The Risk of Staking at a Centralised Exchange

Staking at a centralised exchange may seem lucrative and familiar to use. However, after recent events, you should be aware of its hidden risk.

When using a centralised exchange, you may sometimes find that it offers additional services such as staking.

The service generally works like an interest-bearing deposit account with alternative names — such as “earn” or “stake pool”. Sometimes, this service can offer lucrative yields — somewhere above 5% per year, particularly for tokens that are native to the exchange.

Consistent interest yields may sound enticing. However, in reality, such services bear more risks to the investor than staking it “the proper way” through a decentralised protocol.

To understand these risks, we need to know the actual definition of staking.

What is staking, really?

Staking is crypto lingo to mean depositing crypto assets in a special wallet or smart contract in order to participate in Proof of Stake consensus.

The consensus protocol allows the network to remain decentralised.

Here is how:

In order to update the blockchain with the latest transactions, validators (network maintainers) must compete with each other, in the same way politicians compete for the position of the next term. Validators who earned the leadership position get rewarded with newly minted crypto.

In Proof of Stake, validators compete by stacking up the most crypto.

In theory, those who stake the most are the biggest “stakeholder” of the network, and will therefore have a much higher chance of becoming a chosen validator in the next turn.

Simply put, the more they stake, the more they earn. To stake as much crypto as possible, investors must pool together (or delegate) their crypto to someone with the know-how to create a validator.

This is how staking services came about in the first place.

Learn more in detail: What is Proof of Stake (PoS) and How Does it Work?

Is staking at a centralised exchange “real staking”?

At the turn of the year 2021, many exchanges like to offer “staking services”. Arguably, some of these staking services are legitimate. The service serves the network by keeping the crypto wealth distribution about equal, and preventing a monopoly of staked crypto.

Typically, Proof of Stake staking offers an annualised (real) yield between 1 – 5% APY, according to staked.us. “Real” simply means that the yield % is adjusted for the cryptocurrency’s issuance or inflation rate.

However, some exchanges use the term “staking” in a misleading way. They would advertise a “staking service” that offers annualised yields of 20% or more. That’s simply not possible when adjusted for inflation.

Unsurprisingly, many copy-cat projects with high “staking” yields turned out to be fraudulent projects. Yet, even before the May 2022 crash of the Terra ecosystem, some of the most trusted names in crypto offered “staking”, albeit not actual Proof of Stake staking was involved.

Fake staking: When companies use “staked” crypto to lend them out

In order to sustainably pay out investors the promised high “staking” yield, the companies would use the “staked” crypto to be lent out.

The high interest rate for borrowing crypto would make more sense, because lending out crypto is a very risky business.

Of course, the lack of regulatory oversight in this area makes it easy for fraudulent companies to mislead investors. Unfortunately, many investors, especially those new to the crypto space, never thought about this — they only cared about the %.

The real cost of staking at centralised exchanges

Some exchange companies use the token that they themselves issued in order to backup their balance sheet. During the bull market, this would have been fine. The exchange token would have enough market value to balance out their debt to depositors.

They could then lend out the users’ “staked” crypto, and use the company-issued token as collateral.

But when the market began to crash in early 2022, the price of the exchange tokens came down with the market.

Suddenly, these companies find themselves having more debt (i.e. their users’ deposits for withdrawal) than the assets they are using as collateral — which were also losing value by the day.

