What is Lido Staking? Liquid ETH Staking Explained

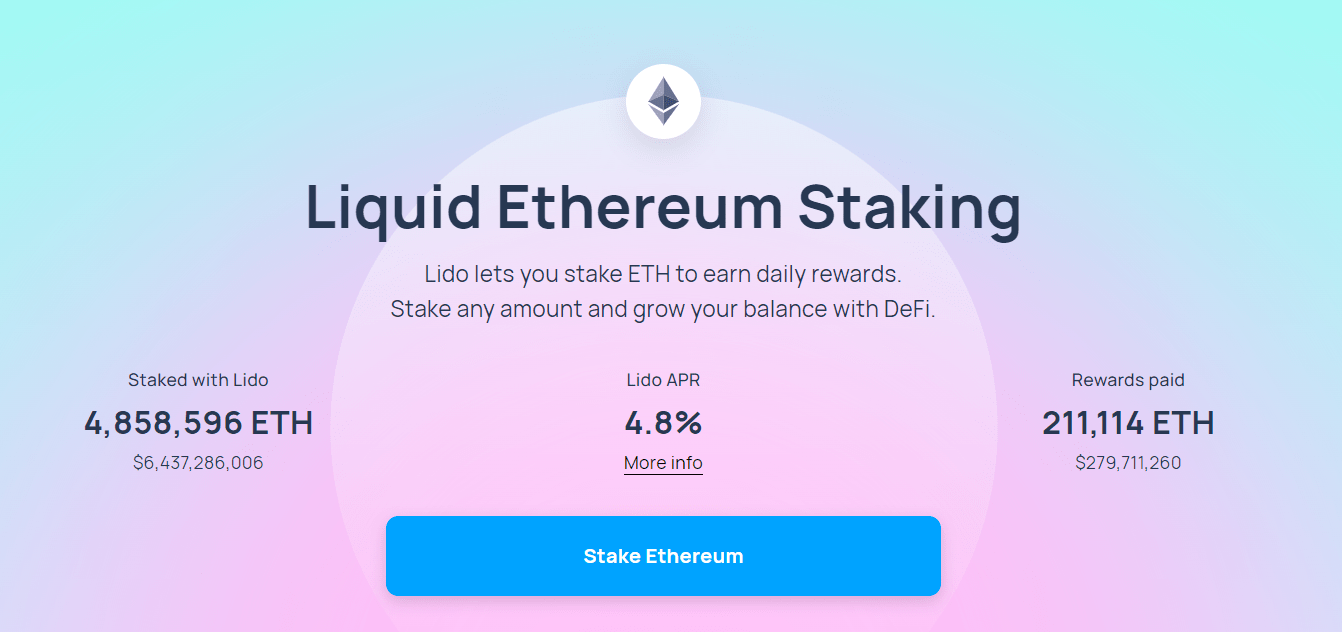

Lido allows users to stake ETH without needing to wait too long until ETH withdrawals can happen. Learn more about liquid ETH staking with Lido.

