Weekly Market Update: Crypto M&A Heats Up

In this weekly crypto market update, we take a closer look at the increasing activity in M&A and the momentum its building. We also discuss other macro economic developments and highlights from around the world.

This week some volatility was reintroduced to the market, with Bitcoin dropping as low as US$35k before recovering.

The core drivers remain positive for Bitcoin and Crypto: the looming ETF, Bitcoin halving and increasingly likely looser monetary policy from central banks. Market commentators are hoping all of this lines up for 2024.

As a result, we are starting to see market consolidation happening, with two key news companies being bought out this week, but if we are in the bull, we think we will see more of this as companies try to time the market.

The majority of Bitcoin holders are now in profit and there are reports that NFT volume is picking up. We continue to see institutional moves with more players getting into margin trading and other derivatives that institutional types know and expect from a maturing market. My take, it’s just another box ticked that we are getting there.

Globally, oil, as a barometer for global economic activity, has remained flat despite the unending conflict in Israel and green shoots of growth are appearing in some markets.

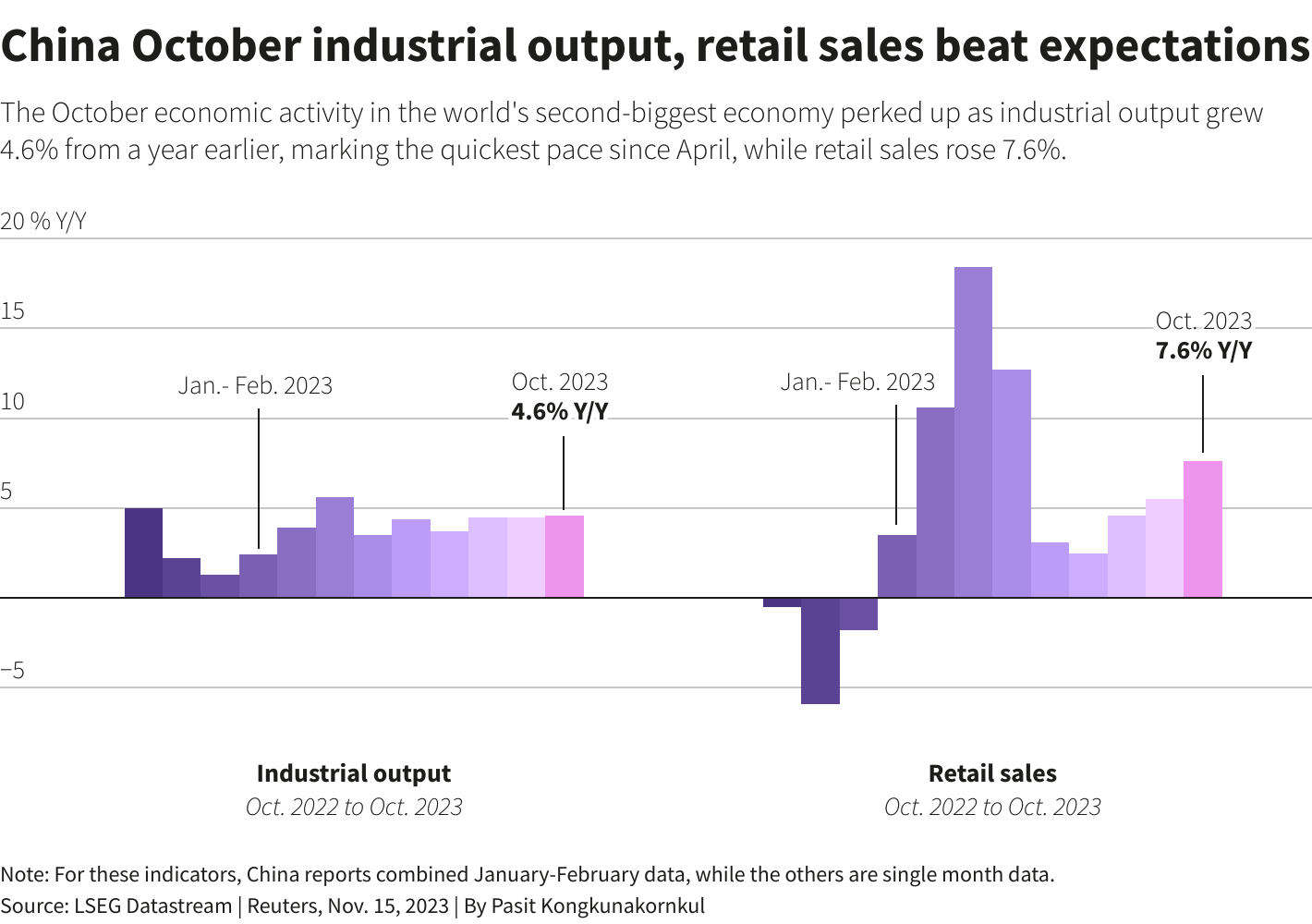

In major economies, US wholesale inflation is down, while the UK finally caught a break with some good inflation data out. Japan’s economy has slowed in the last quarter while China’s industrial output has improved. Their property sector remains …sickly?

Locally, Australia’s employment numbers were flat while in New Zealand immigration is running at all time highs, however retailers are feeling the pinch.

As you may have seen it’s been a massive week for us here at Easy Crypto releasing two new products – a new stablecoin, NZDD that will really help Kiwi investors, businesses and individuals maximise their plans with a local reliable stable.

We have also launched our very own Easy Crypto Wallet giving users one wallet that works across multiple blockchains combined with state of the art security.

Both these products have our typical approach of making things ‘easy’ and come fresh off the back of also releasing our Swaps service last week.

