Weekly Market Update: Market Stabilises After Flash Crash

In this weekly market review, we take a closer look at the stabilising market movements post the flash crash, along with other macro economic and crypto developments from around the world.

This week we have a lot of economic data coming out across Australia, Europe and the US.

There is increasing evidence that the US economy is slowing, and they are now at risk of Stagflation. Europe seems to be on a different path for now as its economies are showing signs of life.

Meanwhile, for those that hoped that China would be the global growth engine, we are seeing signs that this may no longer be the case.

Regionally, Australia looks like it might be past peak inflation, while at home, sentiment is edging up, but we could do with some good news on the economy.

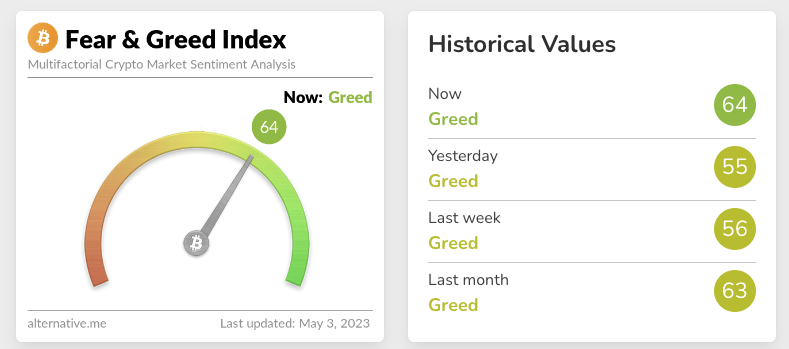

The sentiment in the crypto market has had some wild oscillations of late, however currently we have moved from Neutral back to Greed this week. All eyes on whether that Greed remains steady.

For the week, the major coins have generally shown some modest gains between 2 and 5%. At the time of writing, BTC closed the week up 4.5%, while ETH and XRP were up 1%.

Special mention goes to the 2-week old memecoin Pepe, up 2000% in 14 days with a $500 million market cap… crypto baby.

Our biggest gainer this week was Stacks (STX) up 12.3%. PancakeSwap (CAKE) continues to lose ground, down another 13% following last week’s -24%.

View all top gainers: Visit the top gainers page.

Looking for more flexible pricing and trading volume for your high-value crypto trades?

Get in touch on our OTC page and learn how we can help.

Highlights from the crypto space

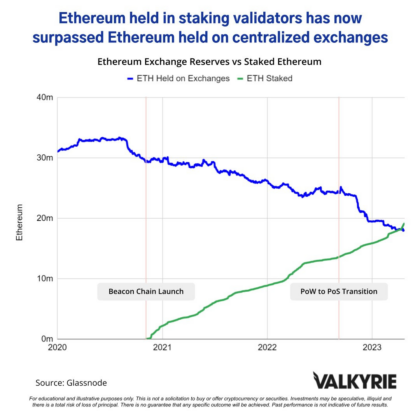

The amount of ETH staked has overtaken the amount of ETH held on centralised exchanges. This has large implications for liquidity and supply of the number 2 asset.

An analyst at Standard and Chartered has said that Bitcoin could reach US$100k by the end of 2024, they also said the winter is over!

Bitcoin, and the wider market, experienced a flash crash due to a fake alert sent by Arkham stating that the US government and Mt Gox wallets were moving BTC. Unfortunately the quick down spike liquidated over $200 million in open interest.

Ordinals keeps doing its thing, driving record high Bitcoin network transactions.

USDC issuer, Circle, has launched a cross chain transfer protocol. It’s like a bridge, just safer and cheaper. Initially enabling Ethereum to Avalanche transfers, more chains are coming.

The Near Foundation has entered into a strategic partnership with Cosmose AI to build a low cost payments system.

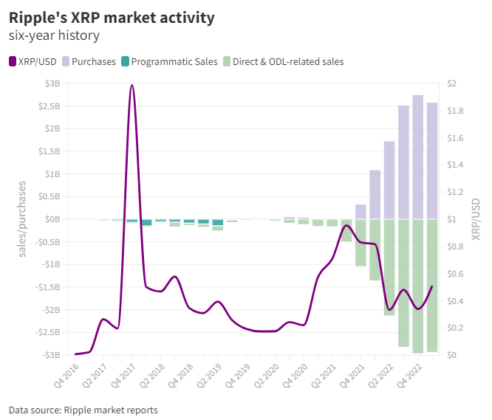

Ripple continues to buy XRP with Blockworks analysis saying they have bought $11bn since the SEC court case began.

Kraken announced its new CEO and laid down a Bitcoin market prediction.

