What is Hedera Hashgraph (HBAR)?

Meet Hedera (HBAR), a distributed ledger technology that uses hashgraph, not blockchain. So, what is Hedera? Read more about it.

Blockchain is cool, but have you ever heard of hashgraph? This unique technology could potentially beat blockchain in terms of scalability, security, and speed. Hashgraph technology successfully gains worldwide business adoption, catered by Hedera Hashgraph.

Hedera Hashgraph is a platform on which decentralised applications (DApps) can be built. On this platform, the cryptocurrency Hbar is used. HBAR functions as a store of value, medium of exchange, processing incentive (or transaction ‘fuel’) and for staking, for higher security.

Key takeaways:

- Created a computer scientist, Leemon Baird, and technology executive, Mance Harmon – Hedera is essentially serves as a platform which anyone can deploy dapps and facilitate secure and fast transactions on a network that is monitored by Hedera’s proprietary software.

- Hedera’s main features and services provide users the facility to transfer value, creation of dapps and smart contracts, file services and management, and consensus service for the network itself.

- Since its original creation Hedera Hashgraph has now forged partnerships and built trust with notable industries including Boeing, IBM, LG, and the University College of London (UCL).

New to crypto? Start here to master the fundamentals.

What is Hedera Hashgraph and why is it special?

Hedera Hashgraph has many similarities with Ethereum. Both networks are a decentralised network of computers that processes and stores data without relying on servers owned by a single organization. Both networks can run smart contracts, which are special computer programmes that can facilitate conditional transactions.

The difference between Hedera Hashgraph and Ethereum (and many of the ‘third generation’ decentralised platforms) is that Hedera Hashgraph is not powered by blockchain technology.

Rather, it uses something called a hashgraph. This is a special type of ledger that records all communications between computer nodes such that all transactions are auditable, immutable, and outstandingly fast.

Related: Click here to read more about smart contracts.

The Hashgraph technology

This technology is the reason why Hedera Hashgraph can provide so much bandwidth compared to the more ‘traditional’ blockchains, such as Bitcoin and Ethereum.

The network is able to process up to 10,000 transactions per second, and is able to achieve finality within 3 to 5 seconds (compared to 10 minutes on Bitcoin, and a few minutes on Ethereum).

It’s not just speed that the hashgraph protocol can offer, though. The resulting bandwidth that is achieved can potentially drive the transaction fee down to about US $0.0001 per transaction on average.

In terms of security, Hedera Hashgrah has been proven mathematically to attain the highest form of distributed cryptographic network security called the Asynchronous Byzantine Fault Tolerance (ABFT), more so than traditional proof-of-work networks that can experience a 51% attack.

