Weekly Market Update: The Return of Volatility

In this weekly crypto market update, we take a look at the volatility post ATHs across the market. Stay tuned for more updates in the crypto space and other macro economic developments from around the world.

Last week we highlighted that volatility is returning to Bitcoin, well we appear to have gotten it. There doesn’t appear to be any major catalyst, so this week’s price pullback looks like it is the result of an over-exuberant market. There are plenty of analysts pointing to previous cycles and it is completely normal to have a 20% pull back before the halving.

This week Ethereum successfully completed the Dencun upgrade, with the major benefit being cheaper layer 2 network fees. Ethereum itself seems largely unaffected at both a transaction fee and price level. Solana on the other hand is having a great run powered by memecoins driving huge amounts of transactions.

Other notable crypto news this week; the spot ETH ETF is predicted to be delayed and a judge ruled that Craig Wright is not Satoshi. He’s been plaguing the ecosystem for a while and this decision will help uncertain developers who have been worried about being sued. We also saw quite a few price predictions, some M&A activity and more regulatory actions across the board.

In the global economy, global shipping is facing even more challenges, this time in Panama. In the US, inflation indicators ticked upwards. With the FOMC meeting Thursday NZT, there is now a possibility that they may talk about rate rises not cuts. This uncertainty is being attributed to the pullback in the risk on markets.

In Europe, the UK eked out some minor economic growth, but is clearly challenged, so is European industrial production. While in Germany they appear to have gotten inflation under control.

In Asia, India continues to grow, albeit at a slower rate. China’s property sector continues to struggle, but industrial growth looks like it is improving finally. In Japan there are growing the BoJ lifted rates for the first time in 17 years, and they now actually have a positive benchmark interest rate. .

Lastly in Australia, business confidence is improving, aided no doubt by the RBA holding rates and in New Zealand we recorded a significant drop in food prices and an improved PMI reading. This was offset by GDP declines

For all our readers, there won’t be an update next week as the writers are travelling.

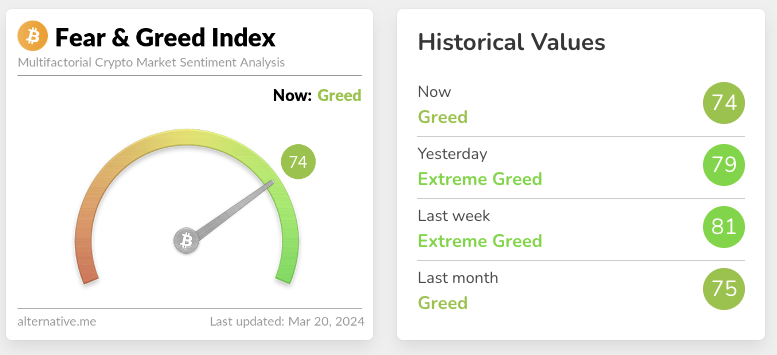

Despite this week’s price volatility, the crypto market sentiment remains in extreme greed.

Highlights this week:

- You will have noticed that the market took a breather from the months long pattern of gains with us seeing more red than green on the weekly chart.

- Our buy – sell ratio has tipped toward a buy side bias as you all are taking the opportunity to get the assets you want at discount to last week.

- As volatility has increased, buying activity has increasingly skewed towards larger cap assets with BTC, SOL and ETH being the most popular assets.

- At the time of writing BTC and ETH were down 9% and 15% respectively.

- Fantom (FTM) bucked the trend to be up 27%, as did SOL up a very respectable 22% on the back of last week’s 15% gains.

- Frontier (FRONT) was our best performing asset, up 75%.

- Injective Protocol (INJ) was our biggest loser this week, down 28%.

View all top gainers: Visit the top gainers page to find out more.

Highlights from the crypto space

Kaiko are reporting that Bitcoins volatility is picking up:

Historically speaking, Bitcoin tends to dip in the weeks preceding a halving, and we probably see a repeat of this pattern in 2024.

Ethereum Dencun has gone live with no hiccups. Apparently the L2’s are waiting to see if it’s stable before making changes on their end.

Bloomberg analysts have reduced the probability of the ETH ETF getting approved for May to just 30% because this approval cycle feels different from the BTC one.

Solana’s great run over the last 7 days looks to be fueled by memecoin mania which is driving unprecedented volumes.

OKK has basically delisted USDT for its european customers as new licensing rules for stablecoins come into effect.

Valkyrie has sold its ETF platform to Coinshares who they say is a better natural owner for the platform.

JP Morgan did an analysis on Coinbase stock and revised up their estimate due to the roaring success of the Bitcoin ETFs which Coinbase is custodian for. The really interesting bit (from our POV) was that they extrapolated out the market cap of Bitcoin to a price target in 3 years.

