Weekly Market Update: It’s been a heck of a year.

2023 is the year crypto has made a comeback after a long brutal winter. What's at store for 2024? Let's find the clues in this week's weekly market update.

This will be the last market update for 2023 as the team are having a bit of a break. Because of this, we thought we’d change it up a little and look back on what a year it has been! If you don’t believe how 2023 has been crypto’s comeback, let the price chart below speak for itself!

We ran a quick survey of our Easy Crypto staff on where prices would be at the end of 2024. This is absolutely not financial advice and we are not experts at this, (some of us are still regretting some life choices from the 2021 bull market!) so treat this accordingly and think of it as a sentiment measure at best.

That said, the BTC price consistently cited was US$100k, there were some bigger numbers mentioned though. So I guess you can say the conclusion is internally we think 2024 will be bullish with a capital B.

The story so far..

It’s been quite a year. Let’s start by reflecting back on what the situation was in December 2022; inflation had just peaked in the US and was still rising in Europe and the spectre of a US recession was real. Get this, China was just exiting its Covid restrictions, Australia was just starting to respond to inflation and in New Zealand the RBNZ had just jacked the OCR by 75 bps to 4.25% and was publicly trying to engineer a recession.

In Crypto, we were a month into the FTX debacle and the subsequent fall-out through the industry was larger than we all anticipated. For a lot of us, this one really hurt, me included. Software doesn’t care though, so the industry marched on, builders kept on building and ironically the resilience of the market during this time seems to have won over Tradfi institutions.

In short, news of crypto’s demise was greatly exaggerated. The tide feels like it’s turned. Momentum swung behind the industry;first the SEC didn’t get a clear win over Ripple, then inflation and monetary supply started to turn in crypto’s favour and then the anticipation of 2024’s halving and ETF noise stole the show.

It hasn’t been perfect, there are still some bad actors out there, companies failed and titans like Binance got censured. Some are saying this is a painful but necessary part of the sector. We needed to clean house. I myself have said that crypto is more capitalistic than any Tradfi; businesses are allowed to fail here and it’s what makes us stronger. One man’s opinion. Looking at 2024 though, it’s hard to argue against the message that the events have created a battle hardened cadre of players who are ready for whatever comes next.

Back to this week’s snapshot.

We continue to see more institutional money flowing into the sector and more institutional-like services come to market. Isn’t it great that you and I can participate in the same market as equals? Satoshi would be proud, I think.

In Macro news, the FOMC held rates steady and finally openly talked about rate cuts in the coming year. Europe looks like it’s in a recession, however the ECB took a more hawkish approach and talked down any cut expectations. The UK did the same.

