Weekly Market Update: The Bottom Might Be In

In this weekly crypto market update we continue to take a look at the price movements of BTC post halving along with other updates in the crypto space. Stay tuned for other macro economic developments from around the world.

A relatively stable week in the crypto space with Bitcoin, in particular, trading in a tight range. Volumes have come off across the board as the ‘halving hangover’ progresses.

There has been quite a lot happening in the crypto sector. Vitalik has proposed a new EIP which could change end user wallets. FTX creditors might get repaid what they had at the time of the collapse and the profitability of the BTC ETFs has been analysed.

There are quite a few commentators speculating that the BTC bottom was hit at US$56k. There are also a bunch of big brand TradFi players continuing to invest in blockchains and ETFs and, no surprise, the SEC continues its crusade against crypto.

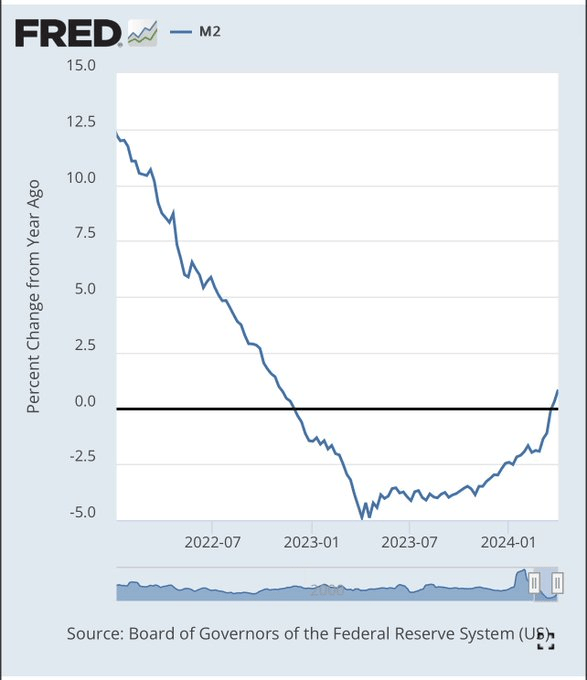

In macro news, global liquidity turned positive for the first time since 2022 and this usually proceeds risk asset price rallies. US – China geopolitics, in the form of trade wars, look to be increasing… it is an election year after all.

In the US, there was a welcome decrease in unemployment and increase in consumer sentiment. It’s a pretty benign week while we await Thursday’s CPI reading which could shift the market if it is different from the 3.4% expected.

In Europe, the UK GDP has turned positive ending the sharp recession, whilst German results are … ‘less bad’. Tough times over there.

In Asia, Japan continues to try and control the currency, but structural change is needed. China has staged a bit of recovery on their imports and exports and appears to have started QE again. India’s CPI is stable while industrial production continues to impress.

Locally, the Australian federal budget is being seen as highly political in an election year with tax cuts for all and a $9bn surplus to boot. This will likely put more pressure on the RBA.

In New Zealand house prices continue to fall, retail spending is down and manufacturing PMI remains in contraction. New Zealanders are voting with their feet with a record number immigrating. Unsurprisingly inflation expectations are rapidly declining.

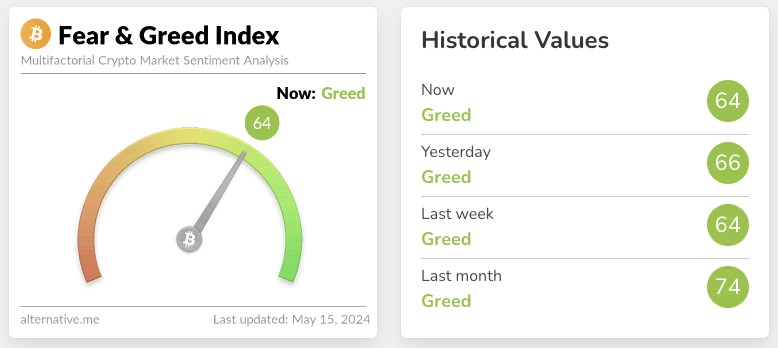

This week’s crypto market sentiment remains unchanged for the 3rd week running, staying stubbornly fixed in greed territory.

Highlights this week:

- Across the top 30 assets, we have experienced single digit price declines this week.

