Weekly Market Update: Inflation Turns, ETF Decisions Delayed

In this weekly market update, we take a look at the inflation going around lately, and movements in the ETF space. Stay tuned for other macro economic developments around the world.

In a hectic week of ETF news for the crypto market, we had some good and bad updates. The SEC effectively bounced all the Spot Bitcoin ETF decisions into the new year, however they did give approval for an ETH Futures ETF which the markets clearly liked.

The Bitcoin options market had a coalescence of weekly, monthly, and quarterly closes which apparently drove the price action on BTC last week.

In the wider market, yields dominated. Bond markets around the world are signalling signs of distress, as yields last week reached multi-year records in the US, UK, Germany and Japan to name just a few markets. End result; equities had a poor month as the near risk-free returns dominated.

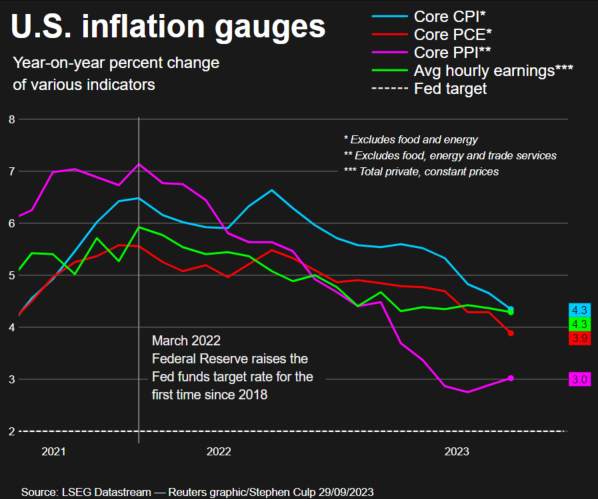

Looking across the global economies, the US inflation picture is looking better, as is Europe. This is fuelling hope that further rate rises may not materialise.

In Asia, China’s manufacturing is holding its own, but it’s fair to say that their sneeze has given the rest of the Asian zone a full-blown cold with many countries’ PMI’s in contraction now. Conversely, China’s property market looks horrible.

At home, New Zealand’s economic news was a mixed bag, manufacturing is picking up, employment expectations are down and building activity is way down.

Against this backdrop, and with an election 2 weeks again, the RBNZ held the OCR at 5.5% as was expected.

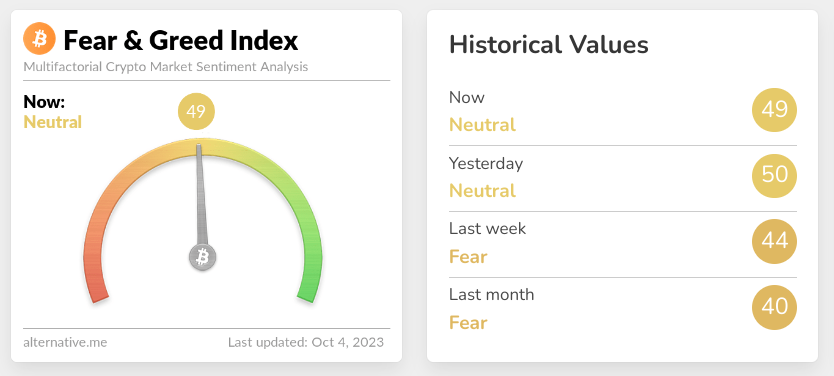

The market sentiment has improved slightly from last week on the back of some positive news and price gains and we are now in neutral territory.

Trend highlights this week:

- The market reversed course this week with the vast majority of the top 30 posting healthy gains after some time in a downward trend.

- BTC and ETH both up 4%.

- Solana (SOL) was the best performer this week, up 25% as it continues to impress investors with its DeFi credentials.

- Theta Networks (THETA) was our worst performing asset this week, down 1.5%.

View all top gainers: Visit the top gainers page to find out more.

Looking for more flexible pricing and trading volume for your high-value crypto trades? Get in touch on our OTC page and learn how we can help.