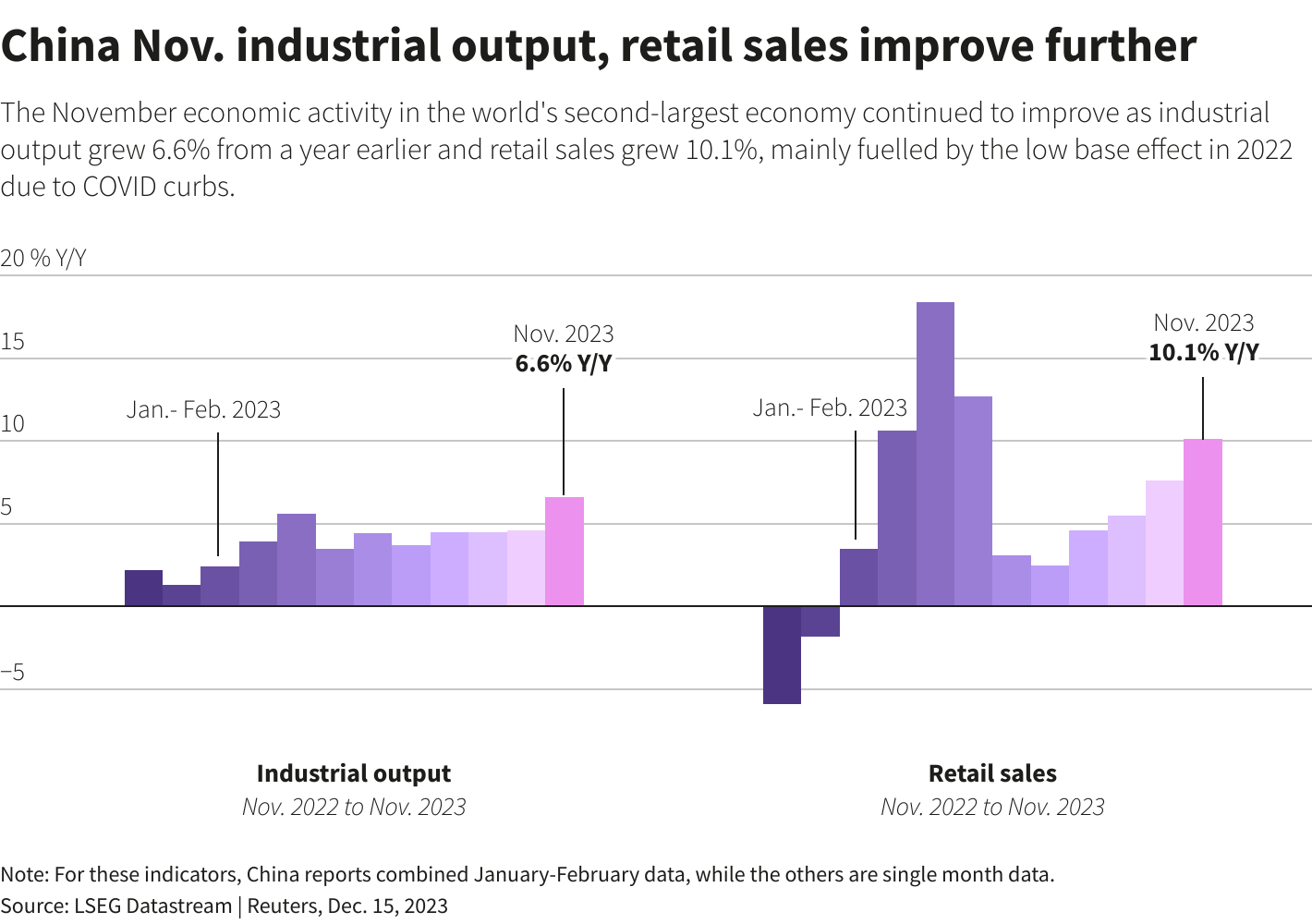

In Asia, India might not have control of its inflation, however industrial production is in good shape. China put out some decent production data, while there are growing calls for Japan to do something about its monetary policy. Australian data is sending mixed messages but they may have bottomed. Things are much clearer in New Zealand, we are most probably in a recession.

The Crypto market sentiment improved on last week’s dip, and remains firmly in greed territory.

Highlights this week

- Domestically, our buy-sell ratio continues to skew heavily to the buy side while customers using our DCA feature are also increasing in numbers.

- Looking at the weekly price movements in the top 30 assets, there are more declines than gains as the market took a breather, profits or both.

- At the time of writing BTC was up 2.5%, while ETH was flat on the week. In a continuation of last week’s mega move, AVAX is up another 7%.

- Injective (INJ), our top performing asset this week, is up 38%.

- Our biggest loser this week was KuCoin (KCS) down 18%.

View all top gainers: Visit the top gainers page to find out more.

Unlock more opportunities with Easy Crypto

- Trade at scale with a more flexible fee! Contact us if you’re interested in High Value OTC Trading!

- Easily swap between crypto directly without banking, or switch to our NZD-backed stablecoin while waiting for better opportunities. Swap crypto now.

- Stop juggling multiple wallets. Buy, sell, and securely store crypto with the non-custodial Easy Crypto Wallet App. Download here.

- Move out of volatile tokens and lock in gains with NZD-backed stablecoins. Find out more about NZDD.

Highlights from the crypto space

Charlie Bilello’s last market snapshot. We’ll just leave it there.

A recent filing on the Blackrock ETF means mainstreet banks can ‘buy in’ using cash not crypto. This in effect expands the market opportunity significantly. Sensing an opportunity, Google is planning to relax its crypto advertising rules in the US with an eye on the ETF launches. The SEC delayed its decision on the ETH Futures ETF.

