Weekly Market Update: Ethereum Turns Deflationary

In this weekly market review, we take a look at movements in the Ethereum ecosystem, memecoins, and other macro economic and crypto developments from around the world.

All the memecoin mania on both Ethereum and Bitcoin has been a boon for both protocols. Etherum has a volume based burn mechanism, which is turning it deflationary.

While the volume driven by BRC 20’s on Bitcoin has spiked miner fees. Layer-2 solutions are benefiting as people look to escape the higher fees.

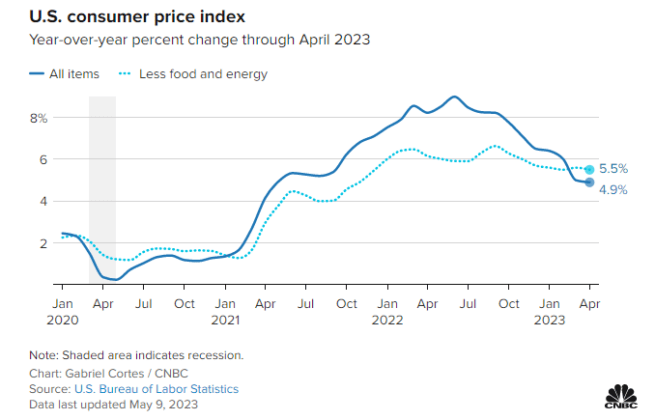

In Macroeconomic news, Europe looks like they are lagging the US by a few months on taming inflation, and GDP for those nations is way lower. The US numbers are trending in the right direction, however there are concerns those who think we will soon get rate cuts might be on hopium.

In APAC, India continues to outperform on most economic metrics. Meanwhile, the worrying trends we have seen in China continue. Australia looks like it’s dancing with a recession and New Zealand looks like we might be there already.

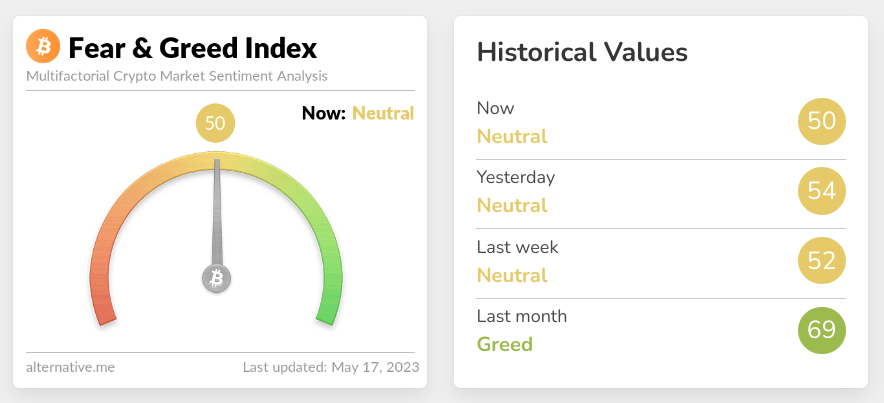

The crypto market sentiment index has remained flat and continues to hold in the neutral territory.

This week, we see a continuation of last week’s trend with slight price reductions across most of the top assets.

Trend highlights this week:

- As of today, BTC and ETH closed the week down 2%.

- While BNB, SOL, ADA, and XRP were all basically flat, down a half a percent on the week.

- Our biggest gainer this week was Lido DAO (LDO) up 19%.

- Bitcoin SV was our biggest loser this week, down 14%.

- As was the new memecoin PEPE off the back of some initial astronomic rises.

View all top gainers: Visit the top gainers page to find out more.

Looking for more flexible pricing and trading volume for your high-value crypto trades? Get in touch on our OTC page and learn how we can help.

Highlights from the Crypto Space

Glassnode’s recovery from the Bitcoin Bear dashboard has all 8 indicators green.