Highlights from the crypto space

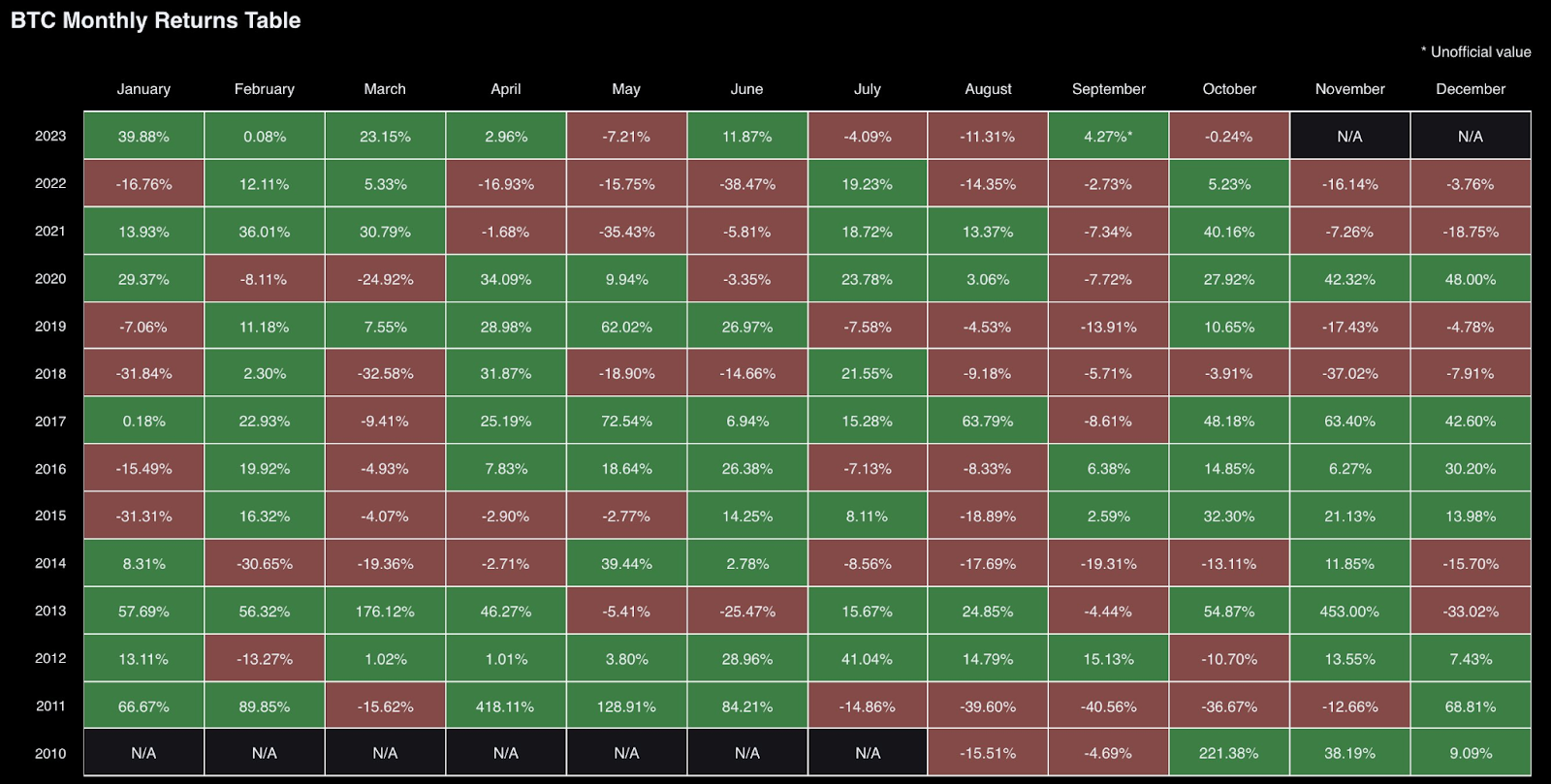

September is known as a bad month for Bitcoin. But not this time! Even with the yield train in full steam, global headwinds, shutdown news and general malaise, Bitcoin had a green September for the first time in 7 years!

The SEC bolted on its decision to delay the Ark 21invest bitcoin ETF, and came out early saying it will delay until January 10th due to the looming government shutdown.

Almost simultaneously 4 members of the US house financial services committee voiced their desire to approve the Bitcoin ETF immediately.

In better EFT news, Valkyrie has been successful in its petition to switch its BTC futures EFT to a dual Ether / Bitcoin Futures ETF.

Essentially ETH Futures ETF is a go. On the back of this, Greyscale filed to convert its ETH trust into and ETF.

Other notable highlights from the crypto space:

- SEC chairman Gensler also said that Bitcoin is not a security but stopped short of saying it’s a commodity.

- Coinbase and the SEC are at it again, this time over Coinbase’s possible role in the Celsius bankruptcy plan.

- Coinbase International has opened up Futures trading for non-US retail trading. They also obtained a full licence in Singapore and can now provide retail and institutional services.