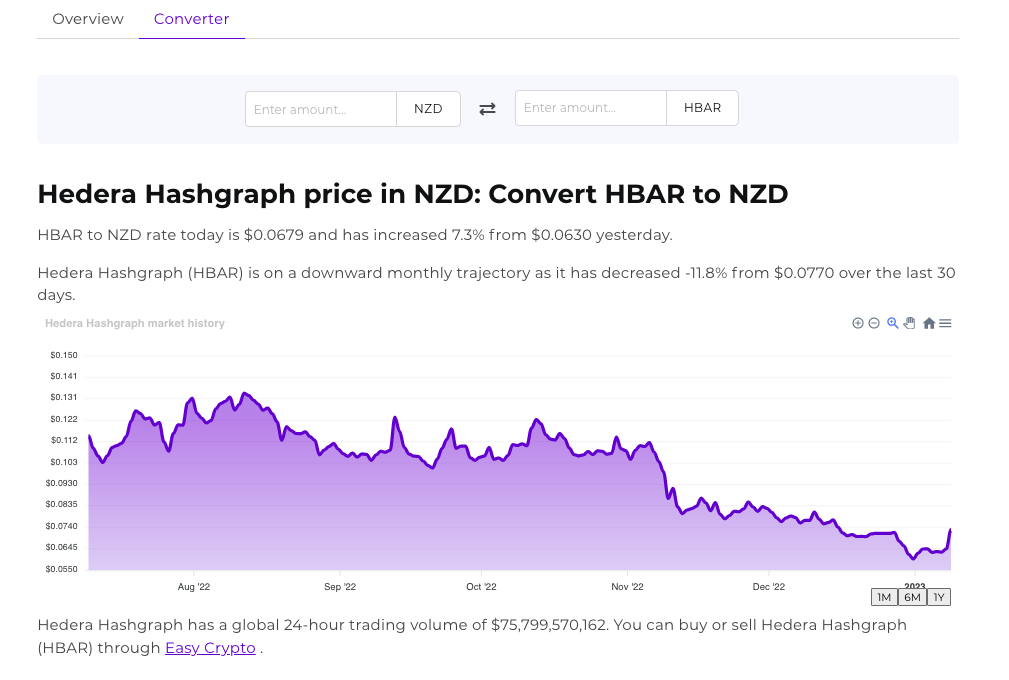

How much for HBAR? Check the latest rates for HBAR with the crypto converter tool.

How does Hedera Hashgraph work?

The hashgraph protocol was invented by Dr. Leemon Baird, who is also Co-founder and Chief Scientist of the Hedera Foundation. It works completely differently from a blockchain.

With blockchain, only one random node gets chosen to validate, process, and write the ledger history (creating the next block) at a point in time, whether chosen through proof-of-work or proof-of-stake consensus algorithms, or some variant of it.

With hashgraph, nodes reach a consensus even if all the nodes validate and process transactions simultaneously.

Here is how Hedera Hashgraph works:

- All nodes communicate with each other simultaneously, sending a message about a transaction to a random neighboring node.

- The neighbor will then relay the message to another node, while the first node sends the same message to another node.

- After a few more cycles of broadcasting and relaying, the number of nodes who receive the message will increase exponentially until all nodes in the network have the same message.

- Now, each node will receive the message at different times. The ‘official’ timestamp that goes into the ledger will be determined by the median timestamp of a particular message.

- Because the median time will always be a single value regardless of which node calculates it, all the nodes can come to a consensus on the order of the message or data within the ledger.

This algorithm is also known as “gossip about gossip”, because every node sends messages (to gossip) until all nodes know the latest ‘gossip’ about a new transaction — and this state of ‘gossip’ is also recorded and processed until a single consensus is reached.

Who keeps Hedera Hashgraph secure and well-developed?

Currently, Hedera Hashgraph is sort of a mix between a centralised and distributed network, with permissioned processes. In other words, up to 39 organisations and enterprises govern the way the network develops.

This is because Hedera has a different approach in its roadmap compared to Ethereum. Hedera was designed for enterprises, while Ethereum has always been the playground for a more anarchic economic system that has little regards to national regulations.

Of course, Hedera is not owned by one company, but several well-known leaders in technology, academia, and many more of the 11 unique sectors and non-profits that have a place in the Hedera Governing Council.

These organisations include IBM, Google, Boeing, LG, and Deutsche Telekom. Each of them have the same voting power on the developmental plan of the codebase, to avoid forking, and to expand the limits of the hashgraph to new horizons.

“We believe Hedera could help provide an interesting way to enhance and simplify the deployment of Hyperledger Fabric in the enterprise, making it easier for groups to build and grow their networks, ”

Jerry Cuomo, Vice President of Blockchain Technologies at IBM.

As a distributed ledger technology, Hedera is transitioning from its current form to become a more decentralised platform. On its next milestone, Hedera will allow proxy staking to exponentially increase its network security.

What can HBAR be used for?

HBAR is the native cryptocurrency on the Hedera Hashgraph network. There is a supply limit of 50 billion HBAR, with 8.26 billion of them in circulation, at the time of writing.

The other HBARs have been pre-mined, and in possession of the current stakeholders who keep the network secure and well-governed, but some portions are also kept in the Hedera treasury for future staking rewards.

Like Ether, HBAR is used as payment for processing transactions. This means developers and users must have HBAR in some excess when using DApps on Hedera, so that transactions can be processed. However, users shouldn’t worry too much about the transaction fees.

