Weekly Market Update: SEC Goes After Binance and CZ

In this weekly market update, we take a look at movements in the crypto space and other macro economic developments from around the world.

The relative calm of the crypto space was shredded on the news that Binance and CZ are being sued by the SEC.

Added to this, the SEC has unilaterally declared another group of currencies as securities. Notably, ETH was omitted.

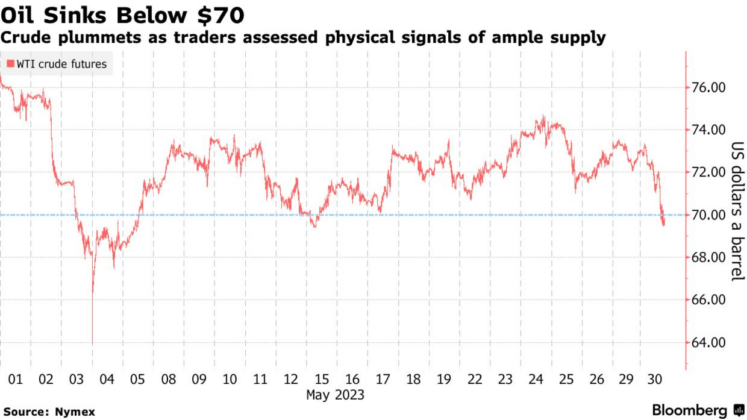

In wider economic news, the price of Oil continues to fall on weak global demand. OPEC has responded with another supply cut, however prices barely registered it.

The charade that was the US Debt ceiling had its final act with another few trillion added to the ceiling. Markets are now weighing the consequences of the US treasury refilling its coffers.

In Europe, they had some good news on the inflation front with some good declines registered. While in APAC, India continues to power ahead and China continues to struggle.

Finally in Australia, inflation rose in April and immigration looks to be fuelling another house price recovery.

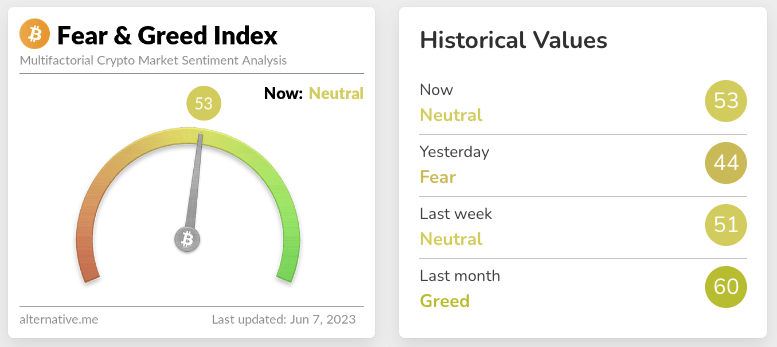

The sentiment in the crypto market has remained in neutral territory despite the macro uncertainty of the US debt ceiling.

A relatively benign week in the markets was turned upside down on the back of the SEC going after Binance. BTC and ETH dropped 6% in the hour after the news broke, but have since recovered most of that.

However the assets the SEC has now classified as securities have sustained their losses.

Trend highlights this week:

- At the time of writing, BTC closed the week down 2.5%

- ETH and LTC were down 1%

- BNB, ADA, SOL and Matic were all down ~5-8%

- Bucking the trend was XRP, AVAX and TRON up ~2%

- Our biggest gainer this week was Wilder World (WILD) up 18%

- BitTorrent (BTT) was our biggest loser of the week, down 10%

View all top gainers: Visit the top gainers page to find out more.

Looking for more flexible pricing and trading volume for your high-value crypto trades? Get in touch on our OTC page and learn how we can help.

Highlights from the crypto space

Janine has been in the news this week pointing out that we have been having issues with the big Australian banks. We are not alone in this problem and think that the entire Web 3 ecosystem is constrained because of it.

