Weekly Market Update: Higher for Longer Weighs on Risk Assets

In this weekly market update, we take a look at the recent stagnant market movement in the crypto space, along with other macro economic developments around the world.

Yet another ‘meh’ week in the markets as they digested a lot of macroeconomic data from around the world. At a high level, most central banks are openly saying that we are at the end, or near the end, of the rate rising cycle.

Interestingly, in New Zealand there are now some calls for more .🤷 What is now abundantly clear and nearly universal – rates will be higher for longer.

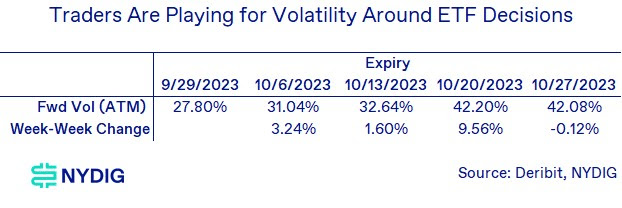

In the crypto space there seems to be a lack of a catalyst, although the Spot Bitcoin ETF decisions in October are getting some investors positioning themselves for that news.

Having been disappointed once already, the majority seem less enthusiastic. The biggest news this week seems to be the extension of Mt Gox payout by another year.

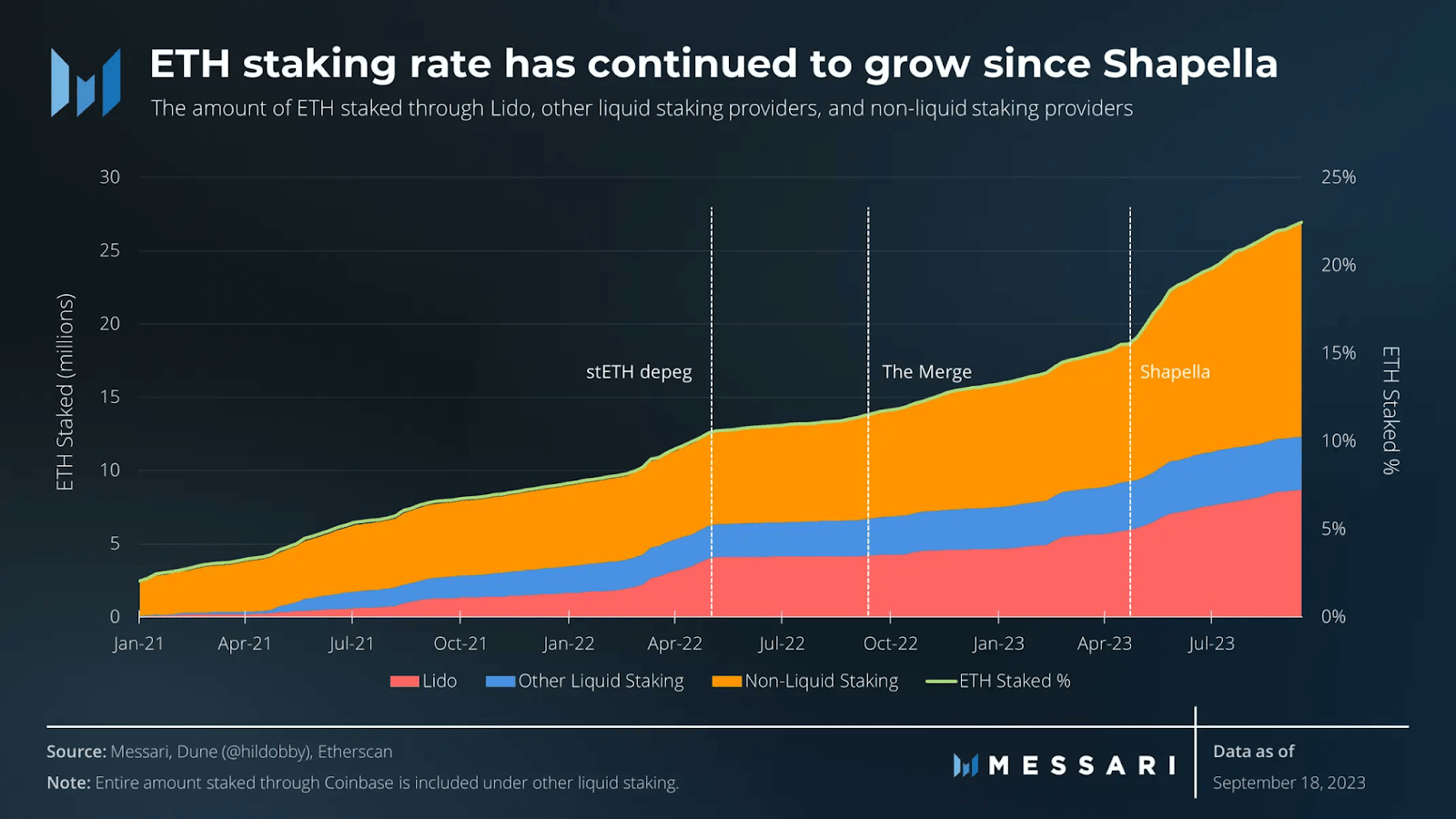

It’s been a year since the Ethereum merge, and while technically a massive success, the fundamentals have not bled into the markets and ETH is largely aimless.

Looking across the global economies, the US is still flirting with a soft landing, but has introduced more chaos with a government shutdown and a continuation of mass strike action.

Wider Europe looks like it has turned the corner on inflation, but outside of that doesn’t have much good news and looks likely to hit recession this year.

