Weekly Market Update: Hope…

Everyone is looking at charts suddenly, mainly because later this week the Fed is expected to cut rates in the US.

This week crypto, mainly BTC bounced hard, breaking US$60k and getting the traders all excited. Higher lows, in the cloud, RSI… you get the point. Everyone is looking at charts suddenly, mainly because later this week the Fed is expected to cut rates in the US. The hope is this will start a run on risk assets. Hope…

Some people do more than hope… instead they are absolutely committed, like this week’s news that Microstrategy bought another billion plus of BTC.

In other big news, Greyscale announced a XRP trust, Coinbase launched its wrapped BTC product and a lot of noise around stablecoins. We’re big fans of stablecoins.

In macro market news, Oil prices declined on the back of OPEC forecasting sluggish global demand. And Gold hit an all time high, apparently developing countries are buying gold ahead of the Fed rate cut.

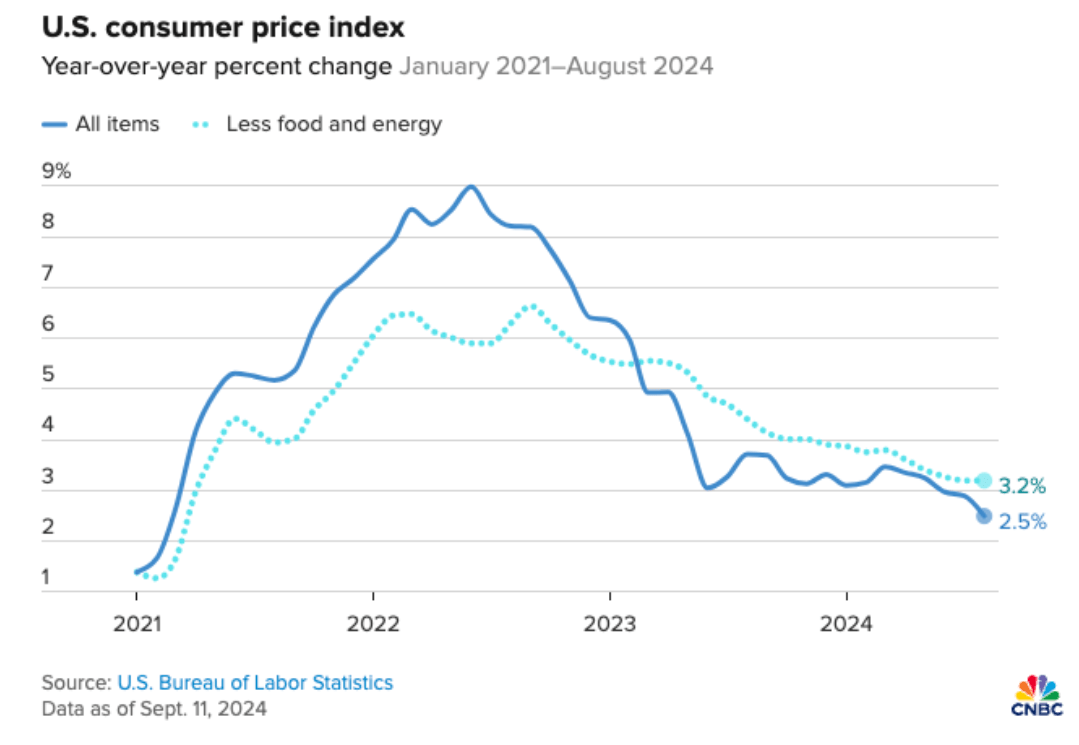

While we wait on the US rate decision, more data came out supporting the decision. Headline CPI was down, core not so much. Producer prices were also down.

In Europe, the ECB delivered rate cuts as expected. They are now attempting to restimulate the economy, Germany in particular needs help with even VW proposing cutting jobs. UK’s GDP disappointed for the 2nd month and Russia’s central bank continues to battle inflation.

APAC feels like a broken record, China missed its numbers, this time retail sales and industrial production. India continues to post good numbers and the BoJ continues to walk the knife edge on rate rises and inflation. This time with more signals.

In Australia confidence is falling, inflation expectations are too high and the RBA is watching employment data.