As mentioned before, it costs less than a US cent to work on the most common forms of data processing.

What are some use cases of Hedera Hashgraph?

The multitude of use cases and real world value provided by Hedera is the reason why the network is so undervalued, and why investing in HBAR may be a great idea.

Hedera is currently ‘home’ to more than 50 decentralised applications that are more than just for decentralised finance (DeFi).

Hedera Hashgraph offers a place for these operational DApps to give various sectors a technological edge:

- Entrust, Australia’s full-service agricultural supply platform.

- The Chopra Foundation, a platform to democratise access to support for mental and emotional wellness.

- AdsDax, a transparent advertising platform that cuts fraudulent middlemen in the industry.

- Earthtile, a platform that incentivises ecological stewardship at a planetary scale.

- Hala Systems, a platform that protects civilian assets in areas of conflict.

A full list of all the DApps that run on Hedera Hashgraph can be found here.

Final thoughts on Hedera Hashgraph

When I got into the crypto industry, I was initially uninterested in Hedera Hashgraph (HBAR) because it’s not even in the top 20 list of biggest cryptocurrencies by market capitalisation.

However, I’ve come to realise that market capitalisation isn’t always the best measurement of quality in a crypto project. If you are a short-term investor, it may be the case, as higher market cap assets are less likely to be volatile.

Although its market cap is far less than that of the Ethereum-alternative coins, like Cardano and Polkadot, this doesn’t mean that it can’t derive value from elsewhere — and finding value in places where other people haven’t looked is a valuable skill to have.

This is not investment advice. Although as a writer and researcher in the crypto space, I find Hedera Hashgraph to be valuable, perhaps for a long-term investment, due to the sheer number of use-cases, corporate support of the network, and its sustainable design.

As a stock investor myself, I do not mind investing in a partially centralised asset, so long as I know that the asset will at least retain its value. After all, I’m not interested in 10x or 100x crypto assets that could make me a millionaire.

Of course, it is all up to you to do your own research and decide for yourself.

The future of Hedera Hashgraph

Although the rise of the HBAR/USD pair has not been as phenomenal as ADA/USD or some other altcoins, HBAR has so much potential. Just like Cardano (ADA), the network effects for HBAR may not be so great now — being the top 50 cryptocurrency in terms of market capitalization.

However, once more projects are being built on Hedera, and once people realise that HBAR is truly a ‘green’ cryptocurrency that uses a fraction of the power that international banks use, then other investors may likely to get on board.

The trick is, of course, to invest in this network before it becomes more popular.

How to buy Hedera Hashgraph (HBAR) in New Zealand

It’s safe to say that Hedera Hashgraph has its place in the crypto space. And considering its utilitarian function, corporate support for the network, and sustainability – it’s definitely an asset that is worth considering to add to your crypto portfolio.

Add HBAR to your portfolio: Click here to buy Hedera Hashgraph.

At Easy Crypto, we make it easy for anyone to add Hedera Hashgraph (HBAR) to their portfolio. All you need is to sign up and have a crypto wallet ready to receive the funds once your buy order is complete.

With Easy Crypto you’ll get competitive rates for HBAR, as well as any other 160+ cryptocurrencies that we offer.

Check the latest rates: Use our crypto converter tool to check the latest rates for HBAR/NZD.

Pro tip: you can preview the conversion rates for any crypto in our collection by going to our complete list of crypto assets.

Also, checkout our video guide below on how to buy cryptocurencies with Easy Crypto:

For more topics on all things crypto explore the articles on our learning hub at Easy Crypto.

Share to

Stay curious and informed

Your info will be handled according to our Privacy Policy.

Make sure to follow our Facebook, Twitter, Instagram, and YouTube channel to stay up-to-date with Easy Crypto!

Also, don’t forget to subscribe to our monthly newsletter to have the latest crypto insights, news, and updates delivered to our inbox.

Disclaimer: Information is current as at the date of publication. This is general information only and is not intended to be advice. Crypto is volatile, carries risk and the value can go up and down. Past performance is not an indicator of future returns. Please do your own research.

Last updated January 25, 2023