Weekly Market Update: Ethereum ETF Watch

In this week’s crypto market update, crypto prices rebounded for the second week, driven by upcoming ETH ETFs, decentralisation benefits, and reduced sell pressure. Stay tuned for macroeconomic developments from around the globe.

Crypto prices rebounded for the second week running this week. Looking at the news there are several potential narratives at play. The imminent spot ETH ETFs coming to market, the so-called Trump trade, the Crowdstrike outage pointing to the power of decentralisation and a lack of sell pressure from certain governments. Anyway, I’ll take the win and move on.

In Crypto news we finally know what the ETH ETF pricing will be, and thankfully Grayscale wised up with an offer that will hopefully stem the massive sell pressure we saw from their BTC funds. Mt Gox distributions have commenced, but it seems to be a shrug 🤷 moment from the market.

In wider crypto news President Trump is attending a Bitcoin conference, Uniswap is taking on Metamask with a new wallet, the Ethereum ecosystem is looking very strong and XRP is having a ride on the back of comments from its CEO on the SEC case. Also note that MATIC token is changing to POL.

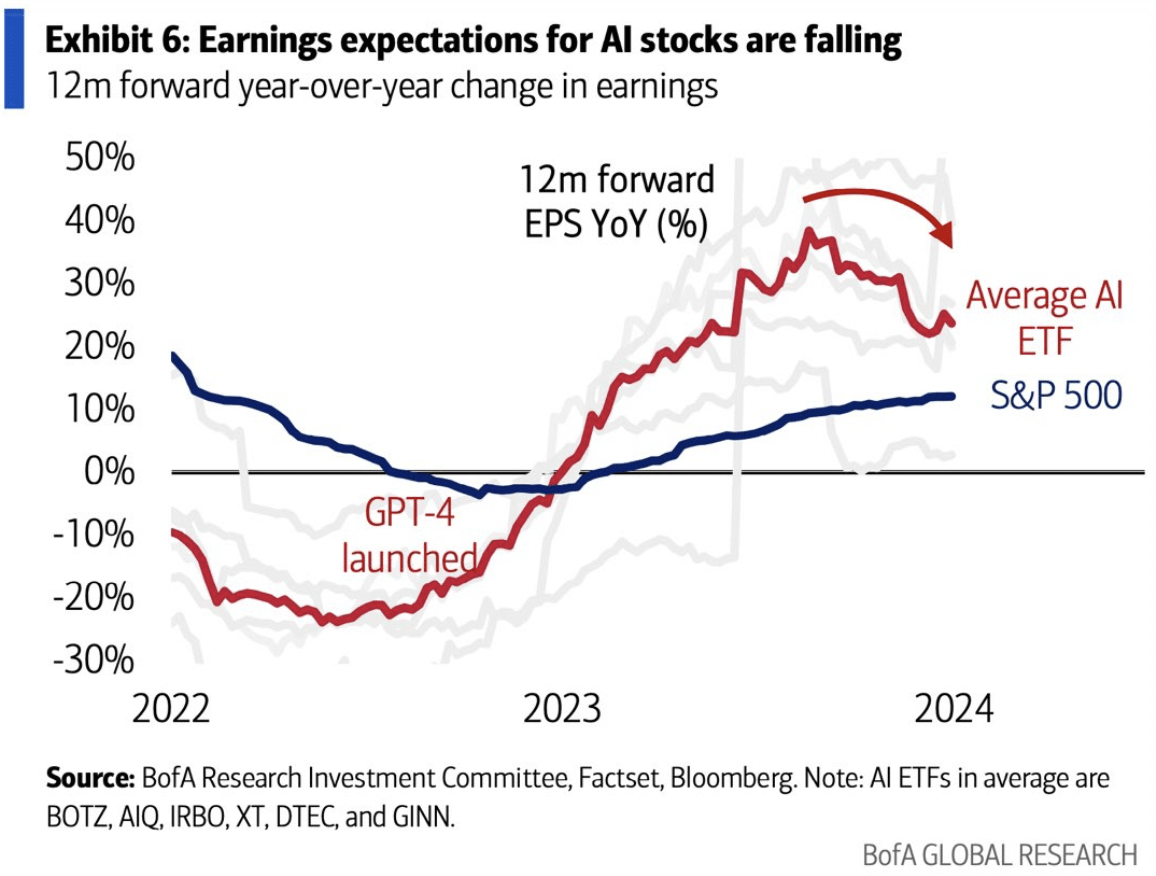

In macro news, the fallout from the Crowdstrike outage rumbles on, the shine is coming off AI stocks and green tech commodities, and geopolitics flared up on some comments from presidential candidate Trump.

The big news this week out of the US was all political with President Biden dropping out of the November race. Prediction markets have Trump well ahead, whereas pollsters who ask different questions have it much closer. It’s a bipartisan world.

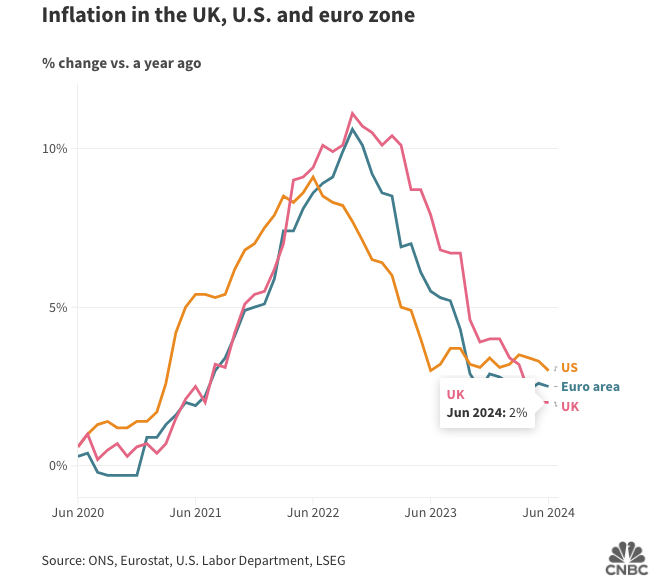

In Europe, the ECB held rates steady but kept the door open for a September rate cut. Meanwhile UK inflation remained flat whilst wage growth continued to post strong numbers.