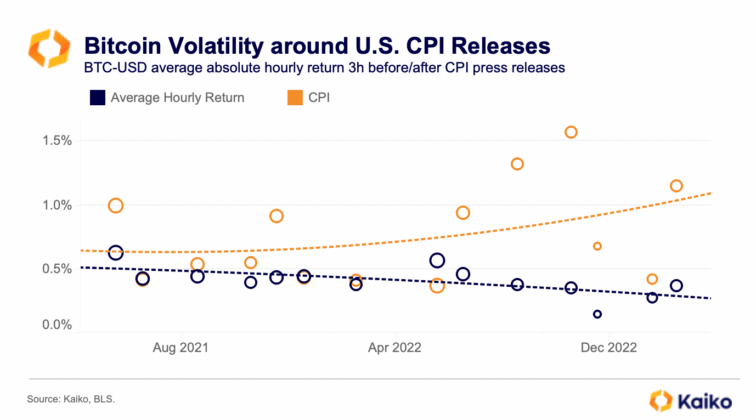

Kaiko research supports what we suspected, BTC has been way more volatile around the US CPI releases.

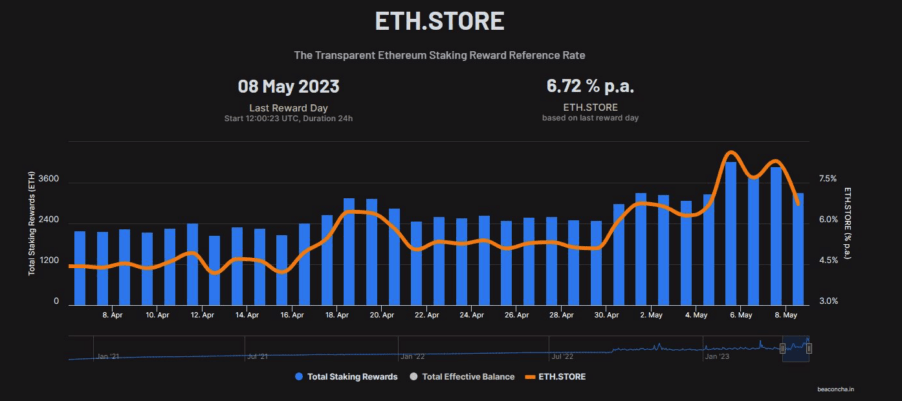

ETH stakers have benefited from the PEPE memecoin mania, with rewards hitting a record 8.6% APY.

This volume also drove an increase in ETH’s burn rate, with total Supply down 1.7% in 7 days. Blockworks is saying $1.1bn has been burnt since August.

This mania may be the cause of a couple of incidents on the Beacon chain. TLDR; network traffic disrupted validators from syncing properly, however transactions continued on Ethereum and some would argue it proves how resilient ETH2 is to outages.

Patches have been released to the Ethereum clients to prevent this from happening in the future.

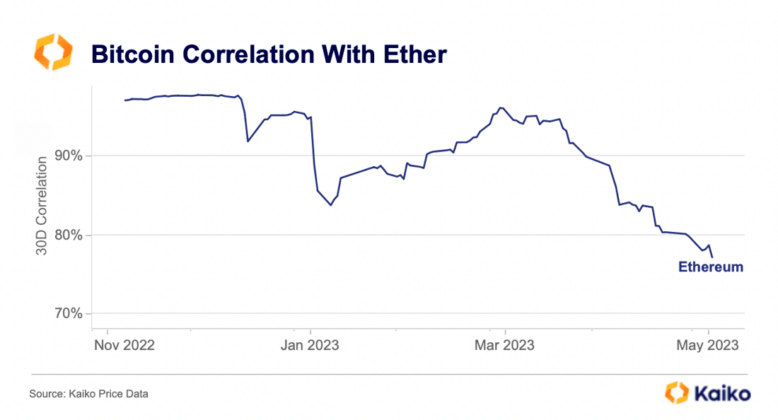

ETH’s correlation with BTC has been steadily falling, with Kaiko hypothesising that they are on differing narratives now.

Finally, the largest ETH staker, Lido finance, has enabled withdrawals with the release of its V2 contract.

Paypal’s filings to the SEC show it is custodying 950m of assets, mostly BTC and ETH.

US institutional market makers Jane Street and Jump are pulling back on their activities due to the US regulatory uncertainty.