As we always say, crypto winters are for building. We hope you like the new products and we are absolutely open to feedback on how we can evolve and improve them for you.

Big thanks to everyone who joined our ‘first minted’ NZDD coin + NFT competition! We’re blown away by the massive interest, and we’re ready to draw and notify the winners via email later this week. The prizes are about to be unleashed too! 🎁 Stay tuned!

The Crypto market sentiment is unchanged this week with us remaining in greed territory.

Highlights this week:

- On the Easy Crypto platform, the big price moves in November mean we have had the highest ratio of buying to selling in 2 years. Game on!

- Another solid week of price action for the majors, however we do see some evidence of profit taking with some falling in price.

- At the time of writing BTC was up 1.5%, while ETH outperformed, up another 5%.

- THORChain (RUNE) led the way this week, up 45%. Avalanche (AVAX) also ripped, up 31%.

- Our biggest loser this week was TrustWallet (TWT) which gave up a lot of last week’s gains due to Binance launching its new wallet, it was down 35%.

View all top gainers: Visit the top gainers page to find out more.

Looking for more flexible pricing and trading volume for your high-value crypto trades? Get in touch on our OTC page and learn how we can help.

Highlights from the crypto space

Will Clemente reports that 80% of Bitcoin wallets are in profit! This is up from 50% in January.

The SEC delayed its decision on converting Hashdex’s Bitcoin Futures ETF to spot, it also delayed Greyscale’s ETH futures ETF application. Looks like we are lining up for an approval next year. Blackrock has officially filed for the long awaited Spot ETH ETF.

Staying with the SEC, they have filed against Kraken for running an unregistered securities exchange commingling client funds. Sounds familiar.

Cathie Wood at Ark Invest has a base case for Bitcoin being $600-650k in 2030.

Cboe is launching margined futures trading for BTC and ETH.

News site The Block has got a new majority shareholder, Foresight ventures. Coindesk has been purchased from DCG by Bullish. Fnality also raised a bunch of money from Goldman Sachs and other banks.

Other notable highlights from around the crypto space:

- OKX is taking a leaf out of the Coinbase playbook and launching its own layer 2 based on Polygon.

- NFT volume has hit a 4 month high.