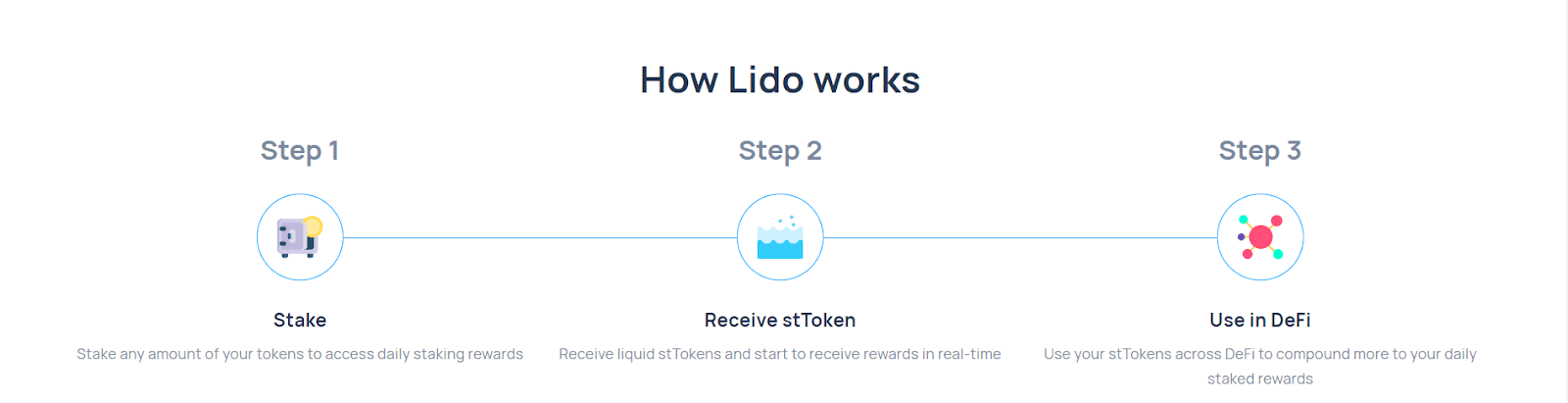

Lido is a DeFi platform that allows ETH holders to stake ETH easily on the Ethereum mainnet. However, there are also added benefits to staking ETH with Lido. One of which is that you get a special token that is pegged to ETH, called stETH or staked ETH tokens.

In this guide, we’ll cover liquid ETH staking and more importantly how Lido works and how it can benefit you.

What is Ethereum? Read our guide to master the basics of Ethereum.

What is Lido staking?

Lido staking solves a problem that is still apparent with the Proof-of-Stake Ethereum network. When an ETH holder stakes ETH onto the mainnet, it is temporarily locked.

The locking period is not the problem — stakeable cryptos generally have a locking period after the first staking transaction.

The problem with Ethereum is that until now we don’t know when the locking period will end. Currently, staked Ethereum is illiquid until the next update — called the Shanghai update. This will allow ETH to be withdrawn from the decentralised network.

What is Proof of Stake? Proof of Stake (PoS) is a protocol for validating transactions on the blockchain by allocating resources to prioritise holders with the most amount of crypto to validate the transaction, and earn the rewards for successfully doing so. Learn more about PoS.

Meanwhile, ETH, as the second-largest cryptocurrency in the world, has so many economic benefits within the DeFi ecosystem. For some, locking it away for an undetermined time seems counter-productive.

Introducing stETH tokens

The stETH token (staked ETH token) on Lido is like a deposit receipt. For every unit of ETH that you stake, you get the same amount of stETH. When ETH withdrawals become available, you can redeem 1 ETH for every 1 stETH.

Of course, this means that on average, stETH tokens are worth somewhat the same as an ETH coin. Without losing the original value of ETH, stETH can then be used on other DeFi platforms.

For example, you can trade stETH against stablecoins or Bitcoin on decentralised exchanges like Uniswap. You can also borrow other assets against stETH on Maker, in much the same way as you would with ETH.

What are stablecoins? Stablecoins are a type of crypto whose value is pegged to an external asset such as fiat currency (for example: U.S. Dollar) or precious metals (for example: gold). This stabilises their value while retaining the benefits of being a cryptocurrency. Learn more about stablecoins.

Other benefits of using Lido

Unlike other cryptocurrencies, Ethereum doesn’t provide a beginner-friendly infrastructure for staking. This means you have to go and actively search for a staking pool.

Even if you are technically inclined, you are forced to stake 32 ETH to operate an Ethereum validator node.

The overhead work for validator node setup, and the general lack of beginner-friendly directions, could spell doom for Ethereum’s security if it wasn’t the second-largest crypto in the world.

Fortunately, Lido, among other staking pools, have made it so easy for ETH holders to stake ETH at any amount!