Other notable highlights from around the crypto space:

- Coinbase has come out swinging against its Wells notice from the SEC

- Google looks to ride the Web3 wave with a cloud start up program. They are also supporting Polygon to grow its ecosystem.

- A US Judge has ruled that Apple cannot stop companies circumventing its 30% cut. This could have major implications for crypto and NFT payments.

- Mastercard continues its crypto moves with a play at compliance.

- Venmo will enable fiat to Crypto payments in May this year.

- Bitget research finds that 46% of millennials across major economies own crypto.

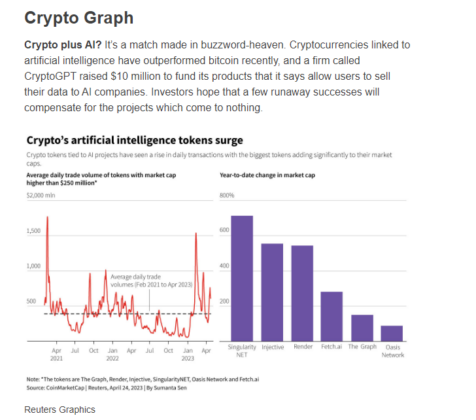

- Crypto AI tokens have outperformed the market lately in what Reuters is calling buzzword bingo

- Hong Kong’s play for Digital Asset providers continues with the monetary Authority reminding banks not to be too hasty in rejecting VASP’s. What a change!

- FTX is looking to sell its derivatives business, Ledger X to M7 for $50m.

With that said, we’ll continue to dive deeper onto other macro economic news and developments from around the globe.

🌎 Macro news TLDR: Inflation turning.

Starting off with global news

Iran has seized a Marshall Islands registered Oil tanker bound for the US, in what analysts are saying is “leverage or signalling”.

The economic impact of the Sudanese war has been hard to gauge. However, we have started hearing about a commodity called Gum Arabic, a key ingredient in soft drinks and cosmetics being impacted by the tragic events.

U.S. economic news

With the continued slowing economy and fears of a recession, US consumer confidence fell in April, however they did post solid numbers for their durable goods, up 3.2% in March.

The devil is in the detail though; when you exclude aircraft from those results, the core elements all fell. US Q1 GDP came in well below the 2% expected, posting 1.1%, (Q4 ‘22 was 2.6%).

The Q1 Personal Consumptions Expenditures (PCE) index, a keenly watched measure of inflation, came in well above forecast at 4.2% vs an expected 3.7%. Critically, core PCE was up 4.9%…

Stagflation anyone?

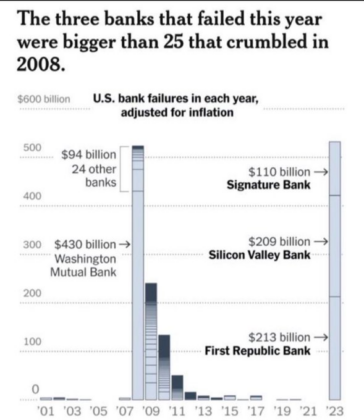

The banking crisis rolls on, with the Federal Deposit Insurance Corporation (FDIC) seized and sold the troubled First Republic bank to JPMorgan, “heading off a chaotic collapse”.

The three bank collapses this year, had asset values that eclipsed the entire 2008 GFC banking crisis. Its’s fine, we’re fine.

The US debt ceiling debate heated up with the House of Representatives putting up a bill full of concessions, which President Biden has already disowned. The US Treasury then said they may not be able to pay their way by as early as 1 June, way ahead of the previous estimate of August.

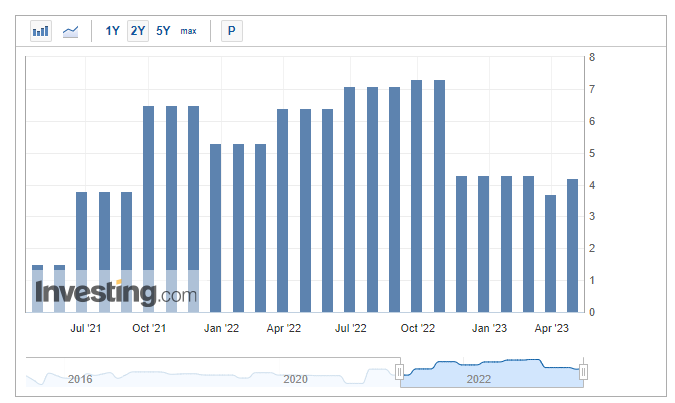

This coming week we will have another indication of the health of the US economy with the release of the US ISM data. Later the Federal Open Market Committee (FOMC) meets with markets predicting a 25 bps hike.

Meanwhile, in Europe

European Central Bank (ECB) board member, Isabel Schnabel, has said that a 50 bps rise in May’s rate review is not off the table and the decision is dependent on the data. The EU also passed legislation on decarbonising Air Travel within the block. Green-wars are on!