- Moneygram, in partnership with Stellar, are launching a non-custodial wallet to help bridge the Fiat USDC worlds. It will have KYC.

- Bitcoin gained legal recognition in Shanghai with the court recognising it as virtual property and acknowledging its virtues of scarcity and inherent value.

- The NYSE filed an update on the Bitwise Bitcoin ETF which according to them addresses point by point the SEC’s concerns.

- Concerns of Houbi’s solvency have reemerged with onchain sleuths pointing out that their stated liabilities don’t match their onchain assets. The USDT point is interesting given Tether’s announcement last week on restarting their loans…..

- Kraken is getting into TradFi and is planning to list US listed stocks.

- The WSJ did another hit piece on Binance, stating that the DoJ had undertaken a years-long investigation that could result in criminal charges.

- The ECB has said that their CBDC launch is still some years away. They state that the pilots have been a success but the major issues seem to be concerns with a “big brother state”.

- The UK arm of Chase bank is banning crypto linked transactions due to an increase in scam activity. Conveniently they recommend you use another bank if you want to do crypto.

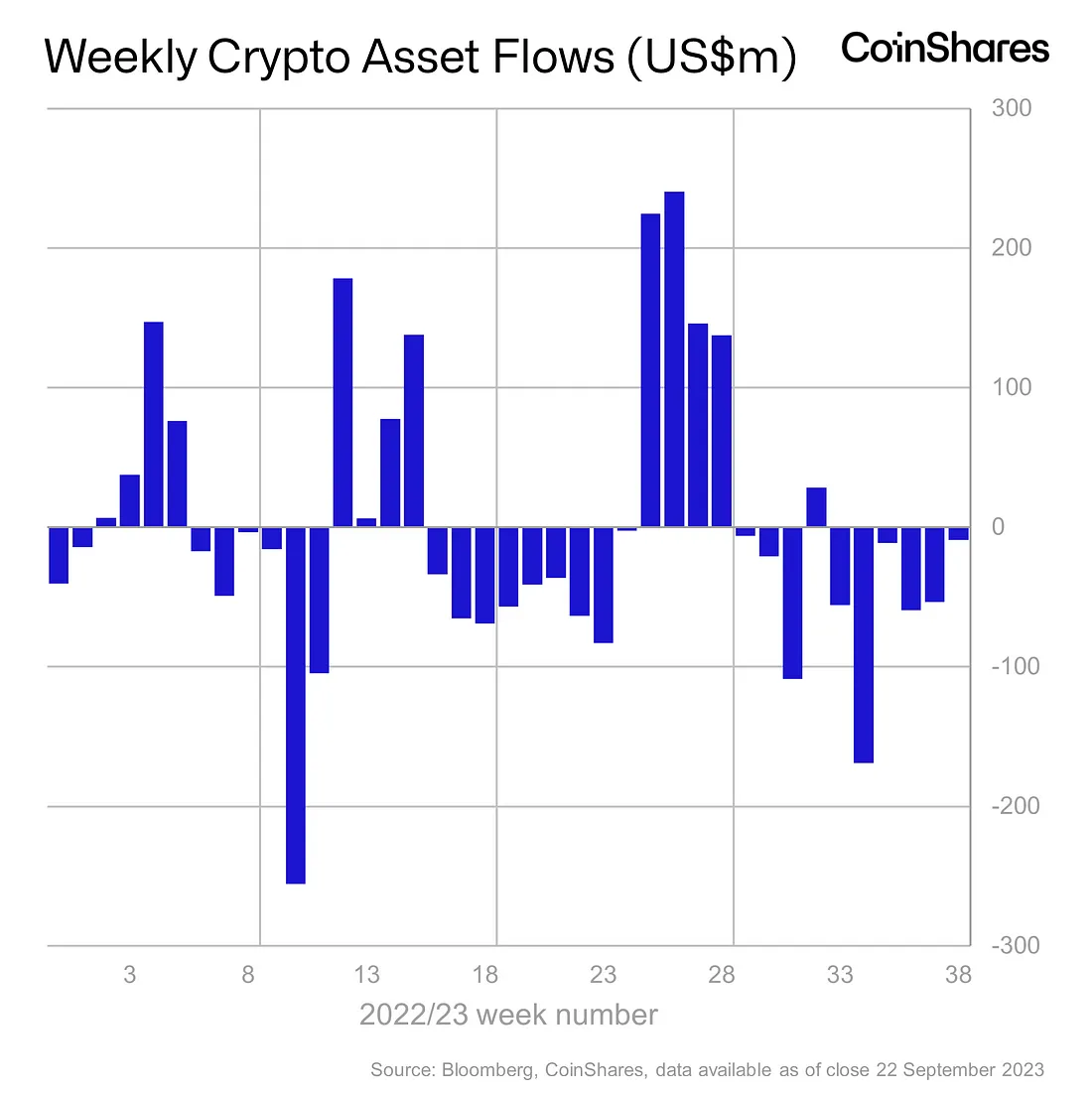

- A Coinshares report on digital asset fund flows showed a continuing decline with small outflow this week. Interestingly Europe saw more inflows while the US was net negative.