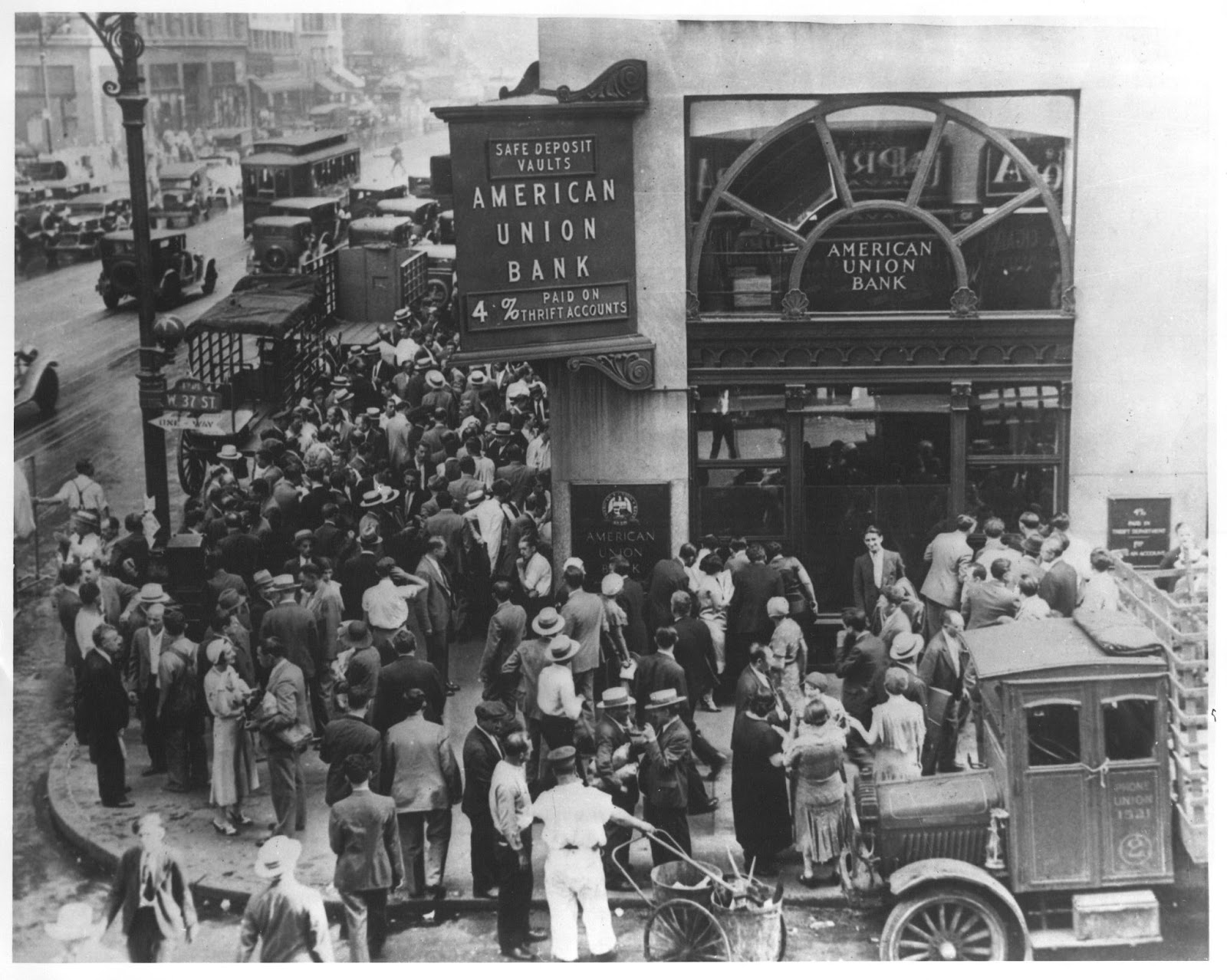

During 2022, we have seen multi-billion dollar companies collapse because they were hit with essentially bank runs.

Users would login and try to get as much crypto and money out of these companies, but there was not enough in its reserve to honour all withdrawals.

That’s called a credit crunch, and it has killed multiple companies, shut down a few well-known crypto tokens, and left investors suffering huge losses.

In a frightening sense, the inability to withdraw money has economically damaged more people than simply holding crypto through the bear market.

But isn’t it still risky to stake with DeFi protocols?

When people talk about the risks of staking crypto with DeFi, they are talking about the “normal” systematic risks that are inherent with crypto and smart contracts.

It is true that hackers have found security loopholes on some vulnerable smart contracts and crypto bridges. At this point in time, developers and investors are still learning to take the ethos of “code is law” very seriously.

When “code is law”, code has to be flawless at their job. There are, in fact, thousands of flawless smart contracts and DeFi protocols that have seen no complaints from users. Unfortunately, there is also vulnerable code.

But smart contracts will strictly do as they are programmed to do. For example, they will not blur the lines between staking and lending protocols.