Outside of its property market, China is looking better, while many other Asian economies seem to be entering into recovery.

New Zealand avoided a technical recession, however our balance of trade is not a great news story as we continue to spend more than we earn.

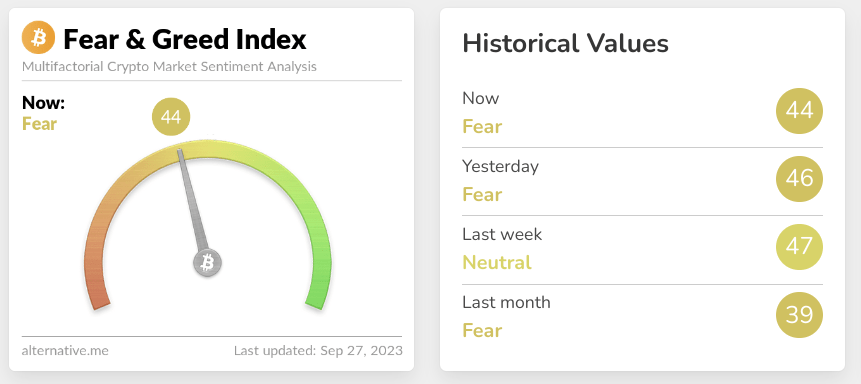

The market sentiment for the last week remains unchanged and firmly in fear territory this week as the market idles along.

Trend highlights this week:

- While it was a week of no significant moves, the majority of the top 30 assets drifted down ~2-5% this week.

- BTC and ETH are down 2% and 3% respectively

- Maker (MKR) was the best performer this week, up 12% as it benefits from higher US treasuries and some whale buying interest.

- Thorchain (RUNE) gave up some of last week’s gains and was our worst performing asset this week, down 10%.

View all top gainers: Visit the top gainers page to find out more.

Looking for more flexible pricing and trading volume for your high-value crypto trades? Get in touch on our OTC page and learn how we can help.

Highlights from the crypto space

Japan’s largest investment bank Nomura is launching a Bitcoin fund to give institutions long term exposure to the digital asset.

Perma-Bull MicroStrategy has bought another $147m worth of Bitcoin at around $27k per BTC since August.

Bitcoin investment house NYDIG has noticed a big spike in the volatility of ‘At the Money’ options around the key dates for a BTC ETF decision from the SEC.