Since Lido is run by professionals, there is also less likelihood of staked ETH being slashed by the Ethereum network for any unexpected technical issues. Additionally, Lido is self-sufficient. It has a 10% fee that is automatically applied to your earned rewards.

In summary, the benefits of using Lido for staking ETH are as follows:

- Users can earn daily staking rewards.

- Users can stake any amount of ETH, and not the 32 ETH required to run a node.

- Users can use stETH to preserve the value of their locked ETH, and use it on other DeFi platforms.

- Users own their own staked ETH 100%, as the staking mechanism uses Ethereum smart contracts.

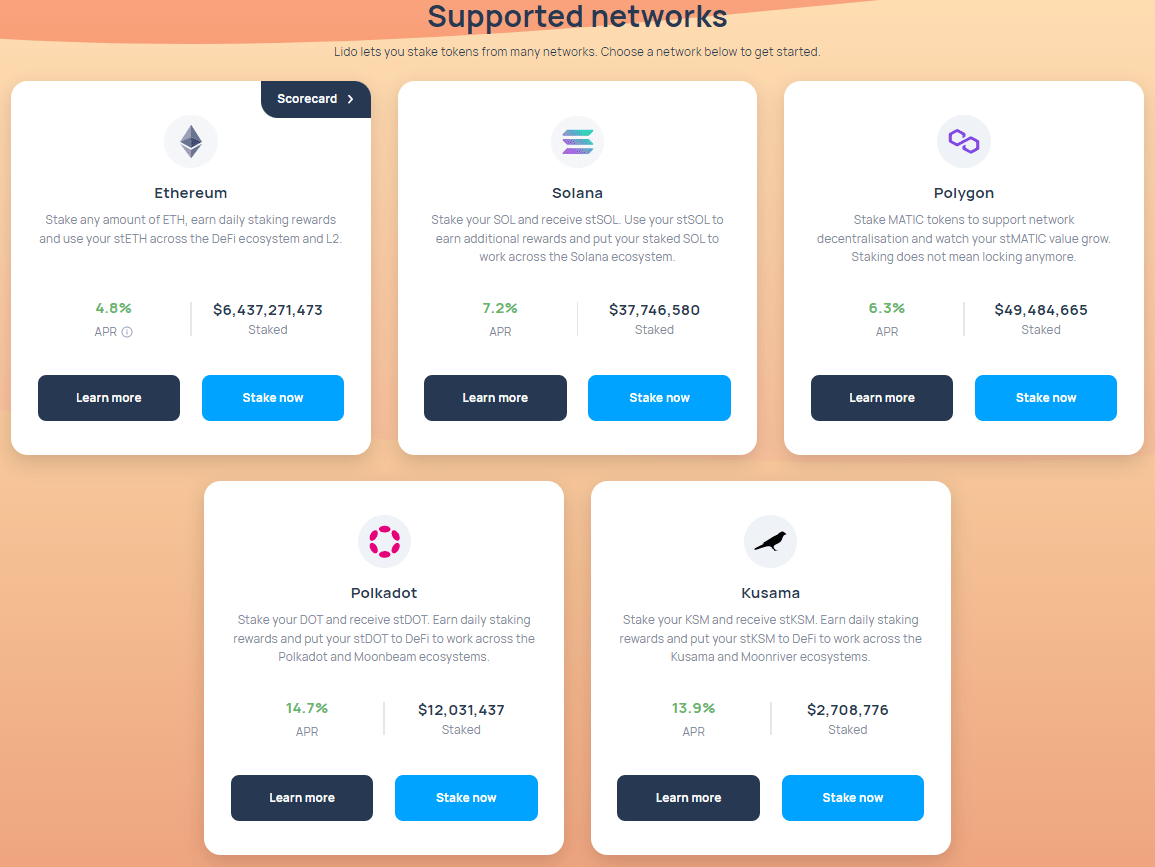

- Added bonus: Lido now offers liquid staking for Solana (SOL), Polygon (MATIC), Polkadot (DOT), and Kusama (KSM).

