Weekly Market Update: Well sideways was boring

This week in the markets has been volatile, with Bitcoin dropping to $53k before rebounding, while crypto remains de-correlated from equities. Read the full story for global macroeconomic developments.

As we say here at EC, it’s been a lolocoaster this week in the markets. Unsure if this is better than sideways but, well, it’s something. BTC got as low as US$53k before rebounding. Crypto is surprisingly de-correlated from equities at present as they are having a good ole time.

In the crypto space the major news revolves around Bloomberg offering up Polymarket data, the FBI warning that North Korea is trying to hack every US exchange and a bunch of action around stablecoins. Other events include Mastercard continuing its foray into the crypto space with a EU partnership and Uniswap getting a tiny slap on the hand from the CFTC.

In macro market news, containerised shipping prices appear to have peaked, Oil prices are falling, and 57 countries signed the first treaty on AI. Finally, don’t mention commercial real estate.

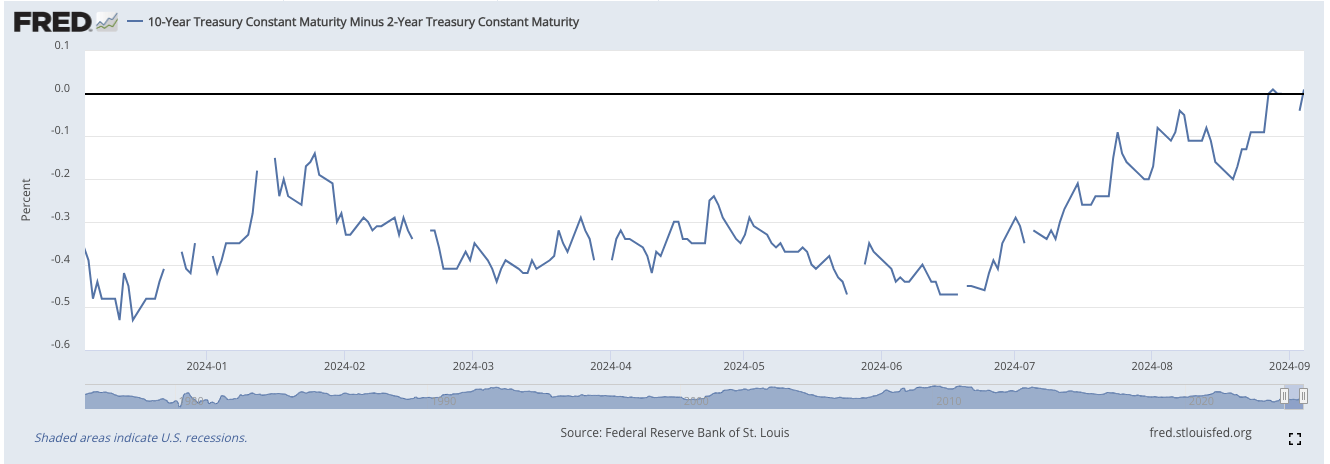

Turning to the US, the much watched jobs data was weak, but not crazily low. The 10/2 year yield curve inverted, which has traditionally been an indicator of recession. Later this week we get their CPI data so expect some action Thursday our time.