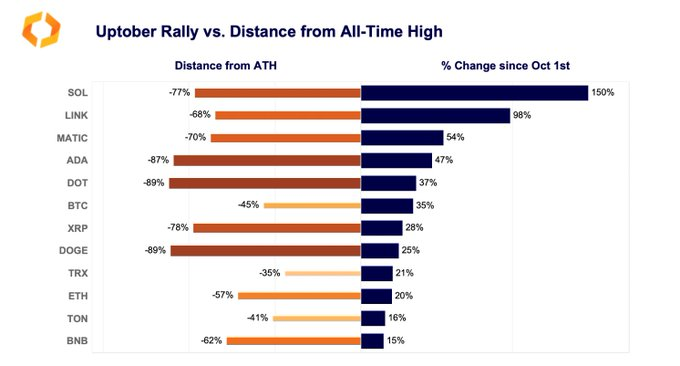

- Kaiko did a fascinating comparison on asset performance since 1 October and included the distance from the All Time High. TLDR; as good as it’s been, we still have a long way to go.

- JP Morgan is tokenising funds using Avalanche in a proof of concept leveraging Singapore’s Project Guardian rules. Coinshares has secured an option to purchase Valkyrie investments ETF unit.

- Pancakeswap is launching a gaming marketplace in a sign of where they think the next big trend is.

- Coinbase has updated its commerce product to do onchain payments in USDC.

- Reports from Bloomberg suggest that the US Justice department is seeking $4 billion from Binance as resolution for a ‘string of legal and regulatory issues”.

- Tether, Chainalysis and OKX teamed up to freeze $225m in assets linked with human trafficking. The request came from the US Justice department.

- Argentina elected a pro Bitcoin president. He’s got plenty of plans to shake things up which might be what they need.

And that sums up the major updates from around the crypto space. Moving on, we’ll take a closer look at other macroeconomic developments from around the globe.

What is going on in the world of Finance …

Oil has had a fairly wild week but closed out about flat on news that OPEC+ will likely keep its supply controls in place next year.

🌎 Macro news TLDR: …Oil eases on weaker global growth

U.S. economic news

It looks like there is bipartisan support for a stopgap bill to avert the government from partial shutdown. This time the can has been kicked to January 19th.