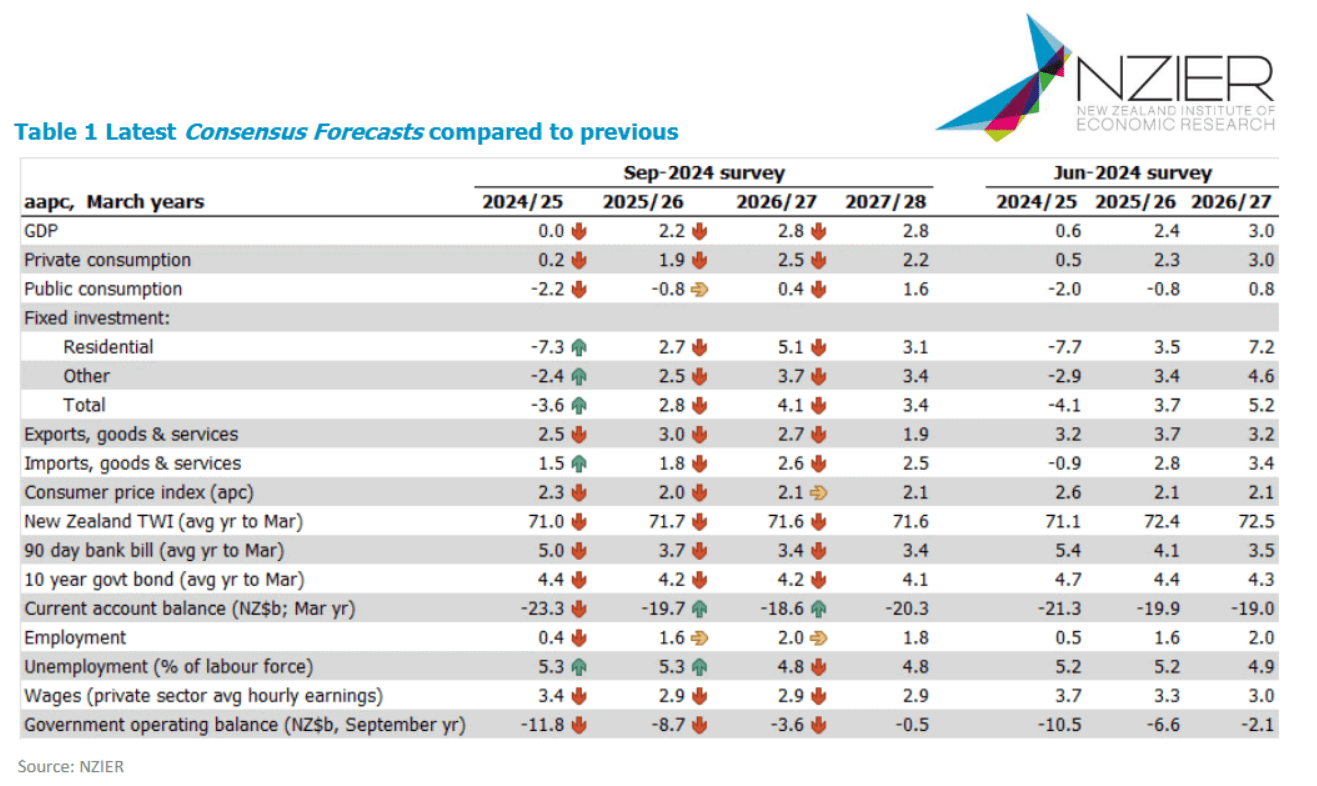

In New Zealand employment is trending down and immigration is plateauing. Some good news though, card spending ticked up and food price increases are basically zero. Economists are predicting we are in a recession ahead of this week’s GDP announcement.

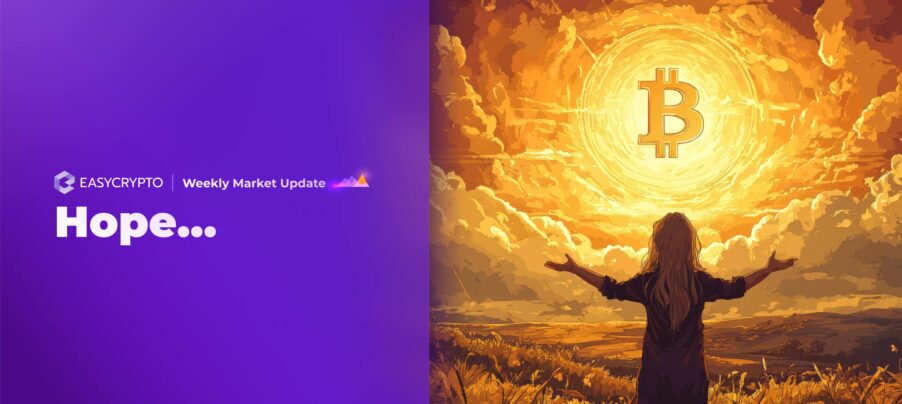

Market sentiment has improved marginally this week, however it still remains in fear territory.

Highlights this week:

- Just like last week, around 40% of the top 30 assets posted gains.

- Our Buy-Sell ratios moved to the sell side as some of you took the mini run as a profit taking opportunity.

- XRP, BTC and USDT dominated orders this week. Go to the XRP army.