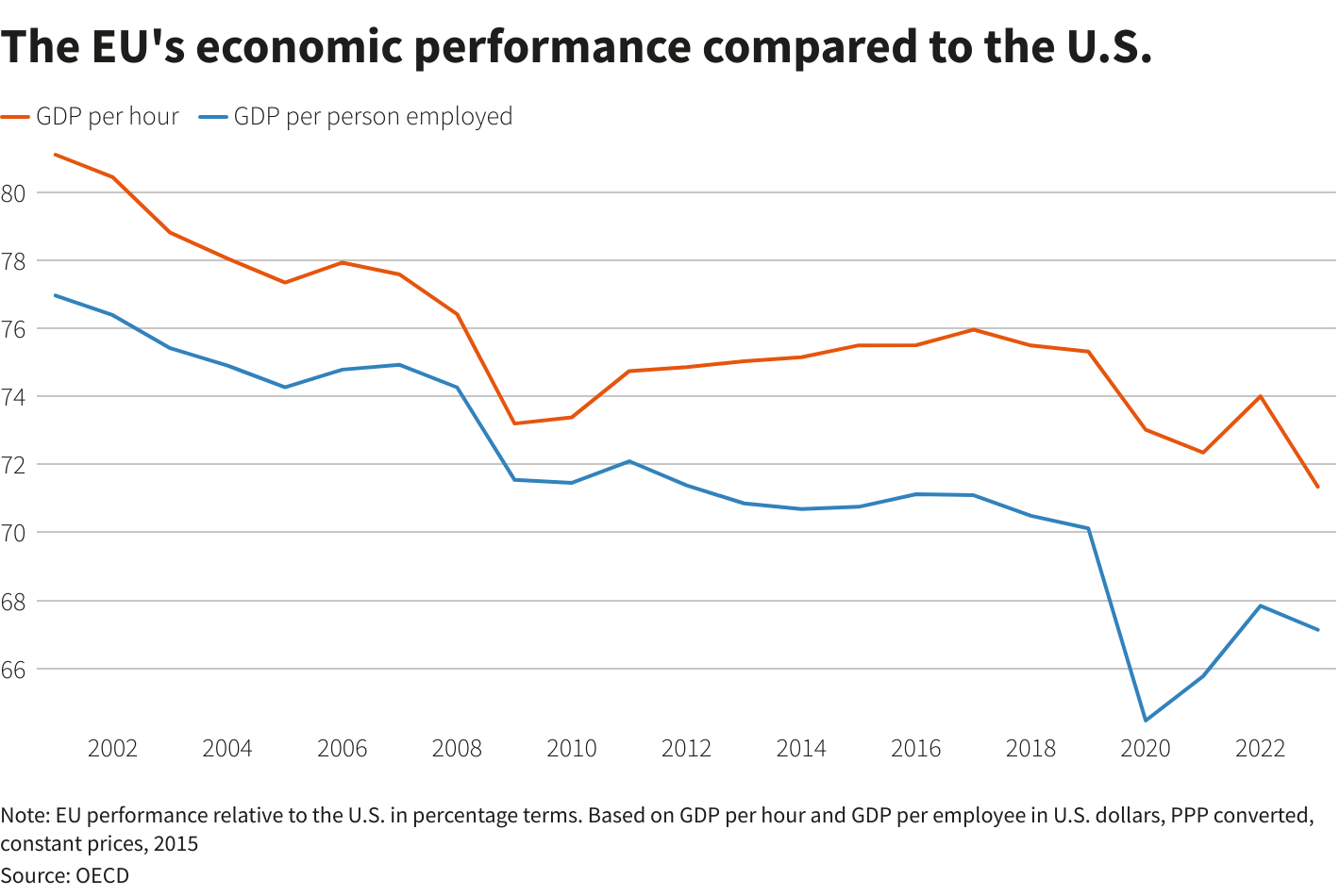

In Europe, calls for major reform of the EU are growing so they can keep up with the US and China. Germany had some good and bad news. New orders are up, but the last year has been dire for manufacturing.

In APAC, China’s CPI was positive but below forecast and another major property developer is ‘in distress’. Japan’s Q2 GDP was positive but below expectations. So was Australia’s GDP. It is becoming clearer that the RBA appears to be fighting inflation induced by central government policies over there.