In the UK, an economist at the Bank of England has said that they all need to accept that they are poorer, so as to avoid a wage price spiral.

The German government has raised its 2023 GDP forecast from 0.2% to 0.4%, saying a gradual recovery is underway.

In Ukraine news, Russia is threatening to seize the assets of western companies, potentially in retaliation to the increased sanctions from the G7 nations announced last week.

President Zelenskiy spoke with Chinese President Xi Jinping for the first time in hopes of brokering peace and securing support for the Black Sea grain flows.

And now to Asia…

In China, their post Covid recovery may not be as solid as hoped for. Factory PMI contracted in April. The lack of growth has seen the local economy attempt to export their supply glut, which is driving down prices.

The new Bank of Japan governor appears to be planning to hold the line on yield curve controls due to concerns about what tightening could do to the economy.

Things are looking up in Japan with retail sales and industrial production up 7.2% and 0.8% respectively. India also seems to be doing well, with their Manufacturing PMI is up to 57.2 and seems to be strengthening.

While Taiwan’s struggles continue, their GDP contracted for the second quarter in a row. Similarly, South Korea recorded their 7th straight decline in export revenues.

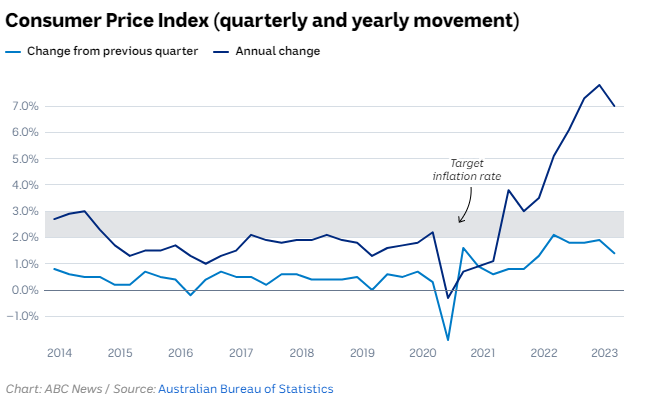

In Australia, their Q1 CPI print came in marginally above forecast at 1.4%, or 7% annualised. CPI has been falling since its December peak of 7.8%, however, services inflation is still increasing which will be cause for concern in the RBA.

Added to the picture, Australian Manufacturing PMI continues to contract, down to 48. And their commodity price index fell 19.2% year on year.

Against this backdrop, markets were predicting the RBA would hold the OCR. However they delivered a shock 25 bps rise to 3.85%, citing the persistently high inflation rate of 7% as the major reason.

In New Zealand, The latest ANZ Business Outlook survey showed that confidence is flat and key inflation drivers appear to be softening. Consumer sentiment edged up to 79.3 in April, but is still at very low levels.

The Stats NZ Cost of Living Price index showed a year on year increase of 7.7%. The main drivers were interest payments and food.

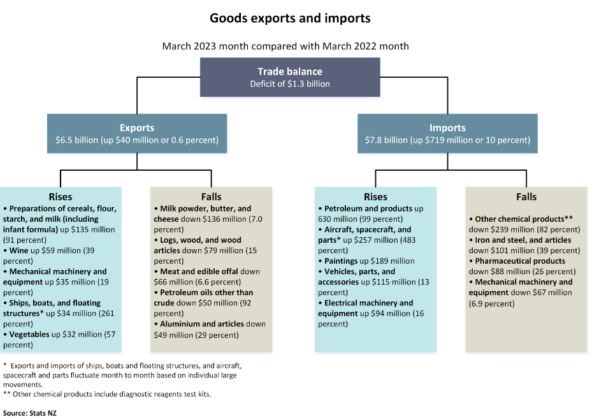

Lastly, to round up this week’s update is New Zealand’s trade deficit for March which widened significantly to $1.3bn with the major drivers being lower dairy prices and higher petroleum goods.

And that’s a wrap for this week. We hope you’ve found this week’s market update insightful! Thanks for reading!

Stay tuned for the next weekly update!

Did you miss the previous market update?

Share to

Stay curious and informed

Your info will be handled according to our Privacy Policy.

Make sure to follow our Twitter, Instagram, and YouTube channel to stay up-to-date with Easy Crypto!

Also, don’t forget to subscribe to our monthly newsletter to have the latest crypto insights, news, and updates delivered to our inbox.

Disclaimer: Information is current as at the date of publication. This is general information only and is not intended to be advice. Crypto is volatile, carries risk and the value can go up and down. Past performance is not an indicator of future returns. Please do your own research.

Last updated May 10, 2023