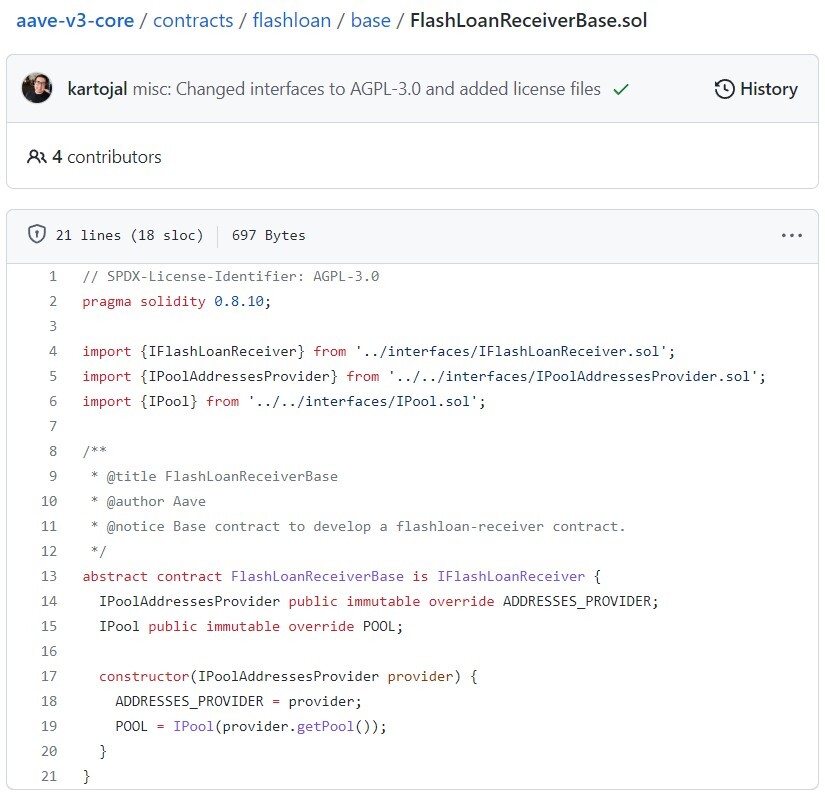

In fact, there are legitimate DeFi lending protocols that have worked for years — let’s use Aave as a prime example. Anyone can take a peak at its open source codebase, and verify that the contracts are secure.

None of these DeFi lending protocols had seen a credit crunch, because the smart contracts were well-made.

Another point to make is that while staking with DeFi protocols, users will absolutely have control over access to their funds. You could, for example, stake billions of dollars worth of ATOM coins and delegate it to a validator. After seven days, you could transfer the same billion dollars back to your private wallet.

No one would complain, because behind these protocols are cold, emotionless self-executing “robots” doing what they’re programmed to do.

Deep dive into Aave: What is Aave (AAVE)? The Popular Lending Protocol

It is ultimately your choice

When staking at a centralised exchange, be sure to ask yourself this question: “How do I know that I’m actually staking?”

On DeFi protocols, you can verify for yourself that the smart contract you are interacting with is the right one for the job, and not for anything else. On DeFi, your funds couldn’t be misused if the code that governs the smart contract is precise and secure.

However, at this stage, it is true that DeFi protocols can sometimes be a hassle to work with. Centralised exchanges offer the comfort and familiarity of an online bank. Please be mindful that exchanges are not regulated in the same way as banks do, though they may act like one.

Easy Crypto is not an exchange. We’re more like a money changer. You transfer to us fiat money, and immediately, your crypto is on its way to your wallet. We don’t hold user funds, and we never do.

That’s because we know our place — we are not a bank.

We are simply your friendly crypto broker! 🙂

Further reading: Explore more topics on all things crypto investments.

Share to

Stay curious and informed

Your info will be handled according to our Privacy Policy.

Make sure to follow our Twitter, Instagram, and YouTube channel to stay up-to-date with Easy Crypto!

Also, don’t forget to subscribe to our monthly newsletter to have the latest crypto insights, news, and updates delivered to our inbox.

Disclaimer: Information is current as at the date of publication. This is general information only and is not intended to be advice. Crypto is volatile, carries risk and the value can go up and down. Past performance is not an indicator of future returns. Please do your own research.

Last updated September 5, 2023