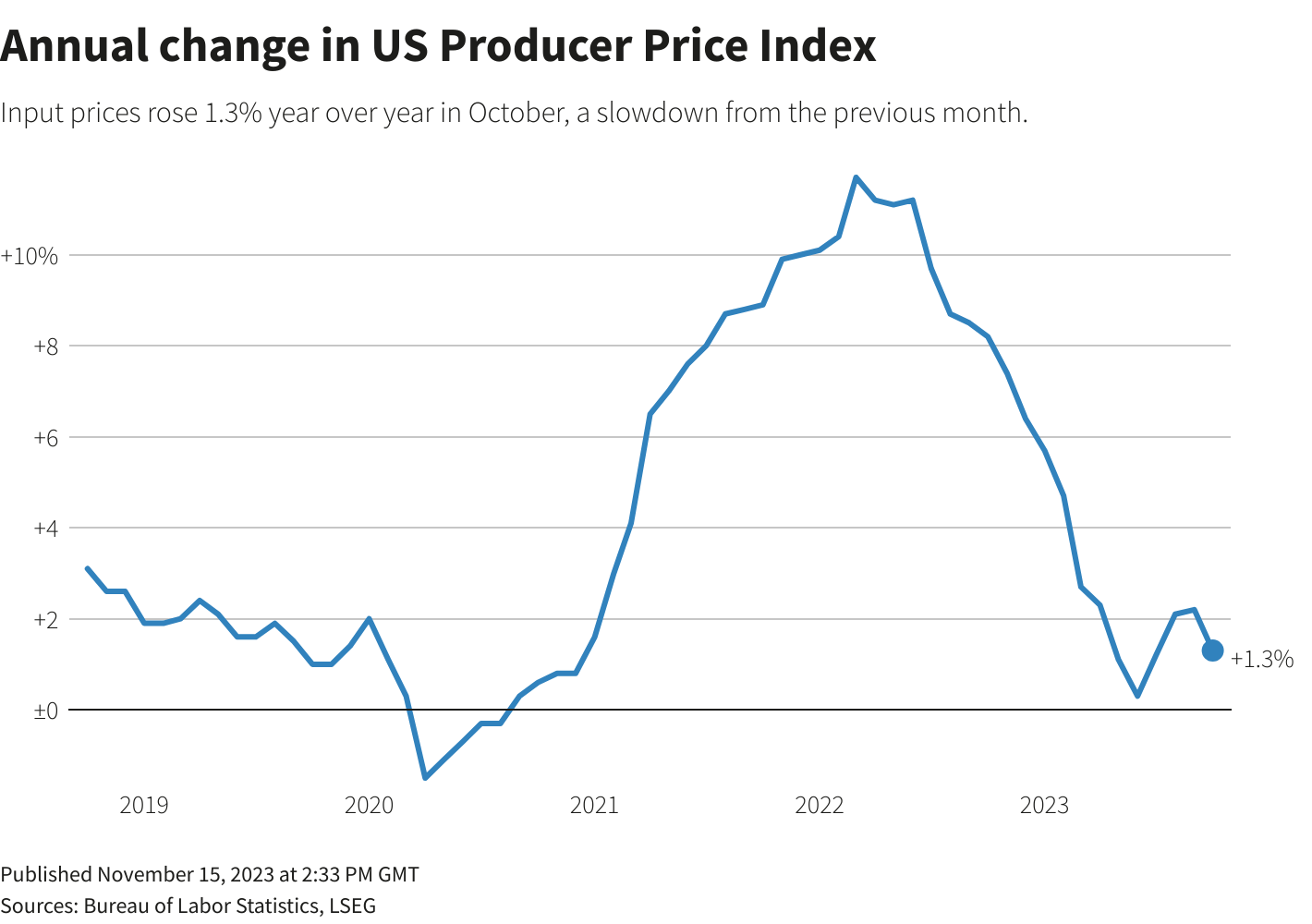

In the economy, retail sales were softer and PPI (wholesale inflation) was unexpectedly soft, coming in at 1.3% annualised.

Meanwhile in Europe

UK wage growth has slowed slightly in the last quarter to 7.7% annualised, unemployment levels remain steady at 4.2%.