- Our buy – sell ratio shows a marked trend toward the sell side with BTC, USDT and USDC being the most sold assets.

- Swaps volume is also skewed towards stablecoins, with NZDD being particularly popular, indicating a degree of market conservatism.

- At the time of writing BTC and ETH were down 2% and 5% respectively. BNB, SOL and XRP were all down 4-5%.

- THORChain (RUNE) was our largest gainer up a tepid 4%.

- Fetch.ai (FET) was our worst performer of the week, down 16%.

View all top gainers: Visit the top gainers page to find out more.

Highlights from the crypto space

Vitalik has proposed a new Ethereum Improvement Proposal (EIP 7702). The TLDR; It gives your regular account some smart contract powers for a day, so it means you can batch transactions or even allow someone else to pay your gas.

Creditors of the FTX estate may get 100% of their funds back under a proposed payout scheme.

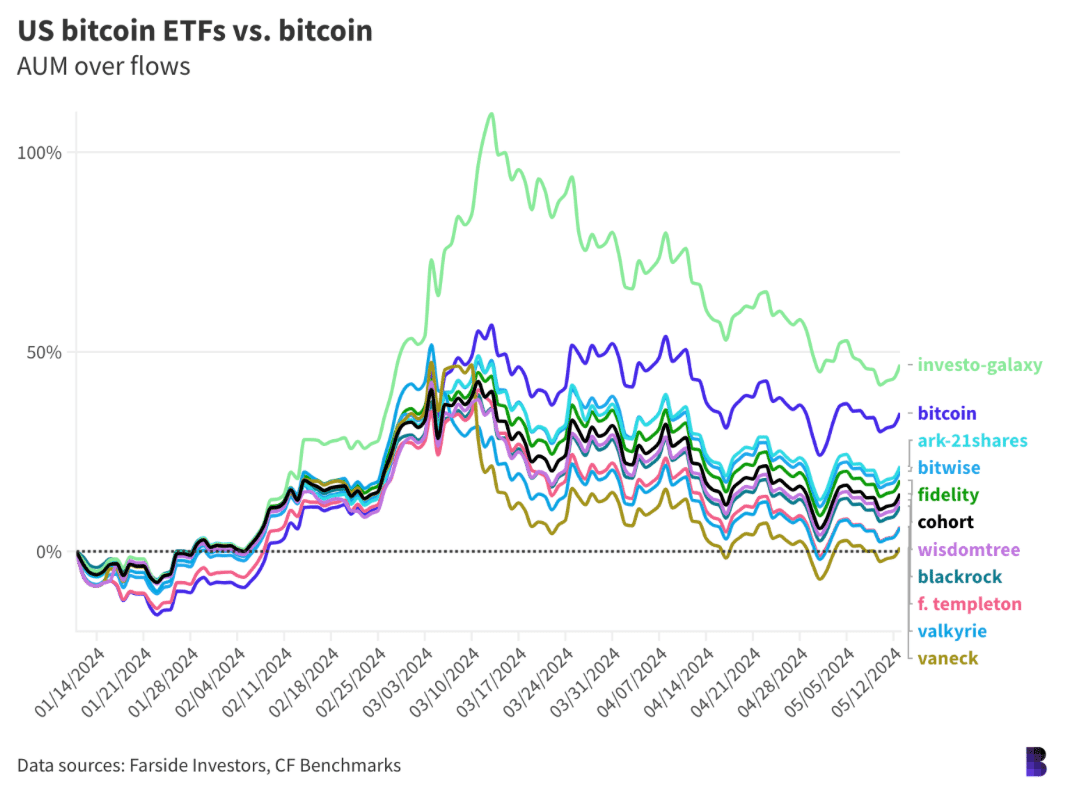

A Blockworks deep dive into the returns from the different ETFs show that buyer timing and behaviour has led to very different return profiles. Galaxy is up 50% because its users got in early and sold at the peak. On average the ETFs are up 15%.

Bitcoin ETF volume turned positive last week after 3 down weeks.