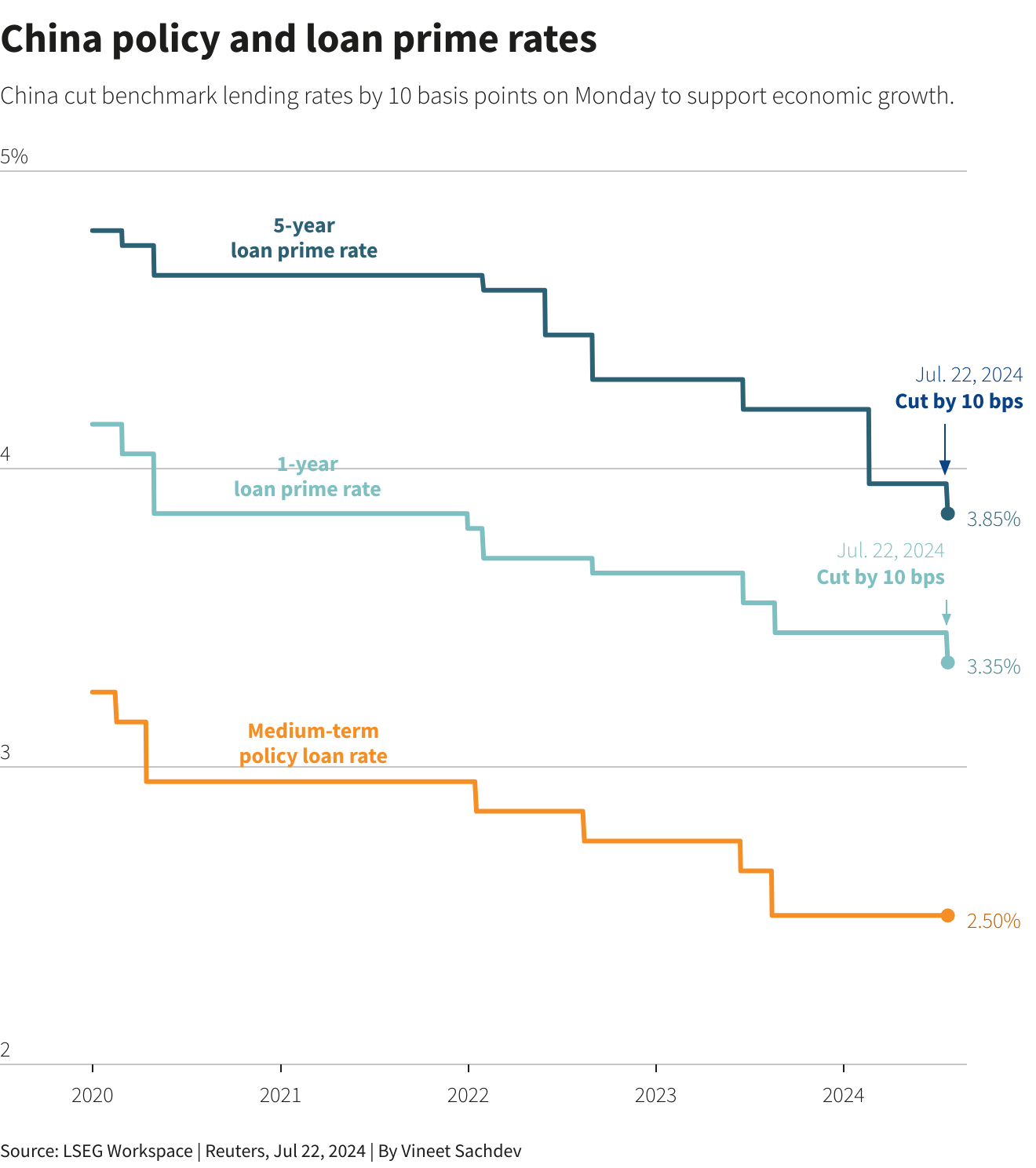

Regionally, it’s all about inflation. China’s PBOC delivered rate cuts to deal with disinflation, India’s central bank is finally focusing on inflation and Japan’s inflation problems are exacerbated by the low Yen price.