- At the time of writing, only BTC and BNB were both up 2%, ETH down 3% while XRP recouped last week’s losses to be up 8%.

- Nervous Network (CKB) was our best performing asset this week, posting a whopping 70% gain this week.

- Bitcoin (NOT) was our worst performer, down 15 % this week.

View all top gainers: Visit the top gainers page to find out more.

Highlights from the crypto space

MicroStrategy bought $1.1bn in BTC this week.

Raby is adding a gas account to simplify paying network gas fees.

Greyscale is launching an XRP trust and the SEC looks like it won’t appeal the recent lawsuit. Big week and nice to see the price reflecting it.

Catch up with finance & blockchain experts Bryan Ventura, Jeremy Muir, and our own Paul Quickenden from Easy Crypto as they break down New Zealand’s wins and lessons learned in digital asset regulations. Tune in to the full chat here!

The Digital Chamber is calling on the US congress to reign in the SEC on its NFT actions.

The UK has introduced a bill that would confirm digital assets as personal property, thus offering holders more protections.

On the back of its Layer 2 launch (Sonium), Sony is also planning to build its own stablecoin.

Castle Island ventures undertook some research into stablecoin usage in emerging markets. The TLDR; outside of trading, dollarisation and paying bills are the most popular use cases. If your currency is deflating at 50% pa, the USD is looking pretty attractive.

Coinbase launched its own wrapped Bitcoin –cbBTC. Makes sense, Kaiko is reporting that Altcoins are underperforming compared to BTC so it’s game on.

The WSJ wrote a piece saying USDt was ‘fueling the financial underworld’, but that it was also useful in inflation riddled economies.

SBF is appealing his 25 year fraud conviction. Staying with convicted exchange founders, CZ will get released next week.

🌎 Macro news TLDR: …Semiconductors are the new battleground.

Oil prices fell this week as OPEC cut its demand forecast. TLDR; global demand is down, so are oil prices. Gold hit an all time high this week too, bolstered by Fed rate cut expectations.

U.S. economic news

Headline CPI for August came in as expected at 0.2% for August and 2.5% annualised. Core CPI surprised to the upside at 0.3% vs 0.2% expected.

Net result is the market is now saying 25bps cut not 50, but that changes quickly. US Producer prices (PPI) for the year to August were up 1.7%, slightly below the 1.8 expected.

Over in Europe….

The ECB cut its deposit rates by 25bps, with larger cuts in refinancing rates.

The UK’s GDP for July was stagnant, for the second month in a row. It was expected to grow 0.2% but was dragged down by weak manufacturing. Sound familiar?

It’s dire enough in Germany that Volkswagen is walking back on decades old sacrosanct labour agreements at 6 plants.

The Russian central bank lifted rates 1% to 19% in its attempt to get inflation under control.

And in Asia Pacific…

China’s retail sales rose 2.1% for the year to August, some way off the 2.5% expected. Industrial production was also below forecast.

The people’s bank said stimulus is coming. Citibank and Goldmans are effectively calling BS on the Chinese government’s 5% growth target and instead forecasting 4.7%.

The BoJ is saying that if inflation moves in line with forecasts then it will hike rates. Take that as a warning sign to the market.

India’s inflation for August rose to 3.65%, up slightly on July. Food prices also ticked up. Industrial production continues to tick along at a healthy 4.8%.

In Australia, consumer confidence fell again on concerns about the economy. Unsurprisingly Business confidence fell in August too.

Consumer inflation expectations have barely moved, coming in at 4.4%. The RBA is saying the tight labour market is a key element in keeping policy restrictive.

And proof that the gloves are well and truly off, the Federal Government is trying to restructure the RBA board and being accused of stacking the deck in doing so.

In New Zealand, employment indicators are trending down, with filled jobs down 0.4% on Q1. Stats NZ provisional data says net immigration ticked up in July, mainly due to inbound students.

Retailers finally got a break with card spending up 0.2% in August, most of the upside was spend on apparel. More good news, food prices only increased 0.4% in the year to August.

Ahead of this Thursday’s GDP announcement, economists are in consensus that it’s going to be a poor result, particularly on a per capita basis.

That’s a wrap for this week.

Stay tuned for the next update.

Did you miss the last weekly update?

Share to

Stay curious and informed

Your info will be handled according to our Privacy Policy.

Make sure to follow our Twitter, Instagram, and YouTube channel to stay up-to-date with Easy Crypto!

Also, don’t forget to subscribe to our monthly newsletter to have the latest crypto insights, news, and updates delivered to our inbox.

Disclaimer: Information is current as at the date of publication. This is general information only and is not intended to be advice. Crypto is volatile, carries risk and the value can go up and down. Past performance is not an indicator of future returns. Please do your own research.

Last updated September 18, 2024