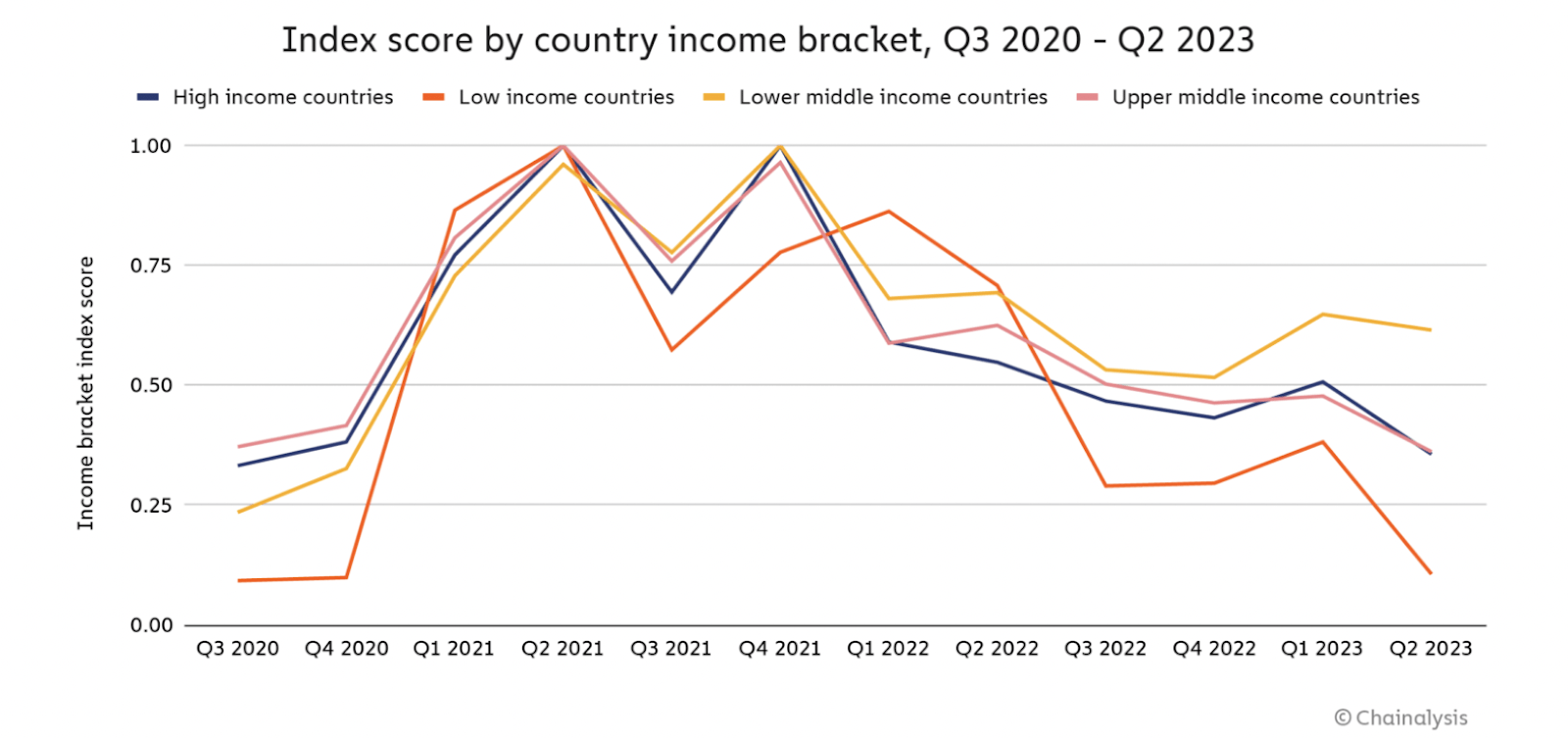

Vitalik’s hope for Ethereum this decade is that we go on to build something that ‘mainstream’ people want to use.