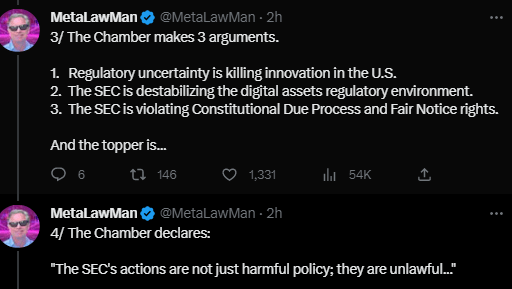

A powerful lobby group, the US chamber of commerce has filed in support of Coinbase against the SEC.

Other notable highlights from around the crypto space:

- The G7 finance ministers are urging the FATF to tighten rules on P2P crypto transactions

- Crypto.com is adding an AI called Amy to help educate people on crypto.

- Tether has been on an amazing ride this year, capturing a lot of growth at USDC’s expense. The Block reports they made $1.5bn net profit in Q1 due to its growth and increase in interest rates.

- Binance is making overtures to the UK regulators as its US problems continue. Binance (along with others) is exiting Canada citing an untenable regulatory environment.

- The Electronic Frontier Foundation has won the right to challenge the right to publish code under the First Amendment. TLDR; They are arguing that that Tornado Cash takedown was illegal because it is just code.

- Former Ethereum miners are saying that their GPUs can be used for the AI boom. Nice pivot.

- Custodial customers of Blockfi can be repaid their crypto holdings, but not those in the lend service.

With that said, we’ll continue to dive deeper onto other macro economic news and developments from around the globe.

Starting off with global news

Global freight container costs continue to fall, down 77% year on year and 35% below the 10 year average. Supports the view that most inflation is now domestic.

🌎 Macro news TLDR: US inflation declines, Europe has more work to do.

U.S. economic news

The high stakes game of posturing over the US debt ceiling continues with both sides pointing fingers. Everyone knows that this will be sorted, it’s just how.

US CPI figures for April showed the rate of inflation is continuing to fall, down 0.4% for the month with Core inflation coming in on expectations at 5.5% annualised.

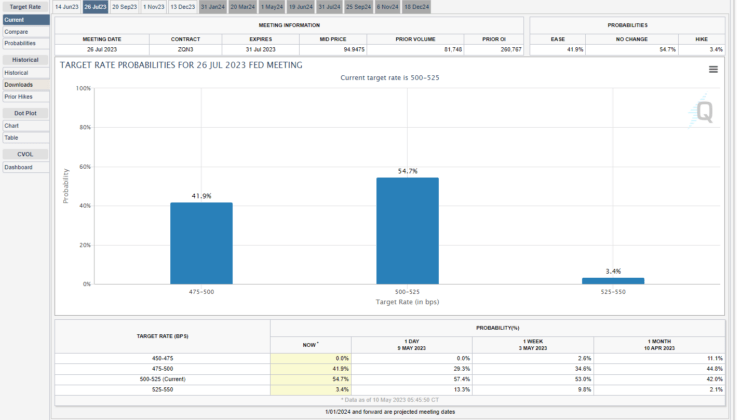

Amazingly, at one point last week the markets had 41% predicting a rate cut in July.

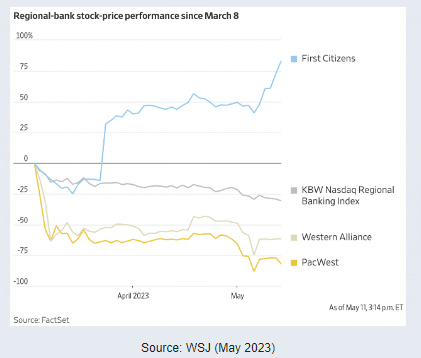

Share prices of regional banks continue to slide with Pac West in particular being hammered. The trend of deposit flight on these regional banks has not stopped, putting them into what looks like a death spiral.

Meanwhile, in Europe

In the UK, wages have increased 10% in the past year, which is about where CPI is, core CPI is at 5.7%. In response the Bank of England has increased the interest rate 25 bps to 4.5%.