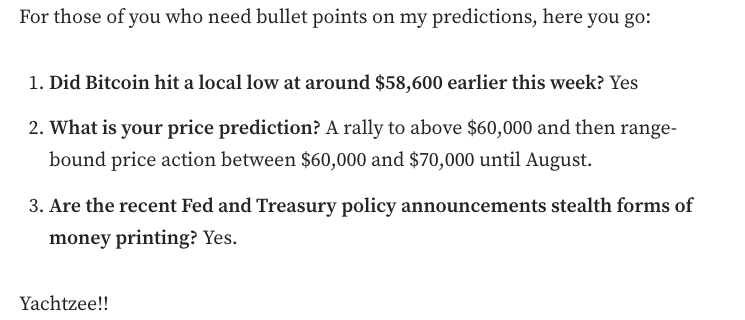

Arthur Hayes says the bottom is in for Bitcoin and is predicting (NFA) that the price will range until August. He’s not alone.

The SEC has delayed its decision on the Galaxy spot ETH ETF. The next deadline is the 5th of July. Staying with the SEC, they have labelled Ripple’s incoming Stablecoin an unregistered crypto asset.

The US House of Representatives voted to overturn a SEC bulletin that forced listed banks to hold BTC as a liability on their balance sheet. 21 Democrats crossed the floor to support the Republican bill, and they did this AFTER President Biden threatened to veto the bill. Crazy times.

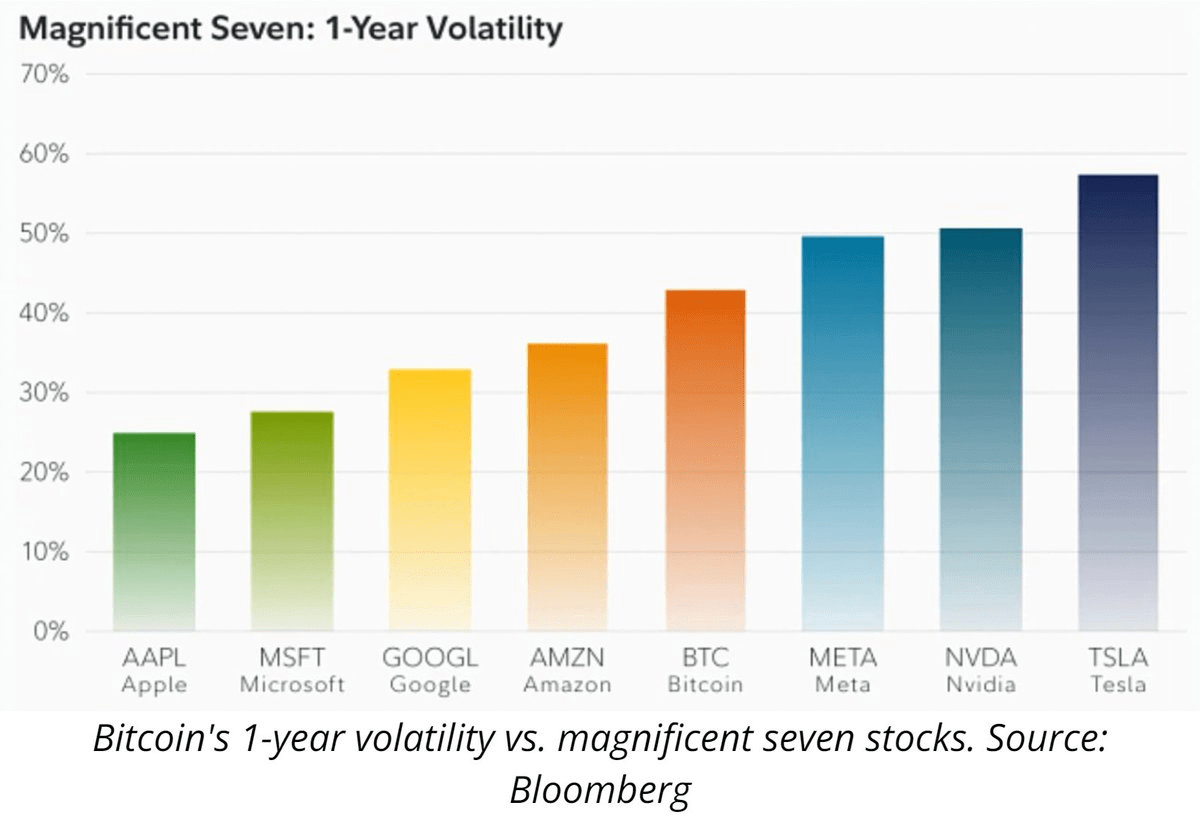

Bloomberg did some analysis on asset volatility. Turns out BTC is less volatile than Meta and Tesla.