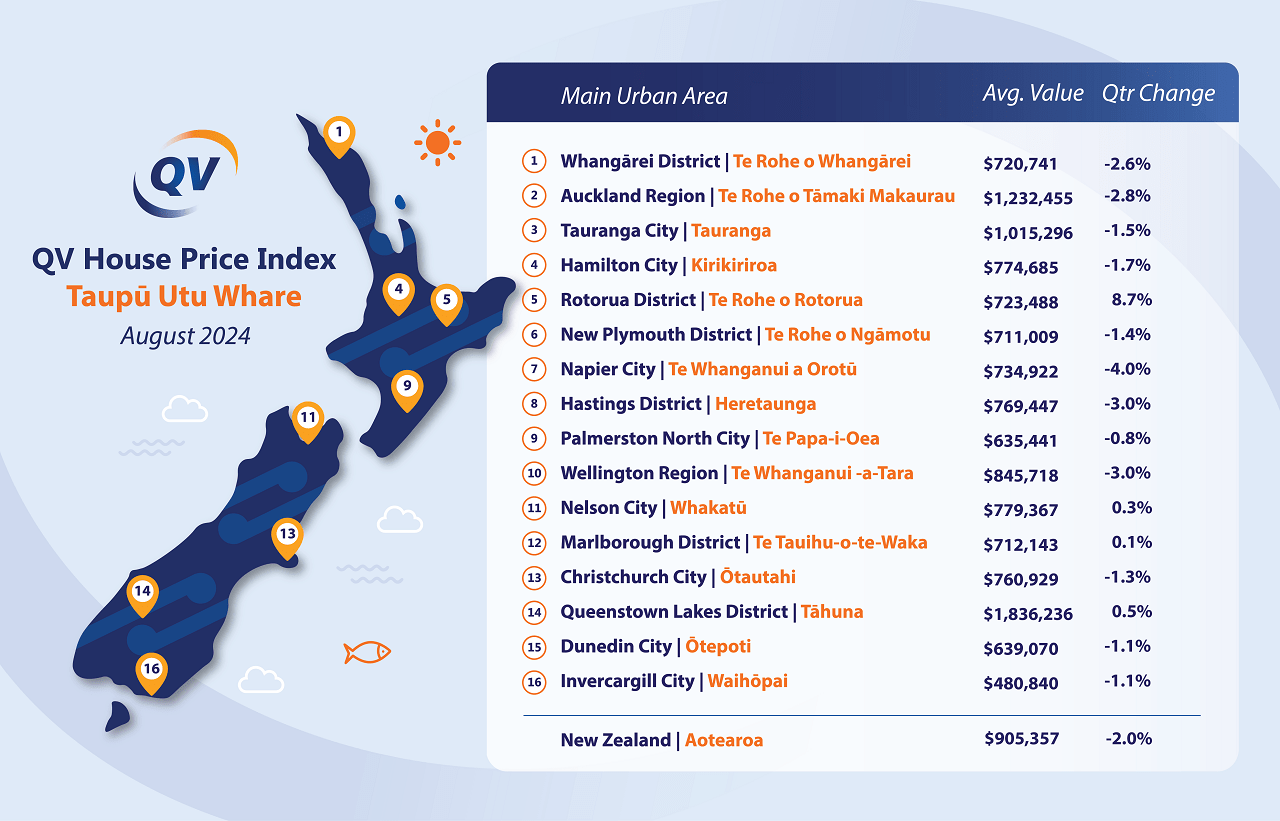

In New Zealand house prices continue to fall with no let up in sight.

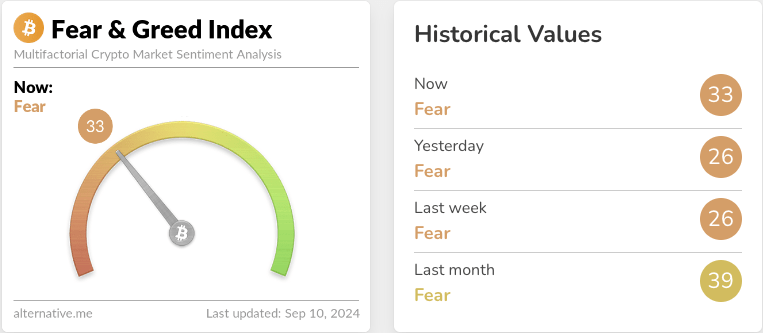

Market sentiment has improved marginally this week, however still remains in fear territory.