“If we are directionally correct on the level of net ETF inflows reaching $220B, applying our estimate of the current multiplier of new capital of ~25X, this alone could drive a $5.5T bitcoin market cap increase, or $280K per bitcoin,”

In a similar piece, analysts at Bernstein are predicting that the crypto market capitalisation will triple to $ 7.5tn by the end of 2025. They also firmed up their BTC price prediction of $150k.

Coinbase continues to fight the SEC in court to make clear how they decide what is a security and how Coinbase has allegedly broken the arbitrary rules. Picking a fight with someone with deep pockets and the will to fight might not have been a wise move.

Other notable highlights from around the crypto space:

- Things aren’t looking great for the SEC with a Utah judge ruling they engaged in bad faith conduct against a crypto firm.

- 15 Asset managers and 15 banks like Goldman Sachs and BNY Mellon have completed a trial to settle tokenised assets.

- Hot on the heels of last week’s $650m raise, MicroStrategy is going for another $500m. 🐂

- A UK Judge has ruled that Craig Wright is not Satoshi Nakamoto. In response the COPA alliance has requested that he be prosecuted for perjury and perverting the course of justice.

- Hong Kong’s regulator issued a warning about ByBit, adding it to the list of suspicious crypto exchanges.

- Prosecutors are asking the court for a 40-50 year sentence for Sam Bankman-Fried. His backers are asking for 5-6 years.

- The Q1 2024 issue of Digital Assets Investor Magazine is out now! Dive in for exclusive insights, expert interviews, and the latest market updates to empower your investment journey.

And that wraps up our highlights from around the crypto space. Stay tuned below for other macroeconomic updates from around the world.

What is going on in the world of Finance …

In a ‘watch this space’ update. The already struggling shipping sector is also being disrupted on the key Panama canal route due to an ongoing climate change induced drought in Panama. As of now, they have slashed trips by 50%. 5% of global shipping goes through the canal.

On the index front, containerised shipping costs have come back, but bulk cargo is holding flat after several months of rises.

Iron Ore prices are falling, so is steel, both in response to “sluggish” Chinese demand.

🌎 Macro news TLDR: …US CPI hotter than expected.

U.S. economic news

More conflicting data out of the US. Employment continues to hold up, however retails sales fell and PPI, or wholesale inflation, is on the rise coming in at 0.6% which was double expectations.

To put this in context, CPI and PPI are no longer trending downwards. Industrial production for February edged up. Traders however, are still betting on a June rate cut. Interesting times.

Meanwhile in Europe….

UK employment data out today shows unemployment rose to 3.9%, while regular pay growth is still outpacing inflation at 6.1%.

The UK also posted some positive GDP growth in January. However businesses are clearly struggling, with debt defaults at their highest levels since the GFC.

EU industrial production dropped 2.1% in January, and is down 5.7% annualised. German CPI eased to 2.5% in February and looks like a broad based reduction.

In Russia, President Putin was re-elected for another 6 year term.

And in Asia Pacific…

India’s industrial production for January was 3.8%, lower than the expected 4.1%. New car sales also declined. CPI for February was flat at 5.1%. In China, a bail out package for another property company Vanke is underway.

At the same time, house prices continue to fall, and surprisingly the PBOC left its 1 year rate unchanged at 2.5%. Industrial production for February was up a very healthy 7%.

And in Japan, there have been growing expectations that the BoJ will change its monetary policy stance. Finally, after 8 years of negative rates, the BoJ lifted rates to just over zero, 0-0.1% to be exact. Maybe, just maybe after 30 years they have beaten deflation.

In Australia, the NAB business sentiment was flat through February. The RBA decided to hold rates at 4.35% and indicated it will be some time before they start cutting.

Some good news in New Zealand, with food prices rising by 2.1% in the year to February. Our Manufacturing PMI also increased to 49.3.

On the negative side, the fortnightly Global Dairy Trade auction recorded another negative result and Treasury in its fortnightly update surprised markets by saying “A range of indicators released over the fortnight confirm New Zealand is in the midst of a severe economic slowdown“… no surprise that Q4 GDP forecasts are…. pessimistic?

That’s a wrap for this week.

Stay tuned for the next update.

Did you miss the last weekly update?

Share to

Stay curious and informed

Your info will be handled according to our Privacy Policy.

Make sure to follow our Twitter, Instagram, and YouTube channel to stay up-to-date with Easy Crypto!

Also, don’t forget to subscribe to our monthly newsletter to have the latest crypto insights, news, and updates delivered to our inbox.

Disclaimer: Information is current as at the date of publication. This is general information only and is not intended to be advice. Crypto is volatile, carries risk and the value can go up and down. Past performance is not an indicator of future returns. Please do your own research.

Last updated March 20, 2024