Other notable highlights from around the crypto space:

- Robinhood’s crypto revenues are up 232% year on year. They also claim that they met the SEC 16 times before getting their Wells Notice.

- Remember Runes? They had a great start, however volumes have declined markedly since the launch.

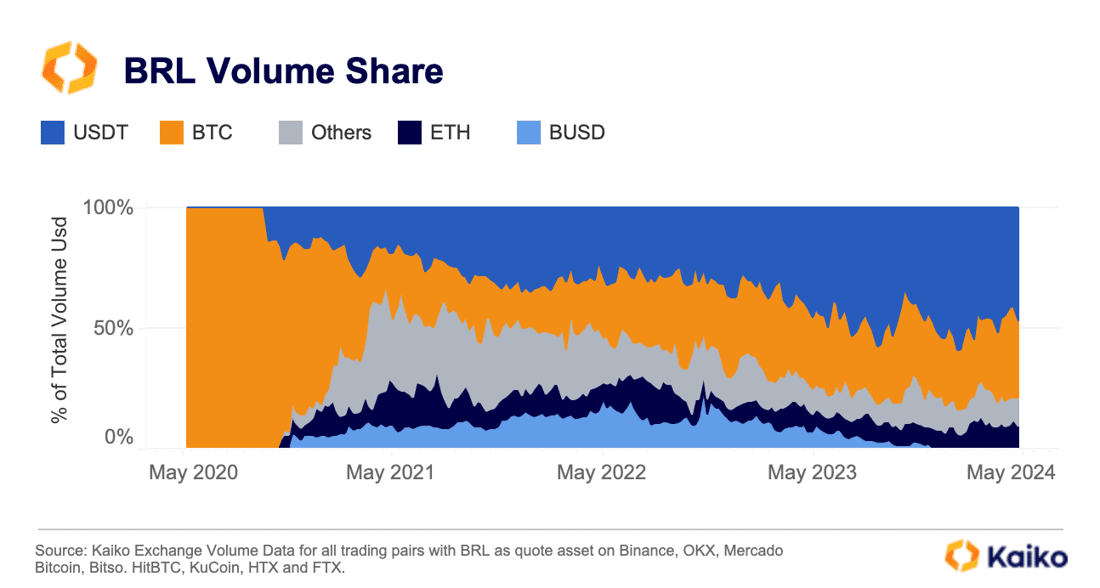

- Kaiko did a deep dive into Brazilian crypto adoption which has surged this year. Half of all volume is in stablecoins which indicates a different driver from other markets where BTC and ETH dominate.

- Mastercard is working with Citigroup, JP Morgan and others to test tokenised settlement.

- There is a report out that Binance chose its high rollers over its compliance program. Binance has denied it. Binance also gained approval to re-enter the Indian market.

- Tornado Cash developer Alexy Pertsev has been found guilty of money laundering and get 64 months in jail.

And that wraps up our highlights from around the crypto space. Stay tuned below for other macroeconomic updates from around the world.

What is going on in the world of Finance …

In a watch this space move, President Biden is quadrupling tariffs on EV’s (and some other goods) to 100%. Expect some Chinese retaliation and the impacts on EV pricing are unclear.

And Global M2, or liquidity, has just gone positive for the first time in a while. Liquidity tends to lead risk assets.

🌎 Macro news TLDR: …China is back in business.

U.S. economic news

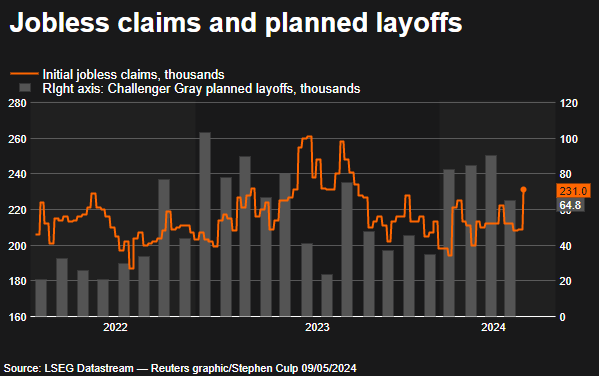

US jobless claims rose (i.e. unemployment) by 231k this week, which was higher than expected and more aligned to what the Fed wants to see.