Highlights this week:

- A better week for the top 30 assets with ~40% posting gains, not however BTC and ETH!

- Our Buy-Sell ratios showed a significant shift to the buy-side by order value with SOL being our most traded coin.

- SOL, BTC and USDT dominated orders this week.

- At the time of writing, only SOL (+1%) and DOGE (+6%) were up. BTC was down 3%, ETH, XRP down 7%, and BNB was down 1%.

- APE was our best performing asset this week, up 40%.

- MKR was our worst performer, down 9 % this week.

View all top gainers: Visit the top gainers page to find out more.

Highlights from the crypto space

The FBI is warning that North Korean hackers are targeting BTC with social engineering scams. That $57bn honeypot that is the BTC ETFs is quite the target.

Another SEC commissioner has come out saying that they aren’t dealing with digital assets in a good way, and that they should create a form to allow companies to ‘come in the front door’ .

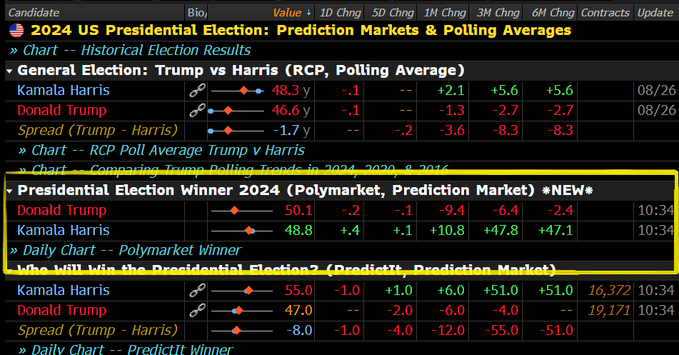

The mainstream-ist of mainstream, Bloomberg’s terminal, now includes Polymarket data. 🤯

People are increasingly questioning Ethereum’s direction and narrative, with the ultrasound money question the lastest.

The CFTC fined Uniswap $125k for illegally offering derivatives. Given the scale of Uniswap this is being seen as a warning shot to DeFi.

Someone has launched a plugin to try and detect rug pulls, it currently has a 60% success rate.

Mastercard, in partnership with Mercuryo have launched a non-custodial debit card for Europe.