He also states that crypto fulfils that promise today in emerging economies. Chainalysis research supports this with low to middle income countries having much more activity.

Paypal’s new stablecoin PYUSD is being rolled out to payment app Venmo in the coming weeks.

FTX is suing SBF’s parents to claw back $26m in gifts and property.

South Korea reported that they have $99bn in digital assets held ‘overseas’, this in response to plans to tax digital assets.

USDT issuer, Tether Holdings has resumed the practice of lending USDT to a few selected clients to ‘manage their clients’ liquidity’. At $200m it’s not massive but the practice is frowned on.

Messari reports that staked ETH has now hit 22% of total supply since the Merge.

Other notable highlights from the crypto space:

- Mt Gox Trustee has extended the payment deadline by a year.

- Bybit is exiting the UK market after the local regulator, the FCA, issued a final warning to crypto players to market to consumers in a fair and accurate manner with risk warnings.

- Tim Draper is launching a Web3 and crypto venture studio.

- Greyscale has filed for an ETH futures ETF, meanwhile European player Coinshares is moving into the US with a digital asset hedge fund.

- Coinbase has been approved by the bank of Spain to be a custodian and crypto exchange.

- Google cloud has added another 11 blockchains to its public data sets BigQuery.

- Republicans in the US have created and endorsed an ‘anti CBDC’ bill due to concerns about the growth of a surveillance state.

- A developer has open-sourced an EVM protocol for private payments and transfers of any asset, including ERC20 and ERC721 tokens. TLDR; Vitalik’s stealth addresses are here.

- Circle has renamed USD Coin and EUROC to USDC and EURC.

And that sums up the major updates from around the crypto space. Moving on, we’ll take a closer look at other macroeconomic developments from around the globe.

Starting off with global news

Oil prices continue to rise with Brent Crude flirting with $100 per barrel. However, analysts believe this will be temporary as non-Opec members are ramping up supply to cash in.

🌎 Macro news TLDR: … Europe continues to struggle

Energy costs are already impacting inflation in most parts of the world, and higher prices for longer will have a profound cooling effect on economies as both manufacturing and consumers feel the pain.

U.S. economic news

The strike by US Auto Workers (UAW) is expanding. At its heart is the question, “if the CEO can get a 40% pay rise, why can’t we…”