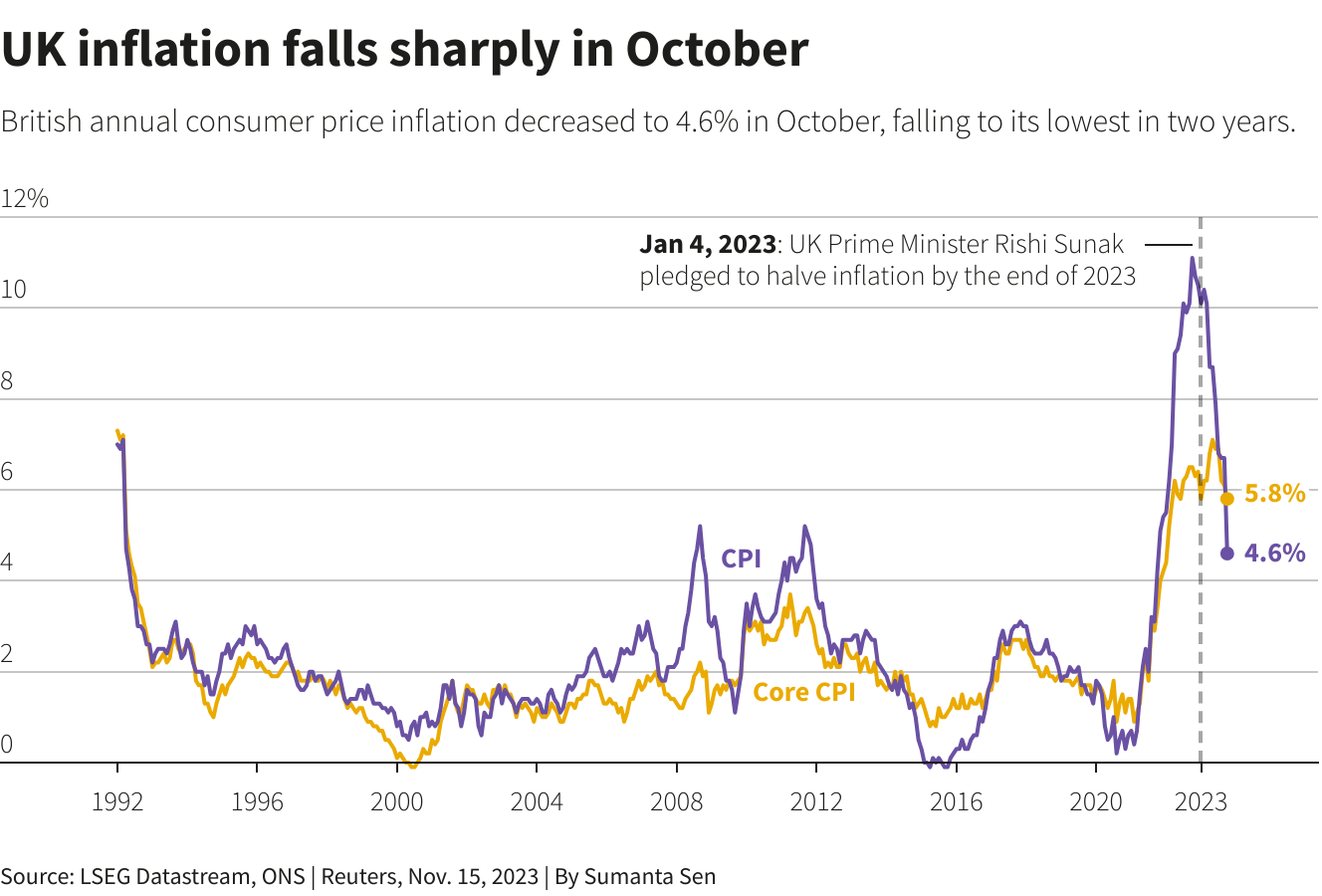

UK inflation plunged from 6.7% in September to 4.6% in October in some welcome news. Core inflation fell to 5.7% supporting the view that large falls in energy are helping. Retail sales fell in October. That economy is clearly slowing down.

And in Asia Pacific…

Chinese industrial output and retail sales all improved in October, however there is a lot of noise in the data and some notable parts of the economy, namely property which has just recorded 4 months of house price declines, are clearly struggling. China’s central bank resisted the urge to pump in more stimulus by holding its key rates steady.

Japan’s economy went into contraction last quarter, with GDP down .5% on the back of weak consumption and a stagnating global market.

In Australia, their unemployment rate has remained steady, indicating what we all suspect; the RBA has more work to do to tame its economy.

In New Zealand, retail card spending in September was down 0.7% with economists saying that this trend is likely to continue.

October trade data from Statistics NZ reports a smaller deficit than the month previous at $1.7bn, which is a $14.8bn annualised trading deficit.

Statistics NZ reported that we had two new population records. One was a record loss of NZ citizens – 44k in September. The other was a record overall net gain of 119k people.

That’s a wrap for this week. Thanks for reading!

Stay tuned for the next update.

Did you miss the last weekly update?

Share to

Stay curious and informed

Your info will be handled according to our Privacy Policy.

Make sure to follow our Twitter, Instagram, and YouTube channel to stay up-to-date with Easy Crypto!

Also, don’t forget to subscribe to our monthly newsletter to have the latest crypto insights, news, and updates delivered to our inbox.

Disclaimer: Information is current as at the date of publication. This is general information only and is not intended to be advice. Crypto is volatile, carries risk and the value can go up and down. Past performance is not an indicator of future returns. Please do your own research.

Last updated November 23, 2023