A Michigan University consumer sentiment survey showed a big drop in May. US producer prices (PPI) was up 2.4% year on year.

Overnight we will get the US CPI reading for April, until this is out the markets are taking bit of a breather.

Meanwhile in Europe….

German industrial production for February fell less than expected at 0.4%. Economic sentiment is picking up too.

The BoE held its OCR steady at 5.25% but is moving closer to rate cuts. The UK’s GDP grew 0.6% in Q1, exceeding analysts forecasts of 0.4%.

They are officially out of recession. Employers in the UK are forecasting 4% wage increases in the next 12 months, which is above CPI.

And in Asia Pacific…

The BoJ has said they may have to change policy to manage the depreciating Yen as they are basically importing inflation… well, yeah.

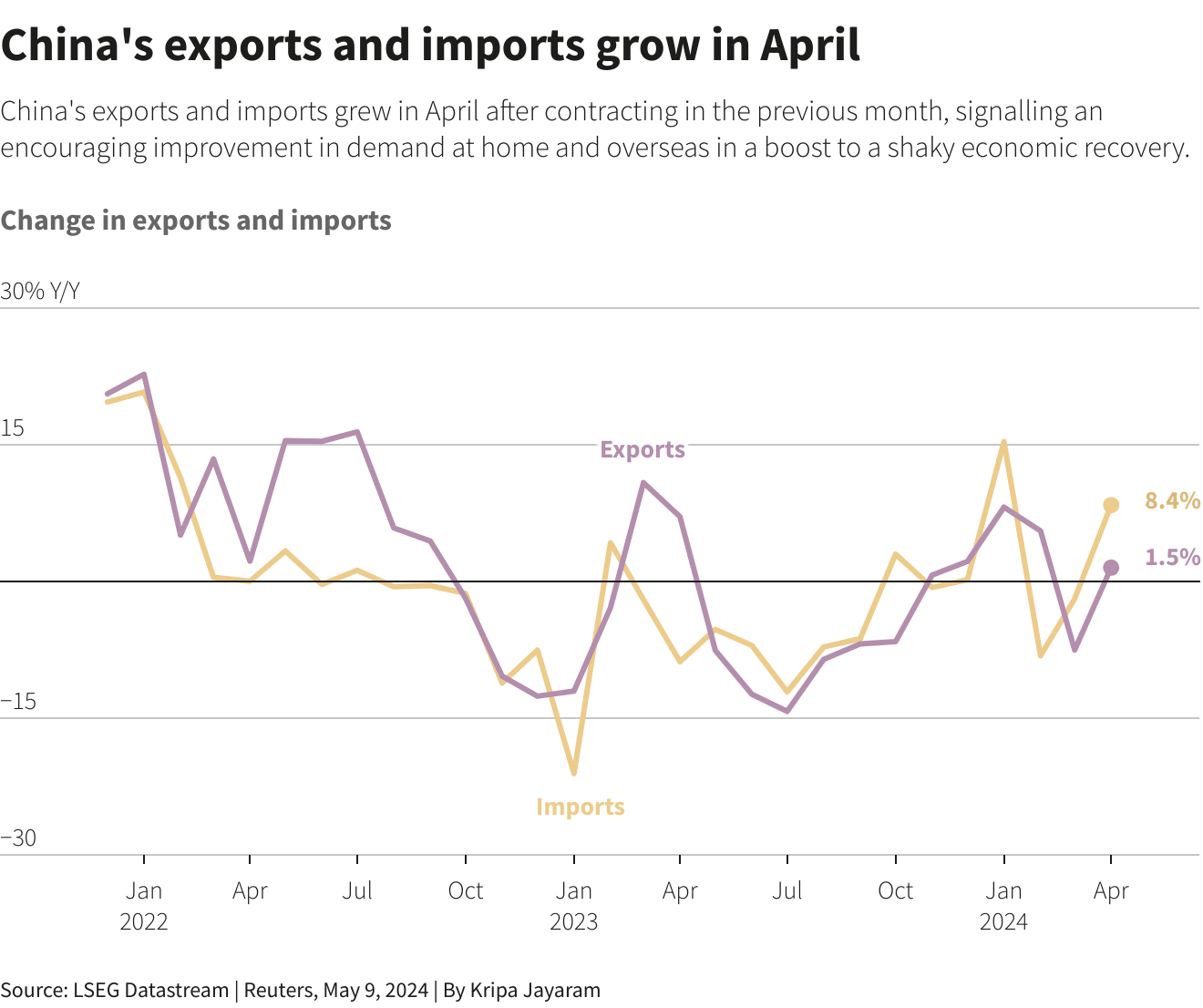

China grew both exports and imports in April, with imports doing particularly well. CPI for the year to April was 0.3%, however producer prices fell 2.5%. There was also a hint that the PBoC is starting quantitative easing via bond issuance.

Indian industrial production rose 4.9% in March, slightly below the rate expected. Indian CPI is stable at 4.83%.

Australian business confidence remains stable. The federal budget was announced Tuesday. Given its an election year it’s no surprises that there are tax cuts for all included.

While this year has an unexpected AU$9bn surplus off the back of corporate tax, the forecast isn’t so rosy as it swings into a AU$28bn deficit next year. It is hard not to see some of this as stimulatory and that will make the RBA’s job more difficult.