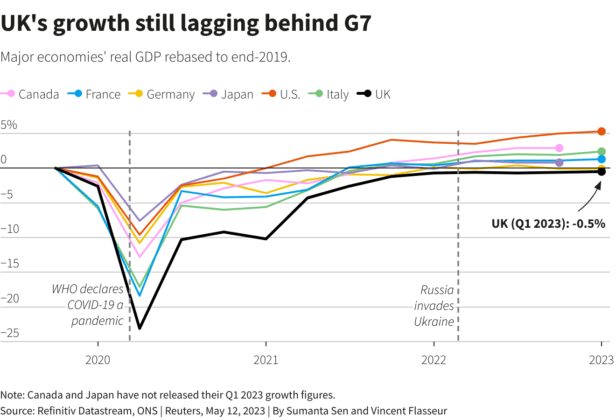

Strangely, they are now no longer forecasting a recession as GDP is forecast to be flat. Interestingly enough UK GDP growth is still lagging other key economies.

Germany has confirmed that April’s inflation number was 7.2%.

In Ukraine news, EU nation states are meeting this week to curb sanction circumventing countries such as China, Iran and potentially also India whose inputs of Russian oil are up 10x.

And in Asiapac…

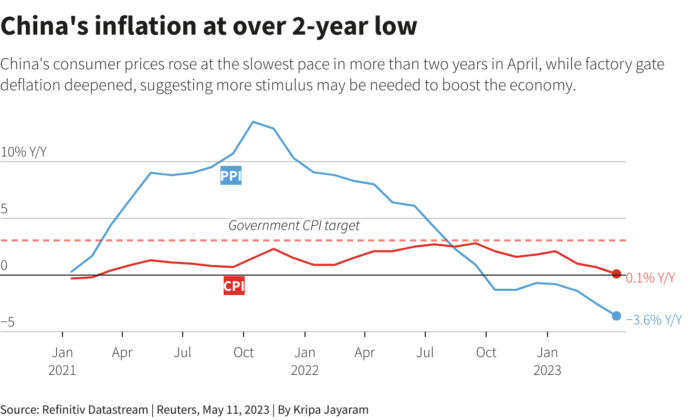

China’s CPI inflation continues to decline, and now sits at 0.7% annualised. Concern is increasing over Producer Prices, with PPI down 3.6% year on year.

TLDR, seller prices are falling rapidly and they may be heading for deflation.

India’s CPI fell ~1% in April to 4.7%, however industrial production for March unexpectedly fell too. Malaysia’s GDP for Q1 came in at 5.6%. Japanese Producer prices disappointed, coming in at 5.8% vs an expected 7.1%.

Research from the RBA has come to light – they think there is up to an 80% chance that Australia will get a recession in their efforts to get inflation under control. And there is real talk of rental price caps to deal with the cost of living issues.

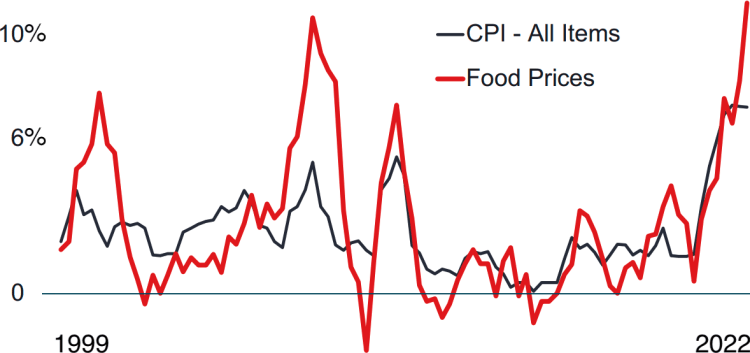

New Zealand food prices are up 12.5% on a year ago, with fruit and vegetables up 22%. Finance Minister Robertson has said the government has found $4bn in cost savings (which looks a lot like spending deferrals).

Manufacturing CPI increased in April but is still in contraction territory at 49.1. Services are also contracting, way down from March to be at 49.8.

That’s a wrap for this week. Thanks for reading!

Stay tuned for the next update.

Did you miss the last weekly market update?

Share to

Stay curious and informed

Your info will be handled according to our Privacy Policy.

Make sure to follow our Twitter, Instagram, and YouTube channel to stay up-to-date with Easy Crypto!

Also, don’t forget to subscribe to our monthly newsletter to have the latest crypto insights, news, and updates delivered to our inbox.

Disclaimer: Information is current as at the date of publication. This is general information only and is not intended to be advice. Crypto is volatile, carries risk and the value can go up and down. Past performance is not an indicator of future returns. Please do your own research.

Last updated May 17, 2023