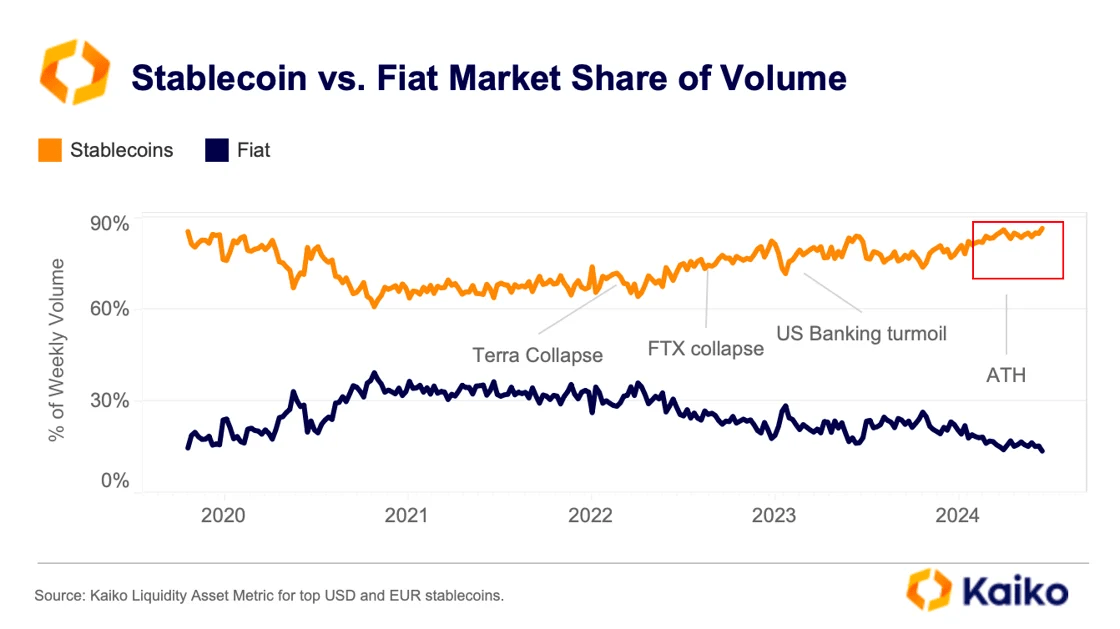

Japan’s 3 major banks are using stablecoins to test cross-border stablecoin transfers. Staying with stablecoins, Tether has acquired nearly 10% of an Argentinian agricultural giant. Finally, Kaiko reports that stablecoin vs fiat volume is at an all time high.

🌎 Macro news TLDR: …Semiconductors are the new battleground

Containerised shipping has come off its July peak but is still up 250% on last year.

The slow global economy and languid oil prices has forced OPEC to delay a planned production rise.

The first international treaty on AI was open for signing this week, 57 countries helped its formation.