The Bank of International Settlements Basel Committee for Supervision has put out a paper detailing how much, and the types of cryptocurrencies, banks can ‘safely’ hold on their balance sheet. Mind blown.

Kaiko reports that BTC’s correlation with risk assets as measured by the Nasdaq 100 is now negative. This would imply BTC is not acting as a tech stock anymore.

The DTCC (the clearinghouse for all share trades in the US) has acquired a company to help it into the blockchain / crypto space.

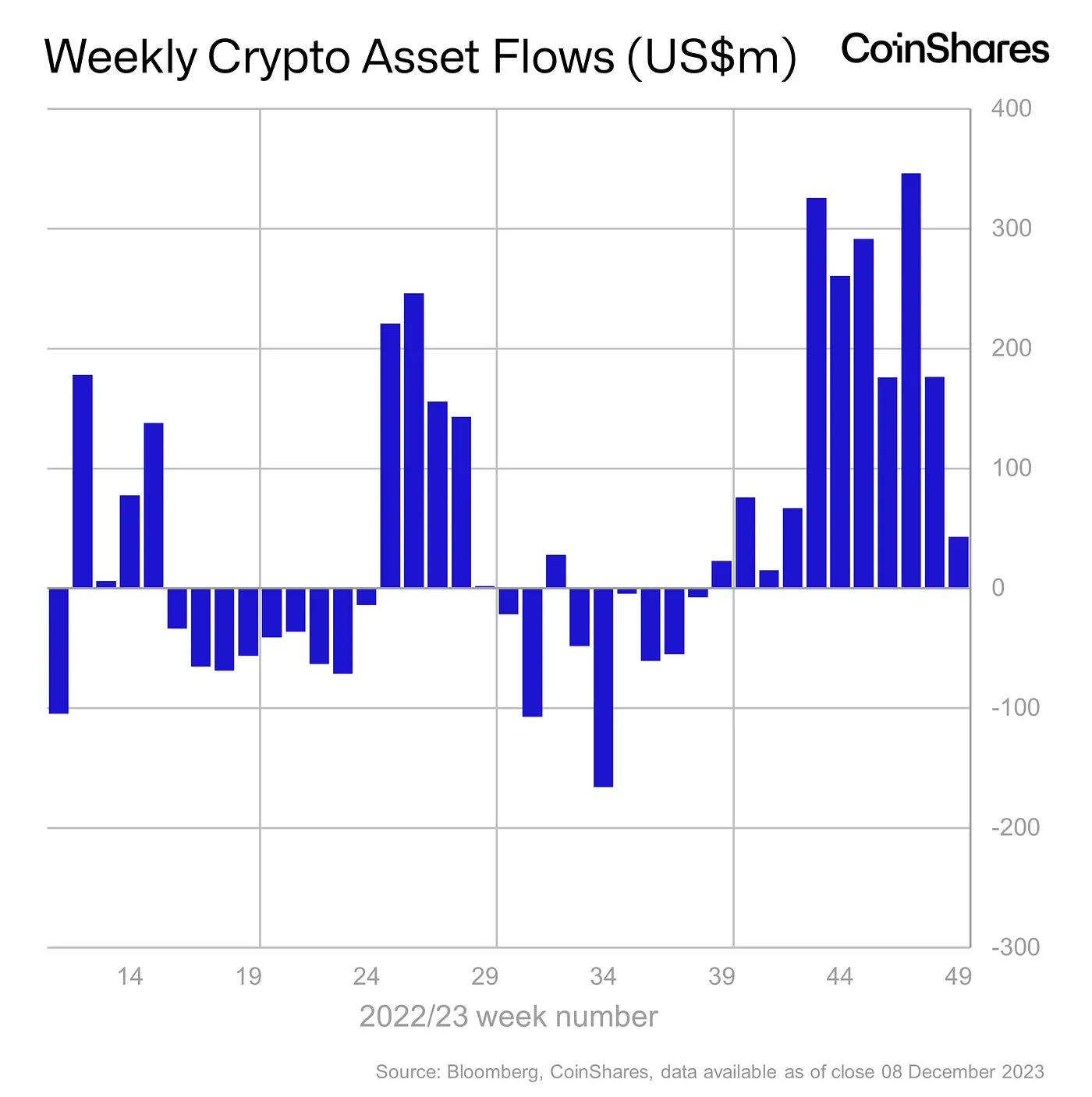

Coinshares reports that we have had 11 straight weeks of net inflows from Institutional buyers. Some interesting data, Germany is the leading buyer and Alts like ETH, SOL and AVAX are all seeing inflows (their words, not mine).