- mBridge, a blockchain platform to allow CBDC’s to facilitate cross border payments is getting closer to commercialisation.

- Leading price oracle Chainlink has added Base to its communications protocol.

- Bankrupt lender Blockfi has had its customer repayment plan approved by the court.

And that sums up the major updates from around the crypto space. Moving on, we’ll take a closer look at other macroeconomic developments from around the globe.

Starting off with global news

Yields, specifically in low risk US Treasuries, have weighed extensively on risk assets. The TLDR is that higher for longer means more money into low risk bonds and the US dollar, meaning less money into equities and…crypto.

Although so far, Bitcoin (white) is holding its own compared to the S&P 500 (orange) and the Dow Jones (turquoise).

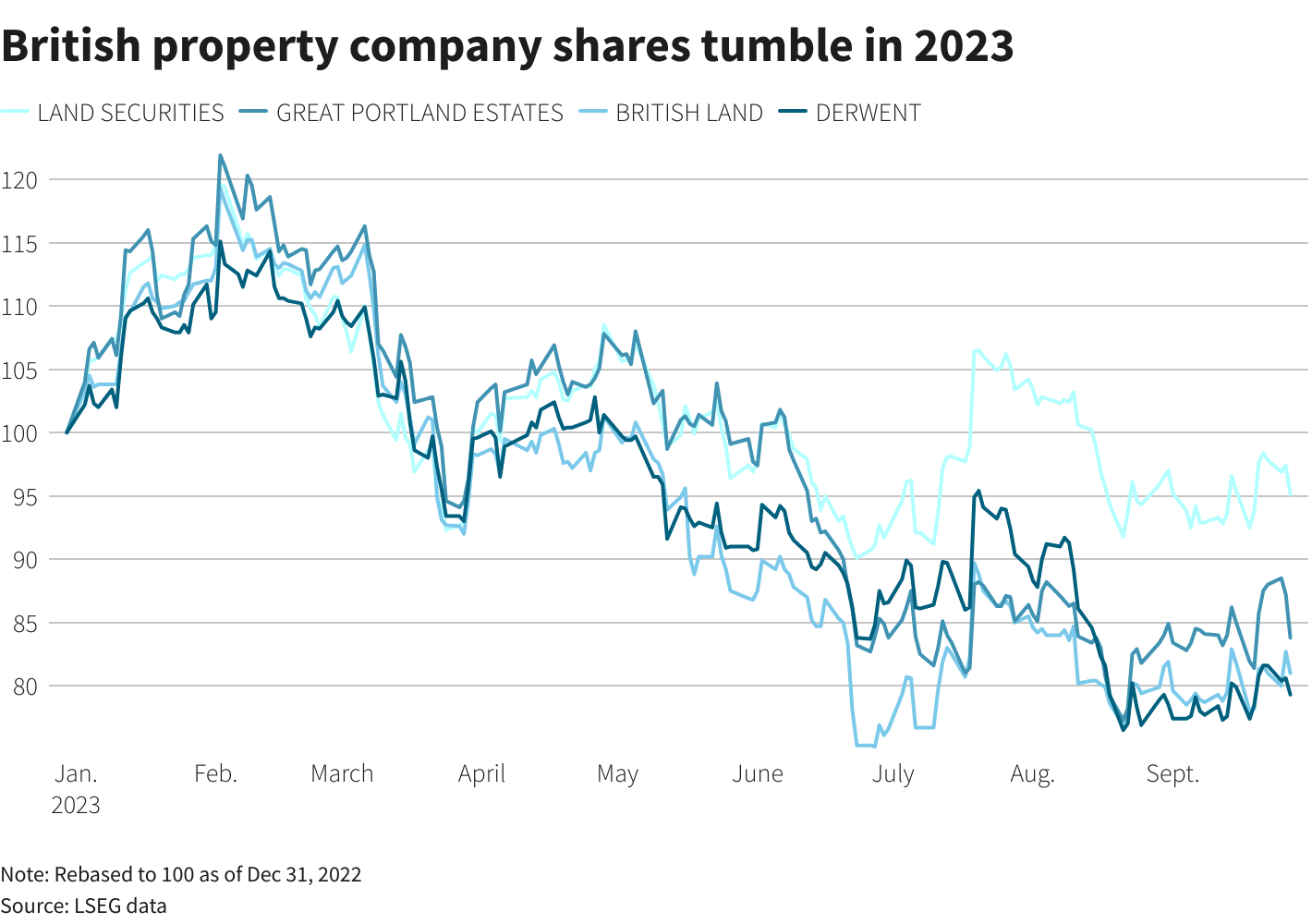

New ways of working continue to hammer commercial property investment returns with multiple markets signalling an end to their property market boom.

High interest rates and economic uncertainty aren’t helping and given that banks globally hold $6trn in debt, it could get very ugly.

🌎 Macro news TLDR: Inflation indicators trending down.

U.S. economic news

US PCE (personal consumption expenditure) rose 0.1% in September to have an annualised increase of 3.9%. All the major inflation indicators are trending in the right direction.

US home sales remain in the doldrums, down 15% year on year. And consumer confidence in the US is starting to tail off, dropping to 103 in September from August’s 108.

President Biden, who is courting the Auto workers union, supported their claims for a 40% pay rise. Finally, the political standoff around the government funding went down to the wire, as expected a last minute deal was put together with a temporary funding deal approved to 17th November.

And in Europe….

Euro area CPI dropped to 4.3% in September, down from 5.2% in August. Core inflation also declined down to 4.5%.

Mirroring global trends, the London office rental market is down 20% as the world embraces new hybrid models of work.

And in Asia Pacific…

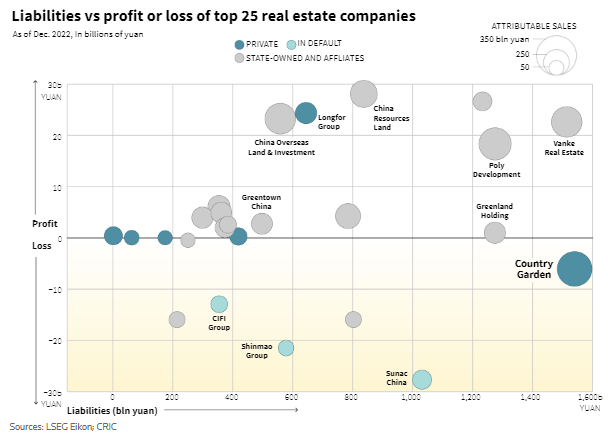