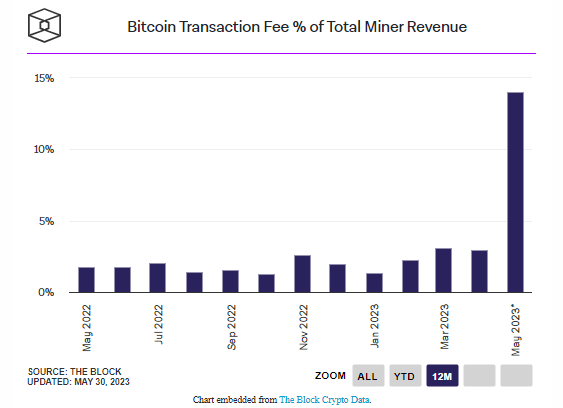

Bitcoin transaction fees rose substantially in May, thanks to Ordinals. Miners must be stoked.

In other Ordinals news, you can now bridge these to Ethereum using the BRC 721E token standard. Like we said last week, innovation is a wonderful thing.

Oh the power of a little AI dust.

Crypto data provider Nansen is reducing its headcount by 30% citing the bear market and too much expansion as the reason.

Similarly, Binance is reducing their headcount, with some saying up to 20% of non-performers will be leaving. Staying with Binance, they are delisting privacy coins in 4 European countries to comply with local laws.

And then the SEC sued Binance and CZ for 13 alleged violations, likely bringing down the crypto market prices due to the FUD.

In doing so the SEC also classified a bunch of coins as Securities – Solana, Matic, ADA for instance. But NOT ETH, big news.

China’s government came out with a Web3 whitepaper. Here is a breakdown of it.

Europe has now formally put the MiCA crypto legislation into law, making it the first block to have tailored crypto regulations.

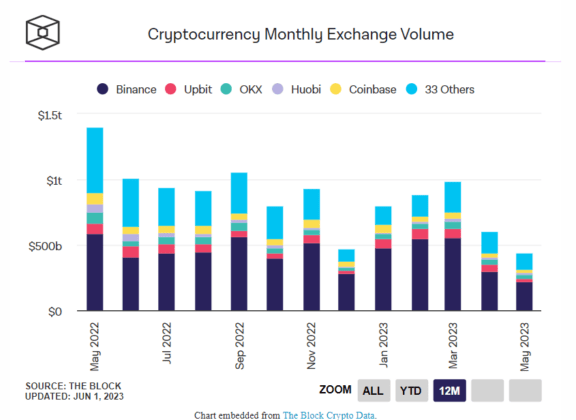

We reported last week that key assets were, well, relatively stable. This lack of movement has translated into the lowest CEX volumes since October 2020 according to the Block.

Some of the biggest names on Wall Street are building their own trading platforms so that established fund managers can trade crypto assets, interestingly they are looking to separate the custodian from the exchange.🚀

In Ripple news, Santiment put out a tweet saying that active wallets on Ripple have risen substantially, as have their mentions on social media.

There are numerous articles out there that say that Atomic Wallet has been compromised. Be safe out there people.

Level-up the security of your crypto wallet with our safety tips!

US regulators pushed through a comprehensive crypto regulation bill. This was lost in the Binance news

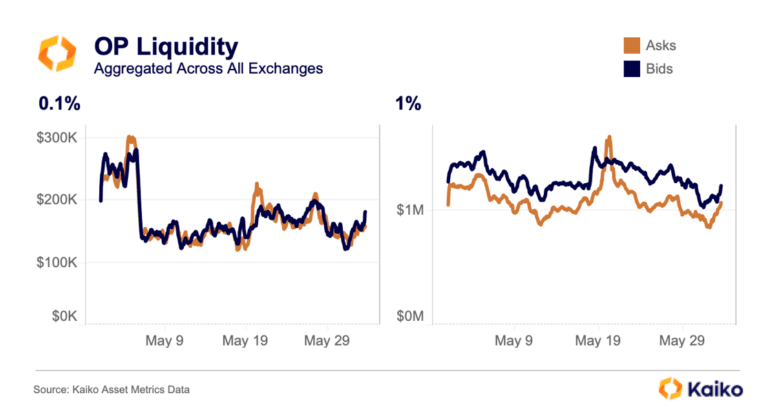

The large token unlock for OP didn’t have a massive impact on price as many expected.