How to stake ETH with Lido

Here is a step-by-step short guide to staking ETH on Lido.

- Visit stake.lido.fi and click “Connect Wallet.” Make sure to double-check the URL. It’s stake.lido.fi and not anything else.

- You can connect to Lido with any valid ETH wallet, such as Metamask, MyEtherWallet, and more. If the connection is successful, you can view your ETH balance on Lido.

- You can stake any amount of ETH — even the smallest amount. Enter this amount and click “Stake”. Please bear in mind that you still need to pay gas fees. It could be more efficient to stake a bigger amount of ETH than a smaller amount — but again, it’s up to you on how much ETH to stake.

- Once you click “Stake”, your wallet will let you know that a transaction is about to occur. Confirm this transaction.

- Automatically, your wallet will receive stETH, which represents your staked ETH on the mainnet. Your stETH balance will also increase daily as you receive daily staking rewards.

What’s the risk of staking with Lido?

It’s fair to talk as much about risks as well as the benefits of staking ETH with Lido. We’re not going to talk about the inherent risks of holding cryptocurrencies — that’s a given. Instead, there are additional risk factors that you should take into consideration:

Changing staking APY (Annual Percentage Yield)

Ethereum is built so that there is a balance between staked ETH and ETH that are in free circulation. An algorithm controls the annual reward rate (the APY or Annual Percentage Yield) depending on the total amount of staked ETH on the Ethereum mainnet.

As more ETH is staked, the APY decreases. This makes sense because staking rewards (newly issued ETH) are limited over a period of time. Too many stakers will decrease the reward, which could incentivise some stakers to unstake and do other things.

The price of stETH fluctuates

The value of 1 stETH isn’t always exactly equal to 1 ETH — there is no hard fast rule that the price must be 1:1. The price is largely determined by the open market, much like how 1 USDT isn’t always exactly equal to 1 real US dollar.

In the recent past, the price of stETH has been in the “discount territory”, meaning that it sells for less than 1 ETH. This happened because a bankrupt crypto firm Alameda Research was selling large quantities of 1 stETH at a discount, to regain some of its losses.

An unexpected incredible delay in the upcoming ETH withdrawal update could also push the price of stETH down. This can be caused by ETH stakers who become impatient and want their original ETH back — so they’re likely to sell stETH at a discount to get out of their stETH position quicker.

DAO management risk

Lido is not run by a company. Instead, it is run by the Lido DAO (Decentralised Autonomous Organisation), consisting of large LDO token stakeholders. A portion of the ETH stake via the Lido DAO is held across multiple accounts that the DAO owns and have the private keys for.

If a hack occurs, users could most likely still redeem their ETH (because it’s not held in custody). However, the stETH price may decrease as panic selling sets in, upon news of a breach.

The takeaways

Lido is a well-known Dapp among the Ethereum community. It allows users to stake ETH without going through the hassle of the traditional staking method. Additionally, it also allows the DeFi ecosystem to thrive because the value of staked ETH is preserved through the stETH token.

We’ve covered both the benefits and risks of staking with Lido. If you’re considering staking ETH on Lido or buying stETH tokens from the market, please make sure to do further research so that you can become more confident with your decisions.

Further reading: Explore more topics on all things crypto in our learning hub.

Share to

Stay curious and informed

Your info will be handled according to our Privacy Policy.

Make sure to follow our Twitter, Instagram, and YouTube channel to stay up-to-date with Easy Crypto!

Also, don’t forget to subscribe to our monthly newsletter to have the latest crypto insights, news, and updates delivered to our inbox.

Disclaimer: Information is current as at the date of publication. This is general information only and is not intended to be advice. Crypto is volatile, carries risk and the value can go up and down. Past performance is not an indicator of future returns. Please do your own research.

Last updated January 24, 2023