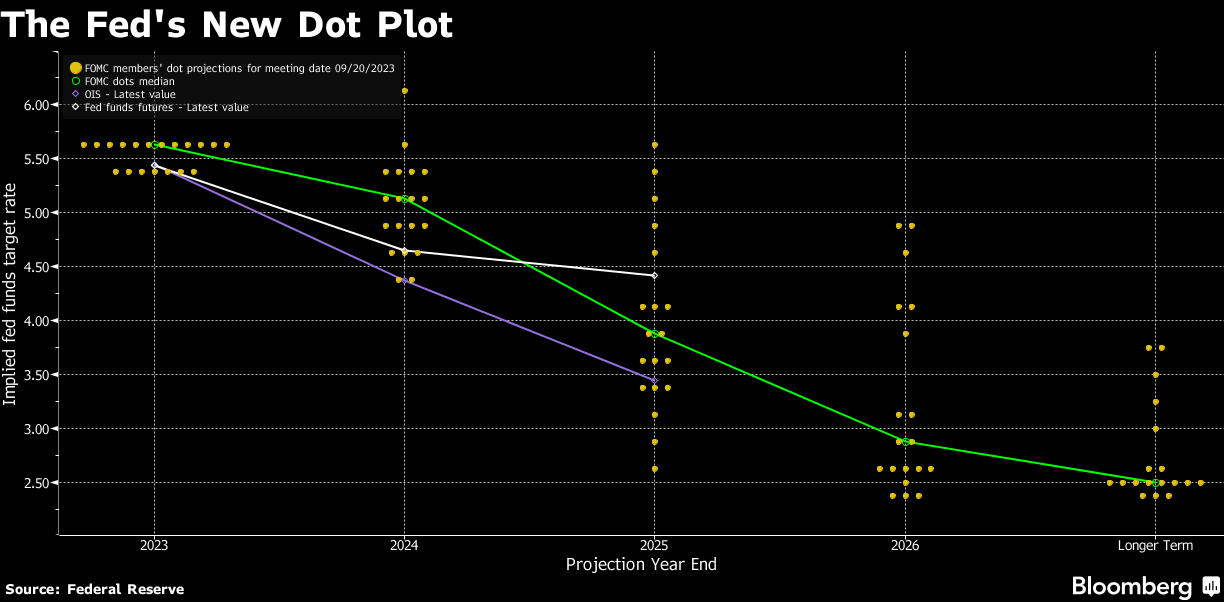

As widely expected the FOMC held the Fed’s funds rate at the current 5-5.25% level, the commentary afterwards was consistent with previous meetings as the fed signalled the possibility of another rate rise this year and a longer time to any rate cuts.

The key message was headline CPI slightly up whilst core inflation is coming down, and rates will be higher for longer.

The threat of a Government shutdown continues with the Republican party infighting blocking the start of the process at the minute. The impact? Hundreds of thousands of Government workers won’t be paid which must cool the economy.

And in Europe….

The Eurozone economy will probably continue to struggle and is likely in contraction, according to flash PMI readings. It looks quite widespread with many economies under stress.