Coinbase is combining a lot of its offers together to offer Tradfi a capital marketplace on its BASE network. They have also launched Institutional Spot trading on its international exchange. The SEC denied Coinbase’s attempt to gain regulatory clarity.

A Deutsche Bank led consortium is looking to issue a Euro backed stablecoin.

While the CEO is out bashing crypto, JP Morgan has been increasing its crypto team according to Bitcoin magazine.

The Financial Accounting Standards Board, a U.S. entity that details how companies should report assets on their balance sheet, updated its standards to allow corporations to recognise “fair value” changes in crypto holdings. TLDR; better treatment of Crypto on the balance sheet.

Binance is still fighting the SEC despite its $4bn settlement with the DoJ.

Bitwise Investments has put out its top 10 crypto predictions for 2024. Snapshot below 👇

Wallet maker Ledger had an exploit in the software that allows Dapps to connect websites to wallets. A fix is out already, however not a great look. In fact, despite having access to just about the entire DeFi ecosystem, only $500k was stolen.

And that sums up the major updates from around the crypto space. Moving on..

What is going on in the world of Finance …

Events in the middle east are affecting global trade as Yemen’s Houthi rebels are forcing shipping lines to redirect traffic away from the red sea and Suez canal route. Apparently insurance costs are way up too. All of this will affect international trade pricing.