Just how bad is it in the Chinese property market? Politely, really bad. Evergrande has been suspended from the share market and, given real estate accounts for 29% of Chinese GDP, this will ripple through the global economy. China’s industrial firms recorded a 11.7% year on year decline in profit.

This shows an improving position with analysts suggesting that domestic demand is stabilising and the path ahead is looking ok.

Supporting this view, China did have some better news with the CAIXIN PMI reading for September coming in at 50.6.

Singapore’s manufacturing output declined 12% over the last year to August; the 11th straight month of declines. Manufacturing PMI’s across the region are painting a picture of decline with Japan, Australia and Thailand all posting PMI numbers under the magic 50 figure.

Australia’s CPI data increased from 4.9% to 5.2% in August. Oil price increases were a part of the reason, but housing and food also played a significant role.

Core inflation came down to 5.5% annualised. All this means that the debate about what happens at the next RBA meeting is getting hot.

In New Zealand, ANZ’s truckometer ticked up in August and supports other data that there is a small pick up in economic activity.

The Westpac McDermott Miller Employment Confidence Index showed a sharp decline of 7.4 points in the September quarter and now sits under the 100 mark at a pessimistic 98.3, about the same as the GFC or Covid periods. Building consents were down 17% year on year.

That’s a wrap for this week. Thanks for reading!

Stay tuned for the next update.

Did you miss the last weekly update? Catch-up on the previous market update.

Share to

Stay curious and informed

Your info will be handled according to our Privacy Policy.

Make sure to follow our Twitter, Instagram, and YouTube channel to stay up-to-date with Easy Crypto!

Also, don’t forget to subscribe to our monthly newsletter to have the latest crypto insights, news, and updates delivered to our inbox.

Disclaimer: Information is current as at the date of publication. This is general information only and is not intended to be advice. Crypto is volatile, carries risk and the value can go up and down. Past performance is not an indicator of future returns. Please do your own research.

Last updated October 4, 2023