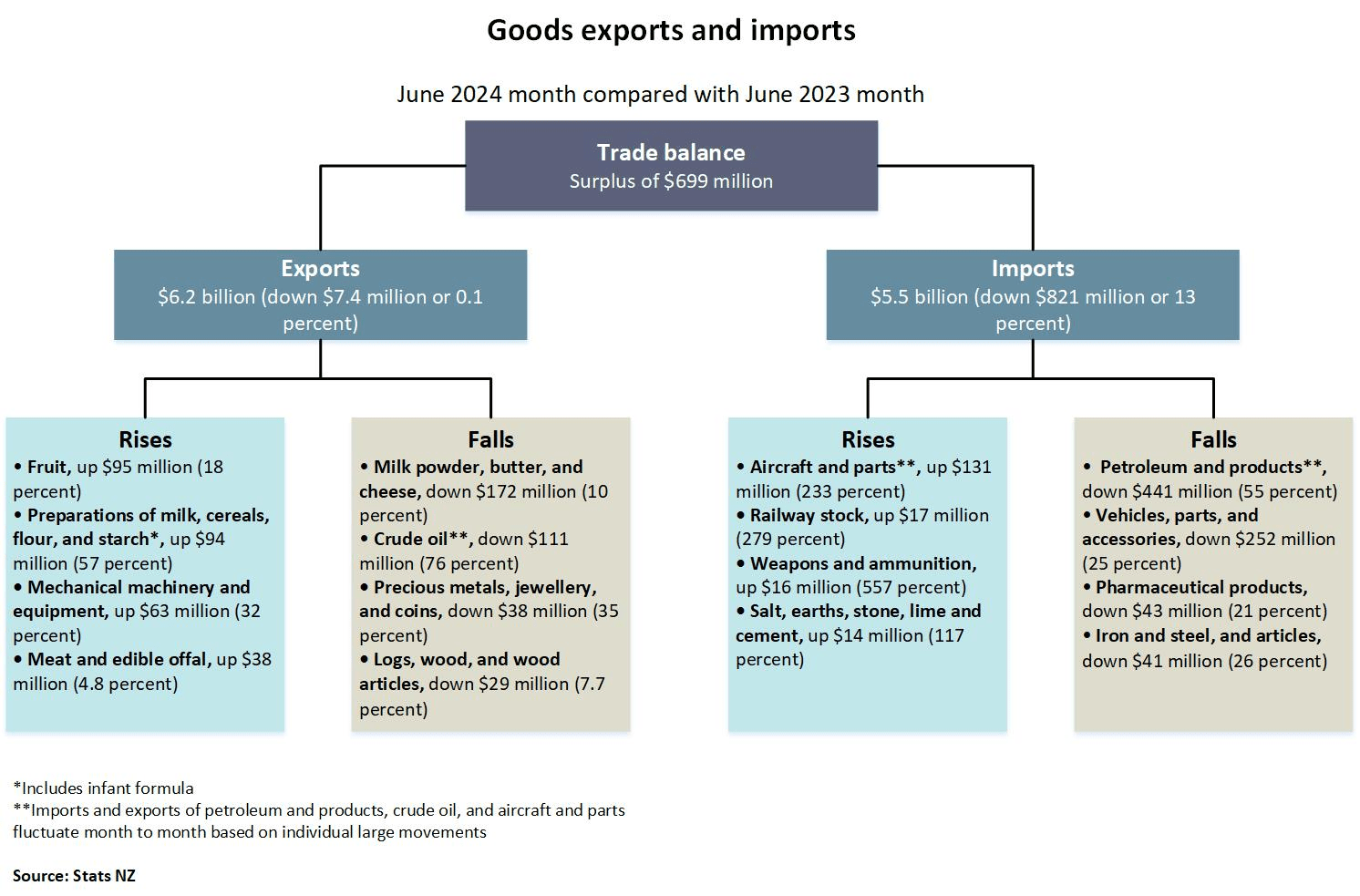

Australia’s unemployment edged up, while in New Zealand job adverts are way down, and our massive reduction in imported goods means we posted a trade surplus in June!

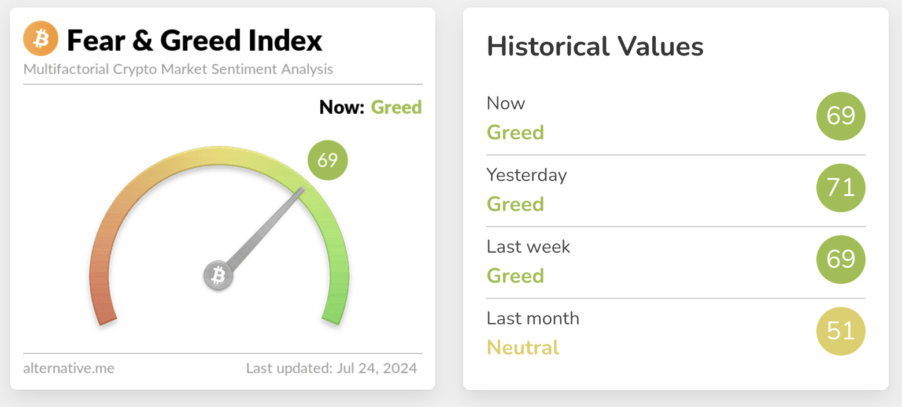

A comparatively stable week in market sentiment means we remain firmly in greed territory.