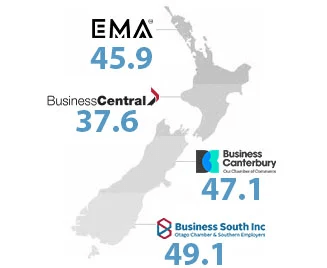

In New Zealand, manufacturing PMI for April has improved to 48.9, up 2.1 from March. Output from the central region is absolutely dire.

Stats NZ reports that food prices are up 0.6% in April, driven by olive oil, potato chips and chocolate. The RBNZ inflations expectation survey shows a marked downward trend revision and is much closer to the RBNZ target rates.

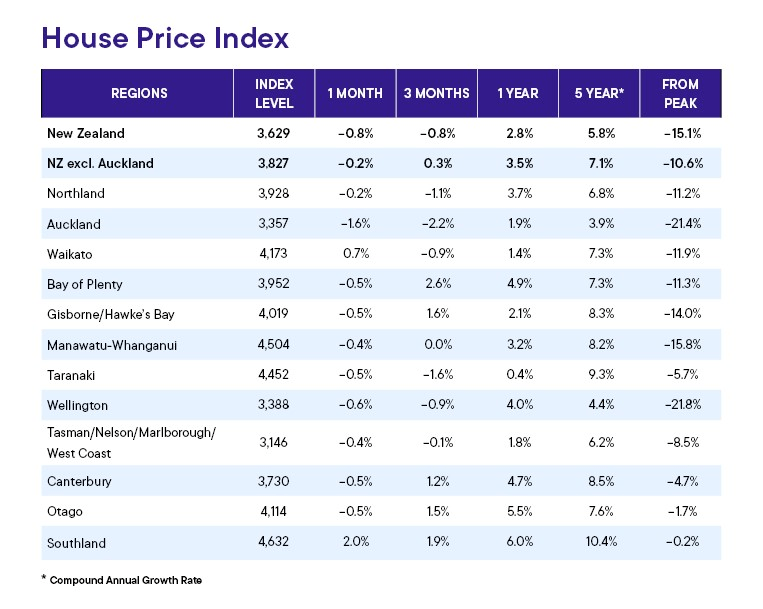

The REINZ house price index shows a continuing decline in median sell prices. Stats NZ reported immigration has trended down to 111000 in the year to March.

We recorded a net loss of 50000 NZ citizens for the first time ever. Stats also reported that retail spending is continuing to decline, down 0.4% on March.

That’s a wrap for this week.

Stay tuned for the next update.

Did you miss the last weekly update?

Share to

Stay curious and informed

Your info will be handled according to our Privacy Policy.

Make sure to follow our Twitter, Instagram, and YouTube channel to stay up-to-date with Easy Crypto!

Also, don’t forget to subscribe to our monthly newsletter to have the latest crypto insights, news, and updates delivered to our inbox.

Disclaimer: Information is current as at the date of publication. This is general information only and is not intended to be advice. Crypto is volatile, carries risk and the value can go up and down. Past performance is not an indicator of future returns. Please do your own research.

Last updated May 15, 2024