Robinhood to Release Crypto Wallet: What It Could Mean for Crypto

binhood announced that they will launch a cryptocurrency wallet. What will this mean for the crypto market?

Robinhood announced on Sunday, 2 January, that they will launch a beta version of their highly anticipated cryptocurrency wallet, which is built into their trading app. The company first announced the start of their crypto wallet project in September 2021.

This will allow US-based users to buy and sell cryptocurrencies as they would stocks, options, and futures on the retail brokerage app.

About 1.6 million people have signed up for its crypto wallet, which is undergoing continuous testing. This signifies an extreme interest among retail traders to leverage the app to trade more risky and volatile assets.

The trading platform noted that testing is still required to understand the users’ needs better. “While some say 2021 is the year that crypto went mainstream, the truth is that most people are still familiarizing themselves with the asset class and how to navigate the blockchain,” the company noted.

What is Robinhood?

Robinhood is a retail brokerage based in Menlo Park, California, that provides access to stock, options, exchange-traded funds (ETFs), and more recently cryptocurrencies.

Unlike exchanges such as Coinbase and Binance, Robinhood has been offering direct access to digital currencies, to be stored in users’ own private wallets. The brokerage currently only accepts applicants from the United States.

Robinhood made headlines in early 2021, which made Wall Street turn their heads onto the newcomer in the financial markets.

The GameStop drama

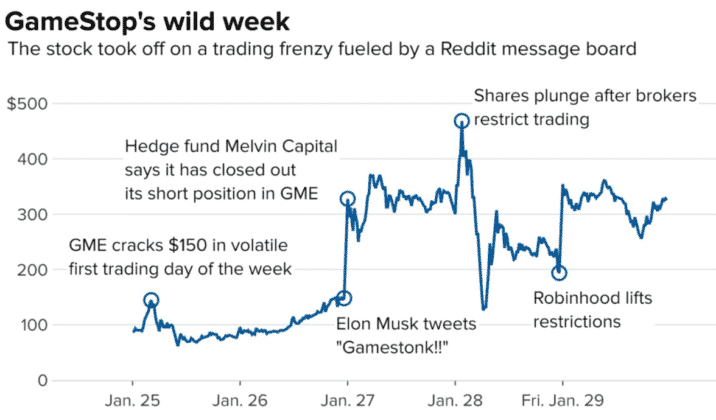

Robinhood traders have been responsible for “pumping” the price of GameStop shares up by more than 1500% in less than a month. Each share of the bankrupt brick-and-mortar game store was valued at $19 at the market open in January, and closed at $325. The mania had kicked its price up to a monthly high of $483.

Behind this market manipulation is a band of amateur traders on Reddit on the subforum WallStreetBets, whose purpose was “to punish short-sellers, and for the little guys to pummel Wall Street.”

Short-sellers are those who make a profit by borrowing and selling underperforming assets. Short-selling is not available on most retail trading platforms, but it is a daily operation for many high-capital fund managers.

We can discuss why retail traders feel that this mania is justified in another article. Suffice to say, though, Robinhood also suffered from the meme-fueled emotional trading.

The platform imposed a limit on buying the GameStop stock, and even completely banned it at one point. “In order to protect the firm and protect our customers we had to limit buying in these stocks,” Robinhood CEO Vlad Tenev told CNBC.

Of course, this made a lot of retail traders unhappy. One of the app users tweeted, “Individual investors are being stripped of their ability to trade on @RobinhoodApp. Meanwhile hedge funds and institutional investors can continue to trade as normal.”

The power of retail trading

Let’s take a step back from the drama. Take a look at the bigger picture: the surprising power of retail trading. For a long time, institutional traders are the ones who can significantly move the prices in the market.

This is because they can send large quantities of money into the market or from the market. There is no denying that retail traders, when their interests and behaviours are collectively synchronised, can completely overwhelm institutional traders.

But just how often does this occur? Research by Jeremy Michels from Wharton School shows that retail traders have the power to move the market, but in a different way compared to more professional ones.

Michels aggregated data on Robinhood traders’ activity and compared that to the stock price at the time of earnings announcement for a given company.

He saw that Robinhood traders are highly reactive to earnings announcements, though not necessarily to the content of the announcement itself. This suggests that the price movement is most likely caused by “attention-induced trade”.

Michels concluded, “Overall, the results are most consistent with retail traders responding to the visibility provided by more extreme earnings surprises instead of the information content of earnings.”

The research doesn’t imply that retail traders are increasingly overwhelming institutional traders. However, attention-induced trade is such a common phenomenon that in the stock market, it introduces so much ‘noise’ and enhances volatility.

What it means for the crypto market

Note that there is no ‘good’ or ‘bad’ consequence in allowing many more retail traders to hop into a nascent and immature market such as the crypto market.

More access to the crypto market (such as Robinhood providing a crypto wallet) will result in more capital flow into the market. This could raise the price of crypto assets, at the benefit of long-term investors.

Also, more attention to the growing crypto space could entice users to “forget about making money” and have fun with what is being created — the metaverse, NFTs, and a myriad of rewarding games.

You can, of course, argue that more inexperienced retail traders entering the market can increase short-term volatility.

This could make it difficult for businesses to adopt coins such as Bitcoin, Litecoin, and Dogecoin as payment options. It’s quite daring that Tesla Inc. announced that it would accept the meme crypto Dogecoin as payment.

Someone could also argue that short-term volatility, however, is a breeding ground of opportunities for scalpers and high-frequency traders. So, whichever way you look at it, the market will change to benefit some if not everyone in the crypto space.

Share to

Stay curious and informed

Your info will be handled according to our Privacy Policy.

Make sure to follow our Twitter, Instagram, and YouTube channel to stay up-to-date with Easy Crypto!

Also, don’t forget to subscribe to our monthly newsletter to have the latest crypto insights, news, and updates delivered to our inbox.

Disclaimer: Information is current as at the date of publication. This is general information only and is not intended to be advice. Crypto is volatile, carries risk and the value can go up and down. Past performance is not an indicator of future returns. Please do your own research.

Last updated October 18, 2022