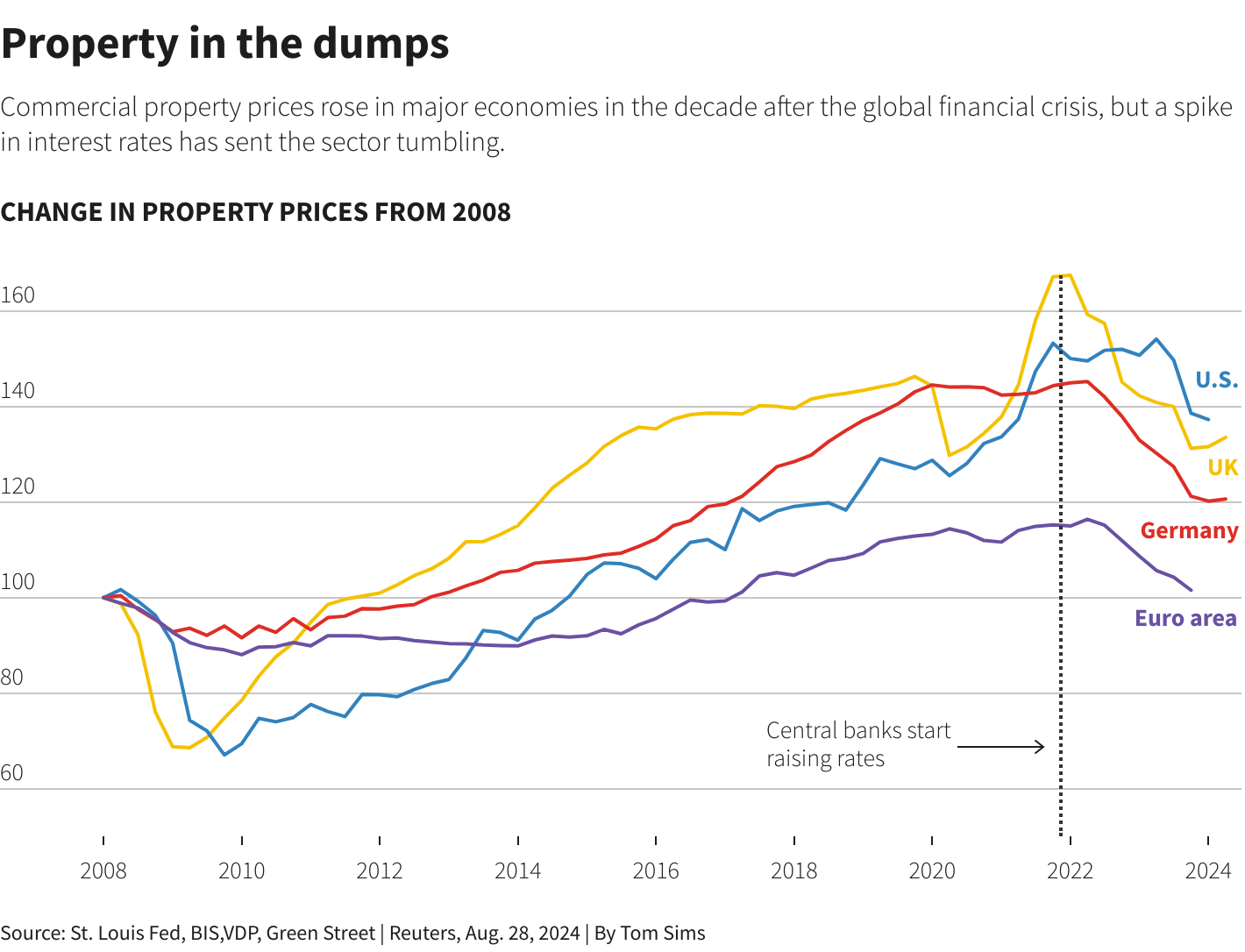

We haven’t discussed commercial real estate for a while. Turns out it’s still getting pummelled by the high interest rates.

U.S. economic news

This week it’s all about the jobs market with the Non-Farm payroll report due out and being seen as the last data point to inform the Fed’s rate cut. With this in mind US job openings (JOLTS) for July unexpectedly fell, and ADP jobs data was well down on expected, all pointing to a softer job market.

This was confirmed over the weekend with jobs growth of 142k added in August, below the 160k expected . The 10yr/2yr yield curve inverted, this is normally a harbinger of a recession.

Later this week we get the US CPI data so the markets are a little tame at present.

Over in Europe….

EU retail trade for July was up; the 4th rise in 6 months. The former ECB head, Mario Dragi, has said the EU needs a more coordinated industrial approach, faster decision making and massive investment if it wants to keep up with the US (and China).

New factory orders in Germany were up 2.9% in July, surprising many. Germany has made a massive shift in its energy production since the Russian invasion, and now gets 60% from renewables and is on-shoring production at a massive rate.

Wonder if the NZ government is watching? Finally, German industrial production fell in July vs June and was down 5.3% on a year ago.

And in Asia Pacific…

According to Caxin, China’s services PMI declined to 51.6 in August. China’s CPI for August rose 0.6%, slightly less than expected.

Producer prices fell 1.8% for the year which is a worrying sign. Another major Chinese property developer is in big trouble. Wages in Japan rose 3.6% for the year (above CPI), and Q2 GDP was just shy of expectations at 0.7%.

Australia’s Q2 GDP was up 0.2% or 1.5% for the year. The Q2 number was below expectations and, worryingly for the RBA, most of the growth came from government spending, not households.

TLDR the RBA is fighting the government on inflation. Right on queue, the RBA governor said it’s premature to be talking rate cuts.

In NZ, house prices continue to fall. Down 2% in August and there may be an oversupply of listings keeping that trend going.

That’s a wrap for this week.

Stay tuned for the next update.

Did you miss the last weekly update?

Share to

Stay curious and informed

Your info will be handled according to our Privacy Policy.

Make sure to follow our Twitter, Instagram, and YouTube channel to stay up-to-date with Easy Crypto!

Also, don’t forget to subscribe to our monthly newsletter to have the latest crypto insights, news, and updates delivered to our inbox.

Disclaimer: Information is current as at the date of publication. This is general information only and is not intended to be advice. Crypto is volatile, carries risk and the value can go up and down. Past performance is not an indicator of future returns. Please do your own research.

Last updated September 10, 2024