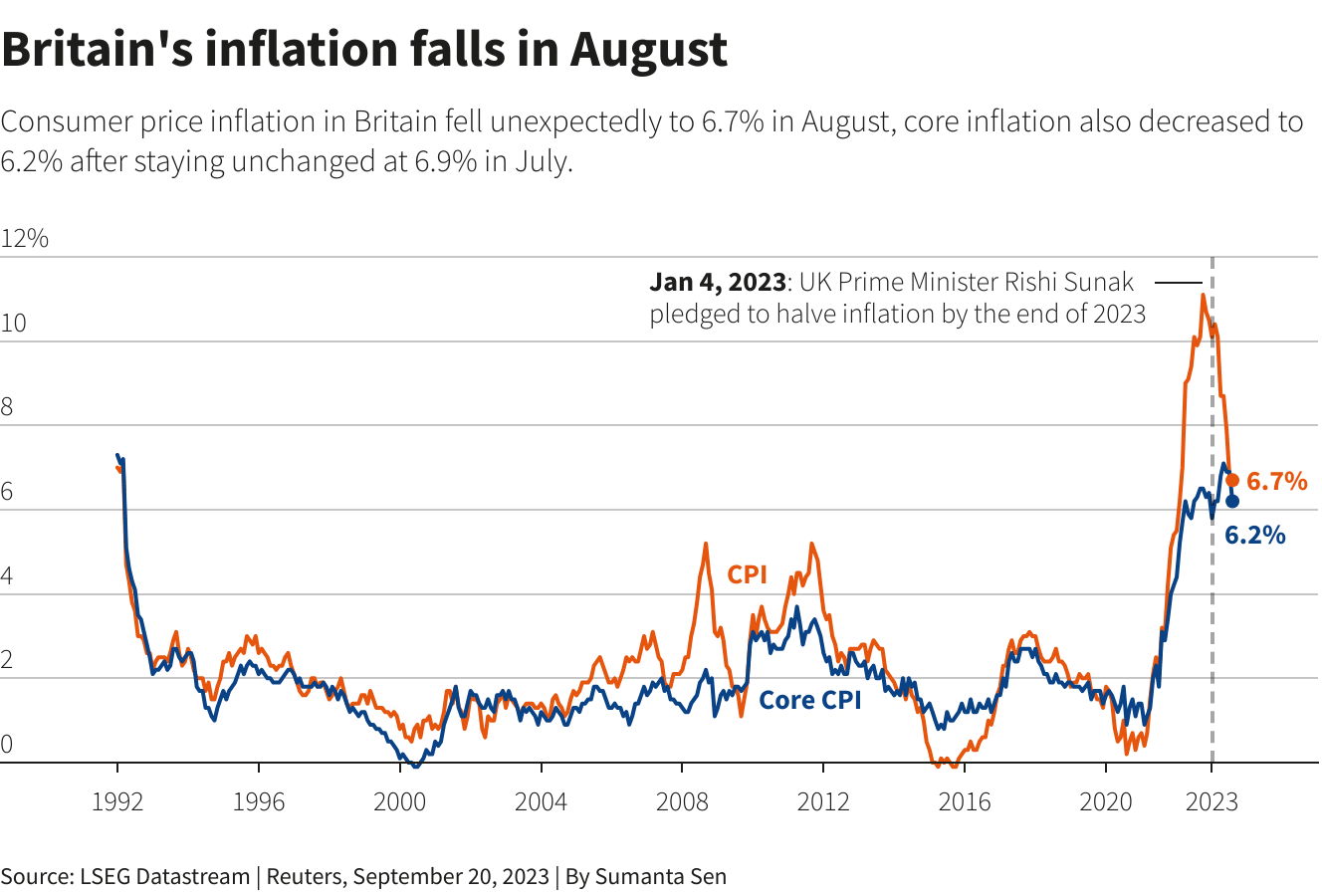

The UK had a welcome fall in CPI in August. Core inflation was an even bigger surprise, falling to 6.2% from July’s 6.9%.

The odds of the BoE lifting rates were put at 50:50 at this week’s meeting, and boy was it close with a 5/4 decision to hold rates at 5.25%.

Like Europe, the UK is looking likely to hit recession with PMI and factory outputs all declining.

German PPI continues to benefit from big falls in energy prices, August numbers are down 12.7% on last year.

Russia issued a ban on all gas and diesel exports except to ex Soviet state countries. Apparently, they have been suffering shortages in some parts of the economy so this is to stabilise supplies.

And in Asia Pacific…

The Asia Development Bank has slightly trimmed its forecast for the region’s GDP growth for 2023, now calling 4.7% vs 4.8% due to the impacts of El Nino & the Chinese property sector.

After a great run this year, Japan’s year on year exports fell 0.8% in August, and were down 11% in exports to China.