Starting off with global news

A clear signal that the global fiscal tightening (and a sluggish China recovery) are having an impact, the price of Crude Oil fell below US$70. OPEC has responded to the softening demand by reducing supply by another 1m BPD.

🌎 Macro news TLDR: … .China struggles, European inflation falls.

Global Air Cargo volumes are down 6.6% on last year.

The BRIC’s nations met in South Africa to reassess their block’s position against the west.

U.S. economic news

The Case-Schillers housing index of 20 major cities was down year-on-year for the first time since 2010. The US labour market continues to confound, with this week’s Job openings data showing an increase in available jobs.

Then the Non-Farm payrolls report for May came out, it added even more confusion coming in 339,000 against a predicted 190,000.

Manufacturing PMI declined to 46.9 for May, this was below expectations and also the 7th monthly decline in a row.

On Friday NZT, the last major hurdle for raising the US debt ceiling passed with the Senate giving the bill its approval despite some 11th hour proposed amendments.

If you are expecting the markets to rip, it might not be all great news with some saying that in replenishing the Treasury, the government is now competing for liquidity with the markets.

Meanwhile, in Europe

On the inflation front, Germany had some good news, CPI coming in ½ a percent under forecast to 6.3%. The same thing happened in France, CPI down to 5.1%.

It was no surprise therefore when later in the week the European blocks CPI for May down to 6.1% from April’s 7%. Core CPI also fell to 5.3%.

However, European economic confidence slid for the 2nd month in a row, tellingly if fell across manufacturing, services and retail activity. Strangely after all of this, ECB president Legarde signalled that there was no clear evidence the tide had turned on inflation and more rate hikes are likely.

Supermarket prices in the UK are up 9% year-on-year, hidden in the data is some staggering rises though, fresh produce is up 17%!!! 🤯

In Ukraine news, the summer offensive appears underway. On the Economic front, new findings are pointing to large scale circumvention of the Russian Sanctions.

And in Asiapac…

China’s challenges keep coming, the WSJ says that the failed recovery in China is highlighting deep problems with growing debt, low spending, and its global relations.

Youth unemployment in the cities has hit 20%. Meanwhile, manufacturing PMI is now in contraction territory at 48.8, and late rains have affected large parts of their wheat producing region.

The Yuan is under pressure and this is affecting commodity suppliers to China. Global ripples are being felt on this.

India continues to be a good news story, the Q1 GDP exceeding forecast. Year-on-year GDP was 6.1%. Their Services PMI came in at 61.2, supporting the rosy picture.

Japan is a mixed bag, their unemployment rate fell in April, however on the downside, so did the Manufacturing PMI.

In a surprise move, Sri Lanka’s central bank cut its interest rate and said they think the worst of last year’s economic crisis is over.

Australia’s inflation defied expectations and went up to 6.8% for April. This is above the expected 6.4%. RBA Governor Lowe told households to prepare for more pain as Inflation is looking more persistent. In a watch this space trend, national house prices in Australia are up for the 3rd straight month.

In NZ, Centrix data for April showed a marginal decline in households in arrears. Stats NZ reports that new housing consents are down 26% year-on-year, ANZ economists are saying that given we have an immigration bump, this is going to cause issues. In what can only be called a surprise, NZ business confidence jumped in May according to ANZ.

That’s a wrap for this week. Thanks for reading!

Stay tuned for the next update.

Did you miss the last weekly market update?

Share to

Stay curious and informed

Your info will be handled according to our Privacy Policy.

Make sure to follow our Twitter, Instagram, and YouTube channel to stay up-to-date with Easy Crypto!

Also, don’t forget to subscribe to our monthly newsletter to have the latest crypto insights, news, and updates delivered to our inbox.

Disclaimer: Information is current as at the date of publication. This is general information only and is not intended to be advice. Crypto is volatile, carries risk and the value can go up and down. Past performance is not an indicator of future returns. Please do your own research.

Last updated June 20, 2023