Highlights this week:

- It’s fair to say this week looks like the market took a breather with a lot of consolidation and a wait and see approach to see the impact of the ETH ETF launch. Because of that the top 30 assets are evenly split on gains and losses.

- Reflecting this pattern, our Buy-Sell ratio is evenly split by value, however there was a noticeable skew towards profit taking from our larger spending customers.

- BTC led the way on our asset tables, but no surprise that ETH was very popular too.

- At the time of writing BTC, ETH, BNB and XRP were all up ~1-2% for the week. SOL led the way in the top 10 assets up 8%.

- StormX (STMX) was our best performer this week, up 33%, followed by ROOT, up 25%.

- Shiba Inu (SHIB) was our worst performer, down 10%.

View all top gainers: Visit the top gainers page to find out more.

Highlights from the crypto space

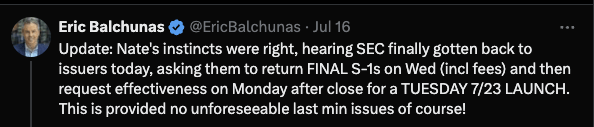

ETF analysts were predicting that the ETH EFTs are going live on the 23 July US time. We literally only got confirmation that they would go live yesterday.

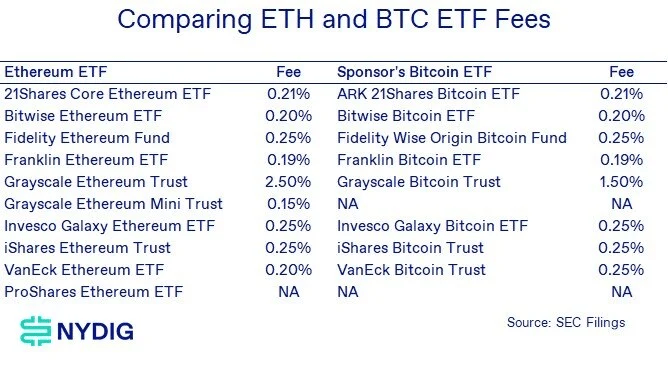

The ETH ETF fees are also out, they run from 0.15% to Grayscales ETHE at 2.5%. In short there will once again be a Grayscale drag from ETHE, but this time around Grayscale got their mini fund up at launch and have the lowest ETH fees.

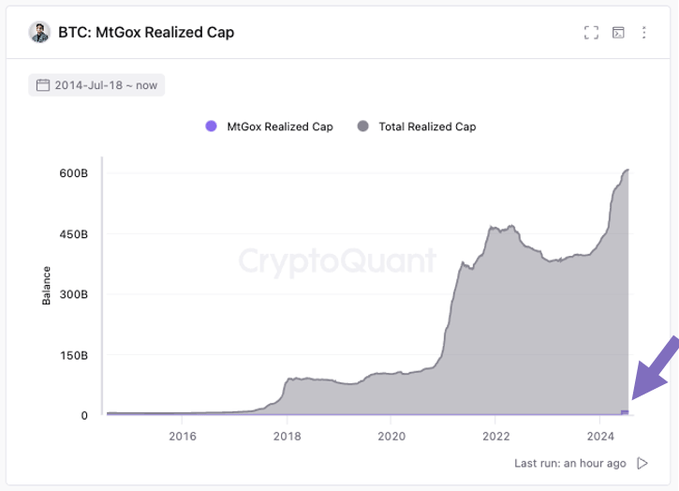

Gox watch is on, we are ⅓ of the way through the disbursements. But let’s keep some perspective.

President Trump is attending a Bitcoin conference, but it could be a fundraiser. You decide.