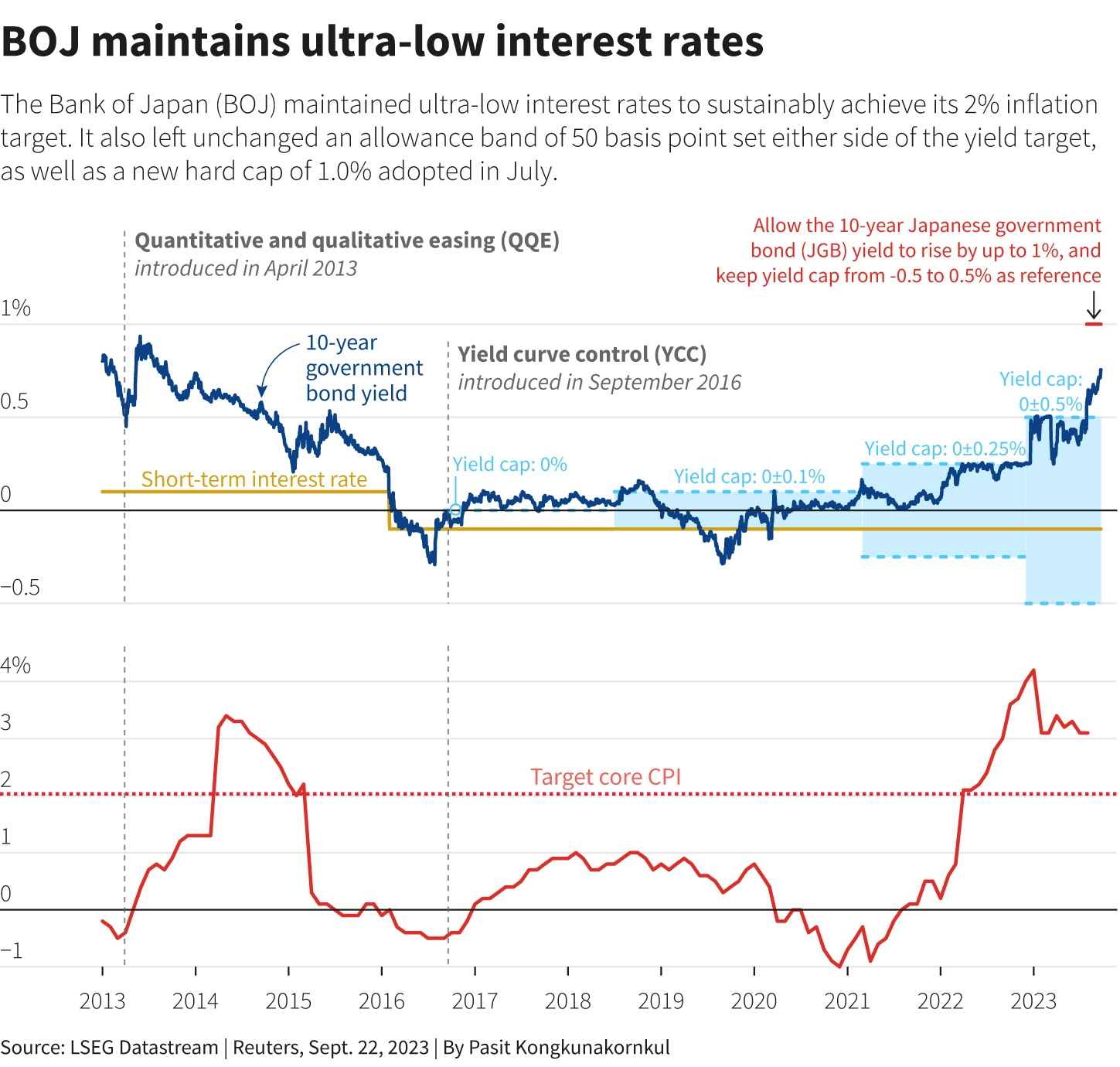

The BoJ maintained its ultra low interest rate policy even with inflation above their target band. Their policy makers are sticking to their thinking that inflation is transitory.

Taiwan is also struggling with its Chinese exports. They are down 15.7%.

Chinese media are reporting that more reforms and stimulus are on the way. Things in their property sector don’t appear to be improving with Evergrande having to cancel its debt restructuring plan due to disappointing sales.

Elsewhere in Asia, the Philippines, Indonesia and Taiwan central banks all held rates at their respective levels. While inflation in Hong Kong, Singapore and Malaysia has stabilised.

In Australia, the RBA minutes show they considered a 25 bps rise, but held off as they await more data.

In New Zealand, the current account deficit for Q2 was better than expected at $4.2 bn vs forecast of $4.6. In short we are sending more money offshore than we are getting in.

Annualised the figure is an eye popping deficit of $29.8 bn. Statistics NZ also put out GDP figures this week and we look to have avoided a recession with Q2 growth coming in at 0.9%.

That’s a wrap for this week. Thanks for reading!

Stay tuned for the next update.

Did you miss the last weekly update? Catch-up on the previous market update.

Share to

Stay curious and informed

Your info will be handled according to our Privacy Policy.

Make sure to follow our Twitter, Instagram, and YouTube channel to stay up-to-date with Easy Crypto!

Also, don’t forget to subscribe to our monthly newsletter to have the latest crypto insights, news, and updates delivered to our inbox.

Disclaimer: Information is current as at the date of publication. This is general information only and is not intended to be advice. Crypto is volatile, carries risk and the value can go up and down. Past performance is not an indicator of future returns. Please do your own research.

Last updated September 27, 2023