a wrap for this week. Stay tuned for the next update.

Did you miss the last weekly update?

Share to

Stay curious and informed

Your info will be handled according to our Privacy Policy.

Make sure to follow our Twitter, Instagram, and YouTube channel to stay up-to-date with Easy Crypto!

Also, don’t forget to subscribe to our monthly newsletter to have the latest crypto insights, news, and updates delivered to our inbox.

Disclaimer: Information is current as at the date of publication. This is general information only and is not intended to be advice. Crypto is volatile, carries risk and the value can go up and down. Past performance is not an indicator of future returns. Please do your own research.

Last updated April 24, 2024