Defi platform LI.FI has announced an exploit of around $11m and is requesting users stop interacting with the platform.

Other notable highlights from the crypto space:

- Uniswap is taking on Metamask and launching a wallet browser extension.

- Ethereum’s validator count is at an all time high of 1.1 million, that is up 65% on last year.

- Bankrupt lender Blockfi is doing its distributions through Coinbase.

- JP Morgan CEO, Jamie Dixon, has apparently changed his tune on Bitcoin now that he’s in line for a WHitehouse job and crypto is political. Or maybe it’s going to be Blackrock’s Larry Fink.

- Recent comments by Ripple CEO Brad Garlinghouse about the impending closure of its SEC Court case have led to a rally in the price of XRP.

- MATIC is migrating to POL as its native gas token on the 4th of September.

- Massari’s CEO is stepping down after some inflammatory political tweets.

- Binance has received approval to invest customer deposits into US Treasuries.

🌎 Macro news TLDR: …The shine comes of tech.

The Crowdstrike induced global outage highlighted our utter dependence on technology, and also our stupendous ignorance of how interdependent and concentrated vendor purchasing that led us there.

The shine is coming off AI stocks due to overbuild / overhype/ over it (I added that bit). Given that most of the S&P 500 gains this year have been from tech and AI stocks this could help crypto.

Geopolitics flared up and tanked Chip manufactures and tech stocks after comments by presidential candidate Trump on Taiwan.

Some commodity prices are falling due to low Chinese demand; Copper, Nickel, and Lithium… all used in the green transition.

U.S. economic news

US industrial production is humming along, up 1.6% on the year to June. While unemployment edged up this week.

President Biden dropped out of the presidential race with VP Kamala Harris now the nominee for the democrats.

In a slow news week, all the focus has been on the Democrats and who will run against Trump. Markets like certainty, and so far that has played well with Trump being the front runner according to prediction markets.

Pollsters have the race much closer. The difference is in the questions they ask. Prediction markets ask “who do you think will win?”. The polls ask “who will you vote for?”. Bipartisanism in action.

Over in Europe….

The ECB kept rates steady at 3.75%, but left the door open to a September rate cut. European consumer confidence is improving but still way down on the long run average.

UK headline CPI remained steady at 2% for June. Core CPI was also unchanged at 3.5% meaning rate cuts are less likely.

Adding to that challenge, UK Wage growth for the last year is running at 5.7%. The new Government is attempting to rebuild its European relations. Apparently Brexit hasn’t delivered all that was promised. Shocker.

And in Asia Pacific…

China’s central bank surprised markets by cutting long and short term loan rates in a bid to stave off deflation or as they pitched it “ to step up financial support for the real economy” .

India’s central bank is finally turning its attention to fighting inflation. The new government delivered its budget which is designed to stimulate jobs and reduce spending.

Japan’s government has cut its growth forecast because of a weak Yen. Staying in Japan, headline inflation for June was flat at 2.8%, but core inflation increased to 2.5%. Malaysian GDP is on a tear at 5.8%.

Seasonally adjusted Australian unemployment edged up to 4.1%. While in New Zealand, Seek’s job report shows job adverts are down 35% from last year.

Stats NZ data on merchant goods import and export showed a surplus of $699m due in a large part to a big decline in imports.

That’s a wrap for this week.

Stay tuned for the next update.

Did you miss the last weekly update?

Share to

Stay curious and informed

Your info will be handled according to our Privacy Policy.

Make sure to follow our Twitter, Instagram, and YouTube channel to stay up-to-date with Easy Crypto!

Also, don’t forget to subscribe to our monthly newsletter to have the latest crypto insights, news, and updates delivered to our inbox.

Disclaimer: Information is current as at the date of publication. This is general information only and is not intended to be advice. Crypto is volatile, carries risk and the value can go up and down. Past performance is not an indicator of future returns. Please do your own research.

Last updated July 24, 2024