🌎 Macro news TLDR: …the Fed blinked, the ECB held the line

U.S. economic news

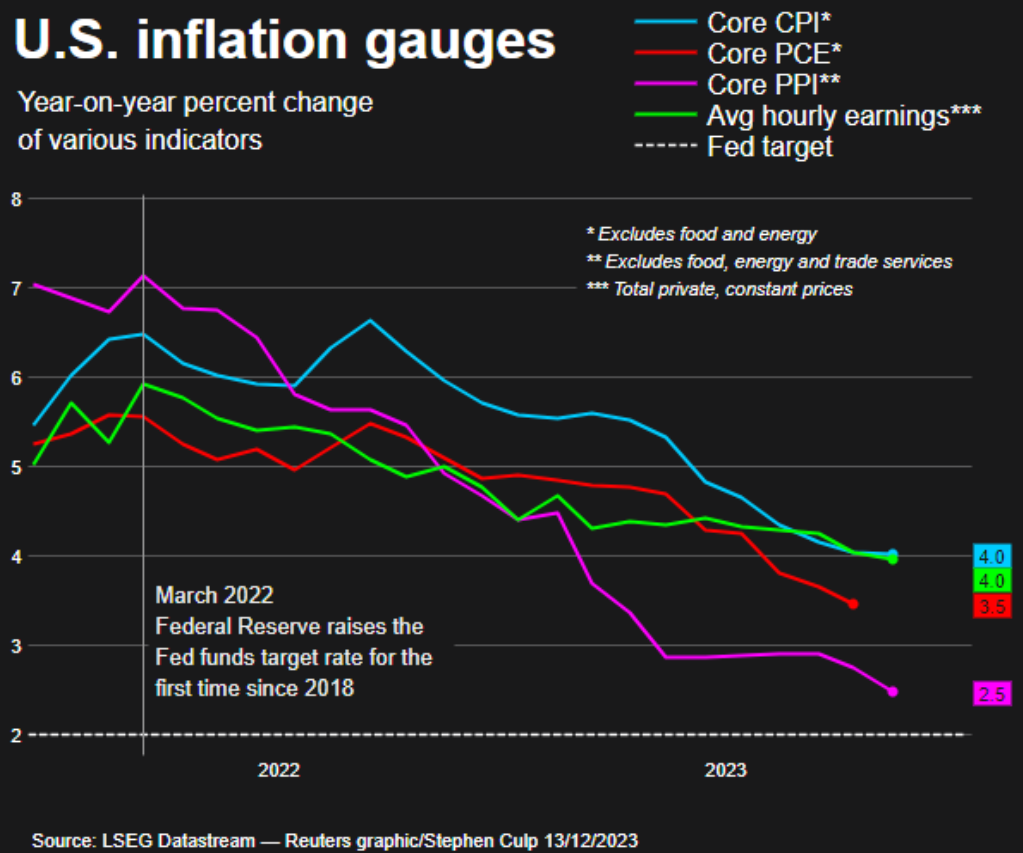

US PPI was muted, coming in at 0.9% annualised, supporting the view that inflation is in downtrend. In the last FOMC meeting of the year, the Fed has held rates steady, and signalled three 25 bps cuts in 2024. The statement explicitly references inflation easing. The dot plot of forward expectations is more dovish than anticipated. Markets on the other hand heard something way different, with an expectation of up to 6 cuts next year and the chance of a cut by March doubling since last month according to the CME fed watch tool. Somebody’s wrong, last time it was the Fed.

Meanwhile in Europe….

Euro area industrial production fell 0.7% in October and is down 6.6% on last year. Basically they are in recession. Despite this, the ECB resisted calls for rate cuts, and jawboned down expectations.

UK’s wage growth fell sharply to 7.3%, however while the economy appears to be flattening off, employment is still a challenge due to post Covid immigration restrictions. The BoE is rightly concerned that wage growth is still too high. The Bank of England monetary policy committee voted to keep rates at 5.25% with those dissenting votes in favour of rate HIKES. Higher for longer. Against that backdrop, the UK’s GDP fell 0.3% in October, this was worse than what the economists predicted which was a flat result.

German economic sentiment improved in December, however it was off a terrible base.

In Ukraine news, a snapshot is that they are asking their allies for more funding to keep fighting. Some Republicans in the US are resisting that. And in Europe, they are moving closer to getting Ukraine into Nato, Hungary is holding out and vetoing any more funding for them. Interesting times.

And in Asia Pacific…

India’s CPI increased to 5.6% in November, up from 4.9. Apparently a poor monsoon season is affecting food production, and food prices are up over 8%. Industrial production is still roaring along, up 11% year on year. China’s PPI and retail sales for November both improved, however their property market worsened and there are calls for more government stimulus.

Over to Japan where the BoJ is coming under more pressure to end its unique monetary policy play with 20% betting they will start in January. However the Bank opted to retain its policy until it sees wage and retail sales growth keep up with inflation. Apparently it’s a when not if decision.

In Australia, November’s consumer sentiment improved, however NAB’s business confidence survey showed a sharp fall in November. Australia’s PMI for December improved slightly, but remains in contraction.

In New Zealand, Statistics NZ put out a proxy for CPI, the Selected Price Index (SPI), this shows a softening inflation picture in most categories except domestic (non-tradable inflation). While overall inflation looks under the RBNZ forecast at 4.7%, non-tradables inflation is likely running at 6.3%, above the 5.7% RBNZ forecasted number. Stats New Zealand’s report that Q3 GDP fell 0.3% and was – 0.9% on a per capita basis. This caught economists by surprise as they were expecting a growth number around 0.3% inline with the RBNZ number. They also restated March and June numbers… we’re probably in a recession.

That’s a wrap for this week. Happy holidays and we’ll see you in 2024!

Stay tuned for the next update.

Did you miss the last weekly update?

Share to

Stay curious and informed

Your info will be handled according to our Privacy Policy.

Make sure to follow our Twitter, Instagram, and YouTube channel to stay up-to-date with Easy Crypto!

Also, don’t forget to subscribe to our monthly newsletter to have the latest crypto insights, news, and updates delivered to our inbox.

Disclaimer: Information is current as at the date of publication. This is general information only and is not intended to be advice. Crypto is volatile, carries risk and the value can go up and down. Past performance is not an indicator of future returns. Please do your own research.

Last updated December 20, 2023